The bill is headed to the US Senate, where both Democratic and Republican leaders have rejected the idea of fast-tracking its passage.

Chinese foreign ministry spokesman Wang Wenbin said the proposed ban amounts to bullying and “will inevitably come back to bite the US itself”. Global Times, a tabloid affiliated with the government mouthpiece People’s Daily, has published more than 10 articles since last week, voicing support for TikTok and describing the US bill as “robbery”.

ByteDance “has been unwilling before to seriously entertain a divestment,” said Justin Sherman, chief executive of Washington-based research and advisory firm Global Cyber Strategies. “When this came up previously, the Chinese government said it would block a sale.”

ByteDance last week denied a news report that Zhang was in talks with potential buyers of TikTok.

Zhang owns 20 per cent of ByteDance, TikTok said in April last year. Institutional investors hold a 60 per cent stake in the company, while the company’s global employees own the rest.

ByteDance’s US investors include private equity firms General Atlantic, Susquehanna International Group and Coatue Management, which all have representatives sitting on the Chinese company’s board. Other board members include Neil Shen from Sequoia China – since renamed HongShan – and ByteDance CEO Liang.

While US investors hold a significant chunk of ByteDance, Zhang has shares with special voting rights that give him control of the company, including TikTok, according to a report by the Financial Times on Friday.

US investors are now mulling a plan that would boost their voting rights while letting ByteDance keep its stake, although this arrangement would still require the approval of the Chinese government, the report said.

On Thursday, former US treasury secretary Steven Mnuchin said in an interview with CNBC that he had spoken to “a bunch of people” about creating an investor group to buy TikTok.

None of ByteDance’s key investors or board directors have publicly commented on a potential sale of TikTok.

Zhang’s early speeches and anecdotes from people who have worked with him showed that Zhang dreamed of building a global business, with the US market being a key piece in this puzzle.

When political tensions started to mount in the US over TikTok in 2020, Zhang tried to personally address the issue by accepting a remote video interview with US magazine The Atlantic. During that conversation, he said he was not a member of the Chinese Communist Party.

But soon, he decided to step away from the limelight, delegating the public-facing job to Chew instead.

Despite its business success, ByteDance has been a victim of Beijing’s regulatory crackdown on the internet sector.

In 2022, as China implemented stringent Covid-19 restrictions, Zhang decamped to Singapore.

In contrast, political scrutiny in the US seems to have done little to slow TikTok’s rise.

In 2020, then-US President Donald Trump signed two executive orders forcing a sale of TikTok, but they were later revoked by his successor. Meanwhile, the number of US users on TikTok rose from 100 million in August 2020 to 170 million this January, according to figures provided by the company.

But political hostility against TikTok is mounting.

“Undoubtedly, the political environment in Washington has grown more hawkish on China since 2020,” said Paul Triolo, associate partner for China and technology policy lead at consultancy Albright Stonebridge Group.

ByteDance has been trying to boost its political clout on Capitol Hill.

Last year, ByteDance and TikTok spent a total of US$10.35 million in lobbying, a 2.5-fold jump from 2020, according to records published on the US Senate website.

But the company has to placate both Washington and Beijing.

