In the view of the US, China’s expanding industrial capabilities could spell disaster for international markets, and Chinese overproduction might undermine the very foundations of economies around the world. Yet, through a different lens, what the US decries as overcapacity might instead be seen as the fruit of foresight, efficiency and an unerring commitment to scale.

Key metrics indicate Washington’s allegations of overcapacity against China may be more fear than reality. China’s industrial capacity utilisation rate is 73.6 per cent, comparable to the US’ 78.4 per cent. In terms of inventory levels, China’s index stood at 49 in March, similar to the US’ 48. Meanwhile, Chinese new export orders rose to 51.3 per cent in March, as China’s industrial profits continue to grow.

Never mind the threat of more tariffs: China’s ability to compete on cost makes it resilient to such international pressure. As its industries continue to offer products at prices too competitive for global markets to resist, even increased tariffs are unlikely to slow China’s economic engine.

China’s strategy, marked by significant investments in technology and infrastructure, reflects not just an ambition to lead but also a philosophical departure from the Western emphasis on profitability. From this perspective, China’s industrial capacity should be understood not as overcapacity, but as a strategic outcompeting of the US in scale, cost and efficiency.

The story here is not just simple economic rivalry, but rather the deep differences in how the two nations view progress and prosperity. In contrast to the US’ focus on profit-driven innovation, China embraces widespread adoption, prioritising long-term dominance through cost leadership.

The depth, breadth and sophistication of China’s supply chain infrastructure is often severely underestimated, such as the extensive vertical integration and advanced automation that make it possible for Xiaomi to produce a SU7 car every 76 seconds.

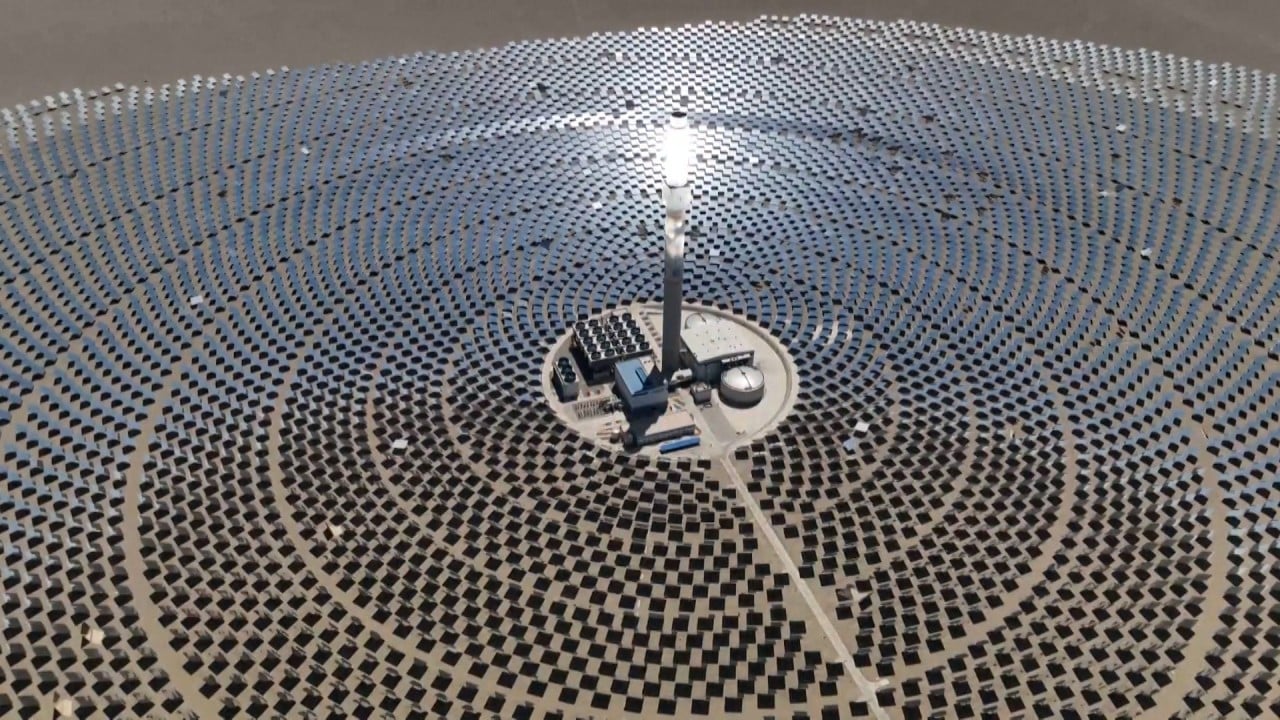

Moreover, substantial investments in renewables not only stabilise energy costs but also afford China a 50 per cent cost advantage over Western power rates, thus laying a foundation for China’s expansive growth across vital industries.

Where Western critics see a dangerous game of economic brinkmanship, those in China see a necessary evolution towards a future where dominance is defined not by the size of one’s economy alone, but by the ability to steer the global community towards the frontiers of more sustainable and equitable technology.

In the face of Blinken’s criticism of overcapacity, there is a way for China to rise above this debate: out-innovating its peers. By doubling down on technological advancements while bolstering research and development, China can shift the conversation from mere quantity to undeniable quality.

This approach not only set global benchmarks for manufacturing excellence but also offers a blueprint for how China can navigate similar challenges today.

However, protectionist narratives threaten to disrupt supply chains and stall these crucial green transitions. Moreover, decoupling from Chinese clean tech could inflate global energy transition costs by 20 per cent, adding US$6 trillion to the already substantial US$29 trillion required for net-zero emissions by 2050.

Through this lens, China’s approach to technological and industrial expansion embodies more than economic strategy; it reflects a deeply-rooted philosophical stance on progress and prosperity, not viewing the future as a destination but as an impactful journey for humanity.

At this critical juncture, the role of global leaders and innovators transcends competition. It demands a profound understanding of the deeper currents shaping our world and recognising the pursuit of short-term gains pales in comparison to the lasting legacy of global sustainable development.

Jeffrey Wu is a director at MindWorks Capital, a leading Hong Kong-headquartered venture capital firm specialising in technology investment across Greater China and Southeast Asia