Global demand for lithium, which was estimated at 130,000 tons in 2022, is expected to multiply more than three times by 2030 because of demand for lithium-ion EV batteries, according to Coface, a global trade insurer headquartered in France.

“The world capacity is likely not to follow the fast-growing demand for the mineral, with some experts foreseeing shortages as soon as 2025,” the firm told This Week In Asia.

Dipping their toes

“However, these countries face challenges regarding the exploitation of the minerals due to environmental implications [deforestation, water pollution], as well as social issues like indigenous people displacement in Indonesia,” said Eve Barre, Asia-Pacific economist at Coface.

Indonesia needs Asean ‘collaboration’ to turn region into an EV leader: experts

Indonesia needs Asean ‘collaboration’ to turn region into an EV leader: experts

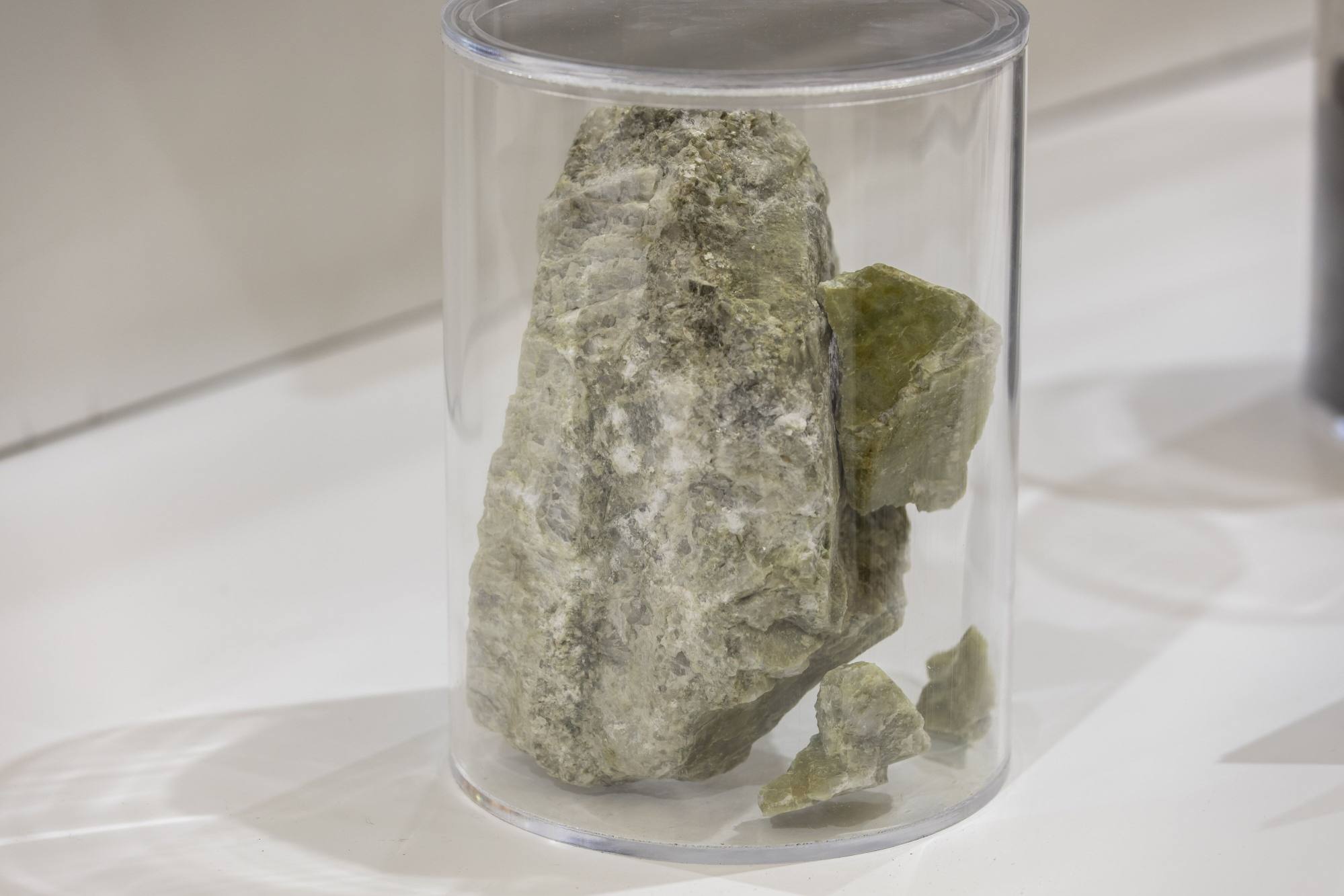

Establishing reliable supplies of minerals such as lithium, nickel, cobalt and copper would be key to making the clean transition affordable, the IEA said.

China accounts for 60 per cent of lithium refining and 77 per cent of the production of global battery cells, while mineral-rich nations like Australia depend on China for their exports of resources.

Double whammy

“China being a country of concern for the US administration, this gives an additional challenge to the Southeast Asian country, which has received large Chinese EV-related investments,” Barre said.

Procuring critical minerals for electric vehicles in Asia poses several challenges, including limited regional resources as well as some other obstacles, according to A.M. Muralidharan, head of productivity and retail development at Volvo Construction Equipment.

“Purchasers often also want to know if the batteries contain conflict materials – which are scarce materials or components known to be sometimes derived from sources that benefit armed groups in the area of origin,” he said. “It is very likely that our industry will depend more on China in the short term, and will then be balanced by Japanese and Korean players, in the mid and long term.”

Tightness in the availability of raw materials is something “that will probably slow EV deployment below what many countries and companies are hoping for”, said James Stevenson, executive director of coal, metals and mining at McCloskey by OPIS.

The global trade landscape for resources was also changing because of “friendshoring”, or relying on supplies from friendly countries, he said.

“However, ultimately, it’s essential to recognise that investment in developing new supplies is critical – this may require sourcing of raw materials from countries that are not necessarily allies,” Stevenson added.

Malaysia has big EV ambitions. To get there, it wants to liberalise markets

Malaysia has big EV ambitions. To get there, it wants to liberalise markets

Another industry executive said the development of the EV supply chain would occur rapidly, despite challenges such as the raw materials’ availability.