Such investors have fled markets in both Hong Kong and mainland China this year amid jitters about the durability of China’s post-Covid-19 economic recovery. The value of IPOs in Hong Kong has dropped 56 per cent from the same period in 2022 to US$5.31 billion so far this year, according to Bloomberg data.

“We benefit from growth opportunities in China’s customised enterprise services e-commerce market,” Zhubajie said in the filing. “The vast and steady growth in the number of businesses, in particular SMEs [small and medium-sized enterprises], in China has driven extensive demand for enterprise services.

“At the same time, the emergence of flexible employment has brought new vitality to the supply of enterprise services.”

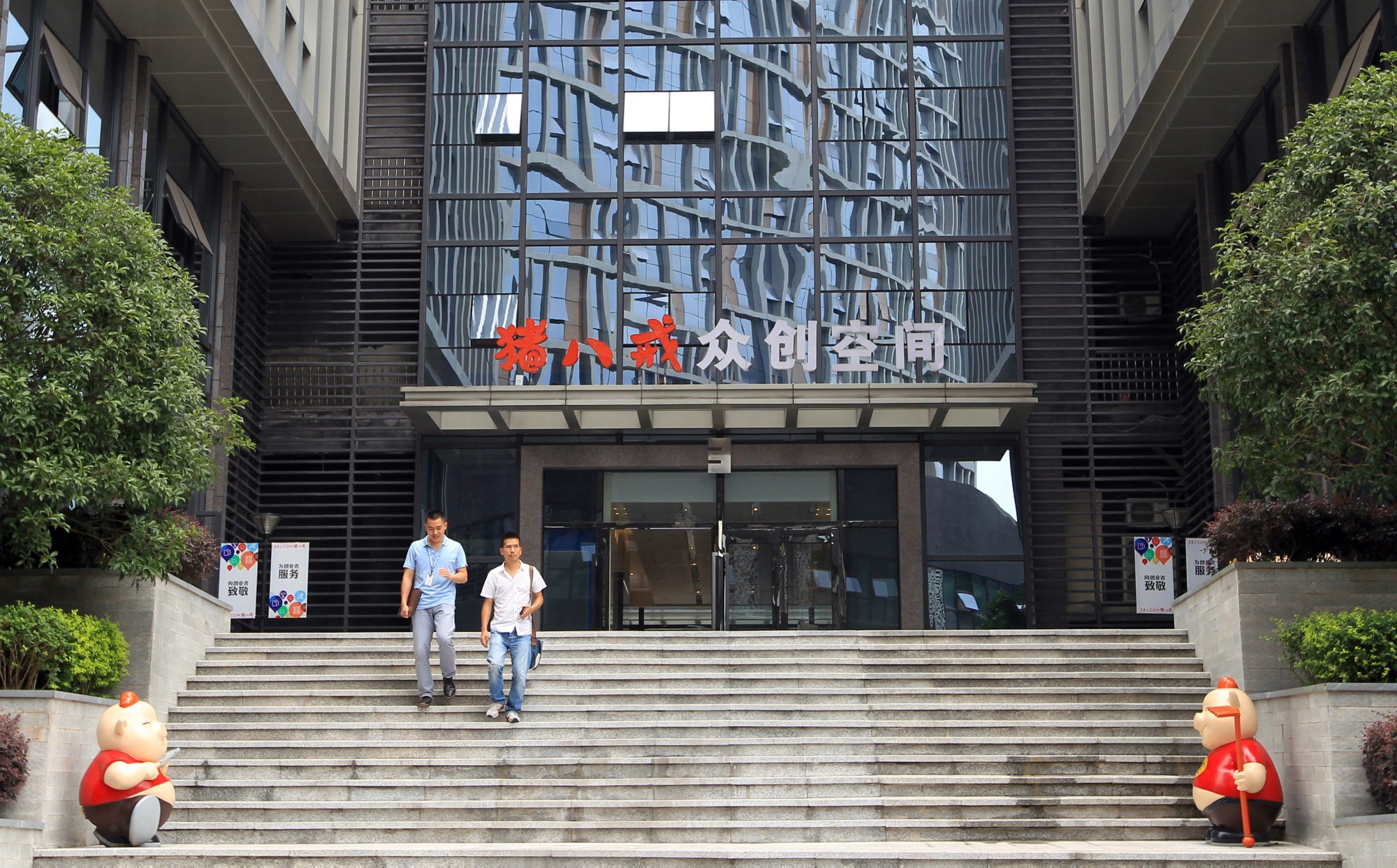

Zhubajie borrows its name from a major character in “Journey to the West”, a classic Chinese novel. It was founded in 2006 by Zhu Mingyue, who worked as a journalist and language teacher earlier.

The company applied for a listing in Hong Kong in October 2022 and April this year. It had also made an attempt to list on Shanghai’s technology-heavy Star Market and overseas markets. Zhu currently has an about 31 per cent stake in the company as its biggest shareholder through business units he controls.

It was once valued at 11 billion yuan (US$1.54 billion) after securing multiple rounds of financing from investors such as IDG Capital. The company was ranked second among China’s enterprise service e-commerce suppliers with a market share of 2.4 per cent in terms of gross merchandise volume (GMV) in 2022, the exchange filing said citing data by iResearch Report.

China IPO volume dives after regulator engineers offering drought to boost markets

China IPO volume dives after regulator engineers offering drought to boost markets

It had about 27 million registered enterprises and 7.7 million service providers on its platform as of the end of June, where more than 810 types of corporate services such as advertising and intellectual property could be sourced, it said.

Its GMV reached 11.4 billion yuan last year, more than doubling that of 2020, according to the filing. The figure stood at 7.6 billion yuan in the first half of this year.

Zhubajie posted a loss of 78.2 million yuan in the first half, which might put the company on course for a fourth straight year of being unprofitable, the filing showed.