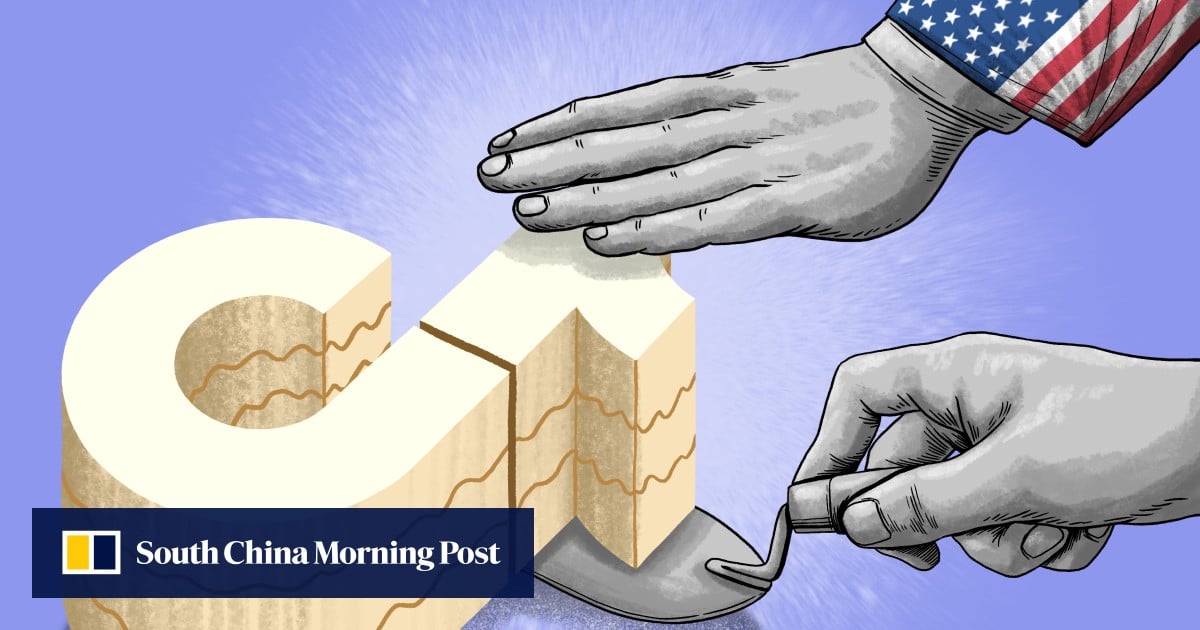

When Trump tried to force a sale of TikTok in 2020, the Chinese government stepped in by updating its technology export restrictions to include software, effectively banning ByteDance from transferring its content recommendation algorithms to foreign owners.

To meet demands from both sides of the Pacific, ByteDance drew up a plan to create a separate entity called TikTok Global and sell 20 per cent of equity stakes to American investors. The board of the new company would include existing ByteDance directors and the CEO of US retail giant Walmart. However, there would be no transfer of algorithms.

That plan was aborted after Trump lost his bid for re-election.

This time around, it is still unlikely for ByteDance to sell TikTok without Beijing’s consent. The Ministry of Commerce, which supervises technology exports, said China would “take all necessary measures to firmly safeguard its legitimate rights and interests”.

“A divestment is not possible,” said Cameron Johnson, a senior partner at Shanghai-based consulting firm Tidalwave Solutions and an American businessman with 25 years of experience in the country. “China would see it as not only a slap in the face, but the US controlling one of its national champions.”

“If TikTok [was] divested, more pressure would build to do this to other companies such as Temu [or] Shein,” he said, referring to two popular shopping apps that originated in China.

The current version of the bill applies not only to TikTok, but also other apps controlled by “foreign adversary” countries.

Resistance to a TikTok ban may come not only from China.

The app has been trying to mobilise its massive user base. Last week, it sent American users a push notification urging them to call their congressional representatives to speak out against a bill that could block their access to one of their favourite apps.

When it comes to TikTok’s overwhelming popularity in the US, politicians are not immune.

“Ironically, many of the Senate and House representatives that would vote on enacting the divestiture, are actually using the TikTok platform to reach voters in the upcoming election campaigns,” said Alex Capri, a senior lecturer at the National University of Singapore (NUS) and a research fellow at Singapore-based philanthropic organisation Hinrich Foundation.

Biden’s re-election campaign also opened a TikTok account last month.

TikTok’s active defiance stands in stark contrast to its response in 2020, when it struck a deal to sell TikTok’s US operations to a group of American businesses – a move that was perceived by many Chinese netizens as “kneeling down”.

“TikTok doesn’t just stay still and wait for death,” Shanghai Observer, a news site under state-owned newspaper Liberation Daily, wrote in a report. “It has mobilised its users to fight back.”

Unlike the House vote, “passage in the Senate is likely to be more contentious”, said Capri from the NUS.

If the Senate passes the bill with changes, the two chambers will have to negotiate to reach a compromise, which “could take a long time”, he said.

Given that, the deadline for ByteDance’s divestment of TikTok would probably extend beyond the November 2024 midterm and presidential elections, Capri added.

Even if the bill were to pass both houses of Congress, TikTok could still take it to court.

“Any attempt to implement a ban resting on a forced divestiture will still run into major legal challenges, including First Amendment issues, in US courts, brought both by TikTok US and by well resourced TikTok influencers”, said Triolo from Albright Stonebridge.

Last year, a federal judge blocked the US state of Montana from introducing a statewide ban on TikTok.

Last year, TikTok said it had already spent US$1.5 billion on the project, which the firm estimated would cost between US$700 million and US$1 billion annually once it is fully operational.

The project, with heavy involvement of former US government officials and industry cybersecurity experts, is aimed at setting up a secure US-based data enclave hosted by Texan software firm Oracle, according to Triolo.

That would give the Committee on Foreign Investment in the United States strong oversight, as well as the possibility for third-party auditing of data access and AI algorithms on the platform, he said.

“In the absence of a broader US data security law that all companies operating the US would need to comply with, Project Texas would set a precedent for all similar applications, and thus would provide a useful precedent for the handling of US citizen data by social media platforms.”