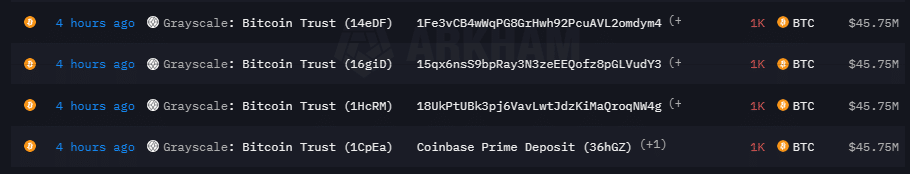

Grayscale Bitcoin Trust transferred approximately 4,000 BTC, valued at $183 million, to Coinbase Prime deposit addresses.

This was revealed from the latest data of Arkham Intelligence. Grayscale’s spot Bitcoin ETF, known for its comparatively high fee structure at 1.5%, may be witnessing a shift as investors explore options in response to the SEC’s recent approval of several spot Bitcoin ETFs.

Other ETFs, managed by companies like BlackRock, VanEck, ARK 21Shares, and Bitwise, offer more competitive fees, ranging from as low as 0.2% to 1.5%, with some even introducing introductory waivers.

The Bitcoin market itself is undergoing notable changes. After the SEC’s approval of various Bitcoin spot ETFs, the price of Bitcoin reached a peak of approximately $49,000, only to fall to around $43,500, marking a 5.5% decrease within a single day. This price volatility could be attributed to several factors, including market response to the new ETFs and a potential supply shock resulting from major transactions like Grayscale.

Previously, several analysts had also suggested that significant fluctuations in Bitcoin’s value can be anticipated as the market adjusts to these new investment vehicles.