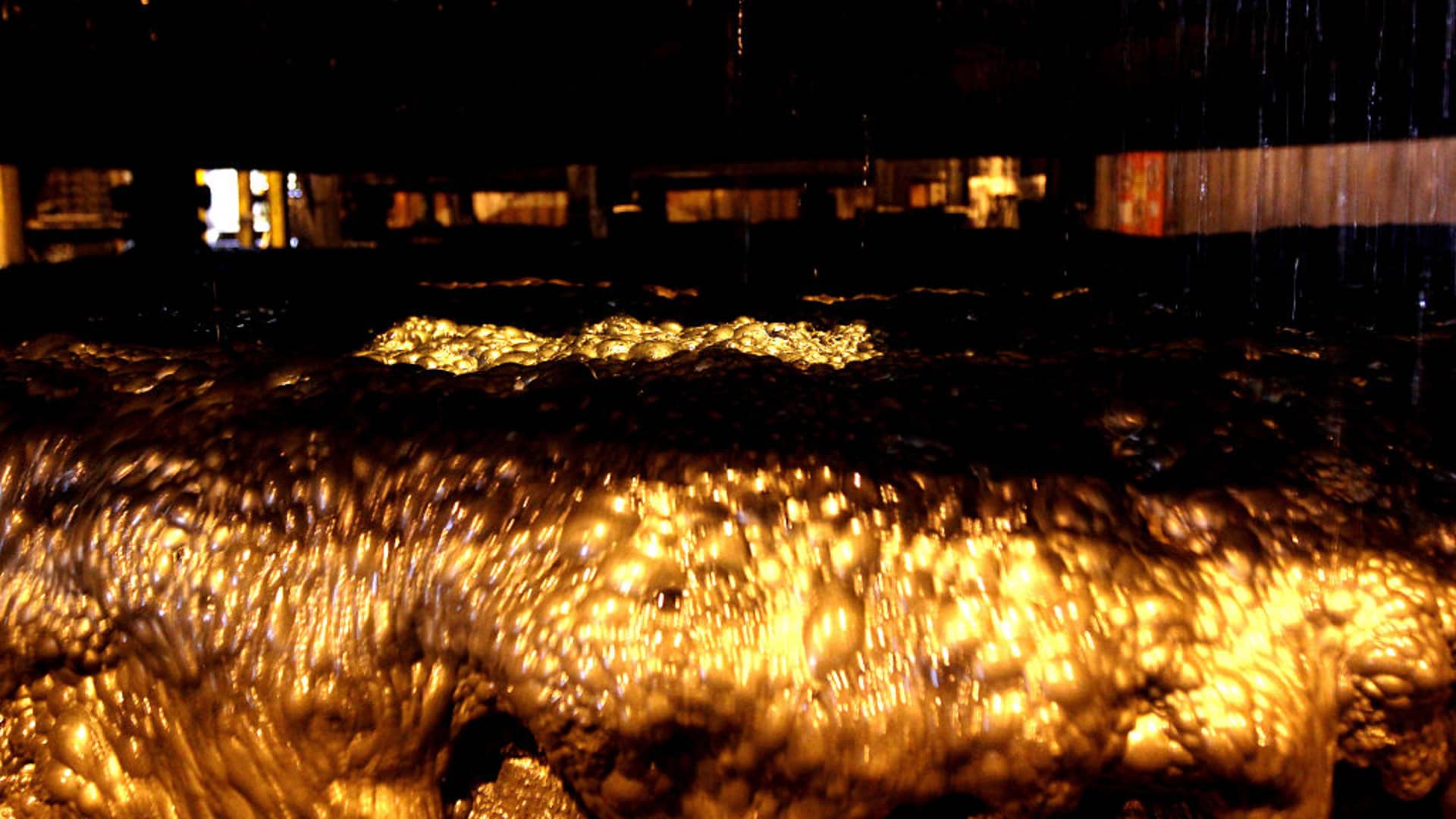

Gold and copper have been on fire, as geopolitical tensions mount, central banks buy up gold, and AI demand for copper grows. Gold prices have repeatedly hit record highs, reaching $2,400 on April 12 . Copper, too, has done well, with copper futures hitting their highest level since 2022 last weekend. Some fund managers and Wall Street analysts continue to be bullish on those commodities. “The primary concern is about a possible resurgence of inflation due to the evident strength in the US economy,” Kingsley Jones, founder and chief investment officer at Jevons Global, told CNBC’s ” Street Signs Asia ” on Monday. “The other factor is the fiscal stimulus that is ongoing in the USA, Europe and other nations with government subsidies for reshoring of manufacturing and green energy,” he added. Copper is among the metals needed for the energy transition, and many are also getting bullish on it amid the artificial intelligence boom. Jones pointed out that those factors will push those commodities higher despite signals from the U.S. Federal Reserve that interest rate cuts may be fewer and later than expected. Stock picks He named Australian gold miner Northern Star and copper miner Southern Copper as stocks he’s bullish on right now. Kamil Dimmich, portfolio manager at North of South Capital, said gold is “interesting,” given geopolitical risks from the Middle East and Chinese demand, which he described as a “very potent driver.” He attributed gold’s recent rallies partly to central bank buying, saying it’s “of course trying to diversify its reserves,” and to retail demand. “One of the thoughts we’re having is people have stopped buying property with their savings and Chinese are still saving a huge amount, they’re not spending the money. That’s one of the problems China has economically and what they’re doing is — they’re pouring the savings instead of into real estate into gold,” Dimmich said. China has been struggling with a major real estate debt crisis for the few years. He said against that backdrop, he’s getting back into some gold mining stocks such as Gold Fields and K92 Mining. Wall Street has also been optimistic on copper miners, thanks to the AI boom. Copper is used in data centers for power cables, electrical connectors, power strips and more. Jefferies estimated in a recent April note that global copper demand by data centers will increase from 239 kt (thousand tons) in 2023 to at least 450 kt per annum in 2030. It said that copper demand will already “significantly exceed” supply starting this year — and that’s not even accounting for demand growth from data centers. Jefferies’ preferred picks for miners with exposure to copper are Freeport-McMoRan , Lundin , Teck , Anglo , Glencore and First Quantum . ‘Cleanest way’ to play copper? In an April 17 note, JPMorgan named U.S.-listed Teck Resources as its top pick for copper, presenting the most upside when using JPMorgan’s bullish price forecast. Most investors the bank spoke to, however, like American miner Freeport-McMoRan as the “cleanest way” to play copper. “We (and investors) are most interested in signs of progress on leaching and improving costs at its legacy North America assets amid ongoing labor challenges,” said JPMorgan. However, it said Teck is still cheaper than Freeport. Ian Roper, a commodity strategist at Astris Advisory Japan KK, told CNBC on Tuesday, “Extreme tightness in raw materials due to so many mine disruptions in recent months. This will cause Chinese copper output to fall later in the year and lead China to import more copper metal, at the same time as the rest of the world continues to consume more on the back of the green energy buildout.” — CNBC’s Michael Bloom contributed to this report.

Buy gold, copper stocks to ride AI, China demand, more: Fund managers

Denial of responsibility! Chronicles Live is an automatic aggregator of the all world’s media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, all materials to their authors. If you are the owner of the content and do not want us to publish your materials, please contact us by email – chronicleslive.com. The content will be deleted within 24 hours.