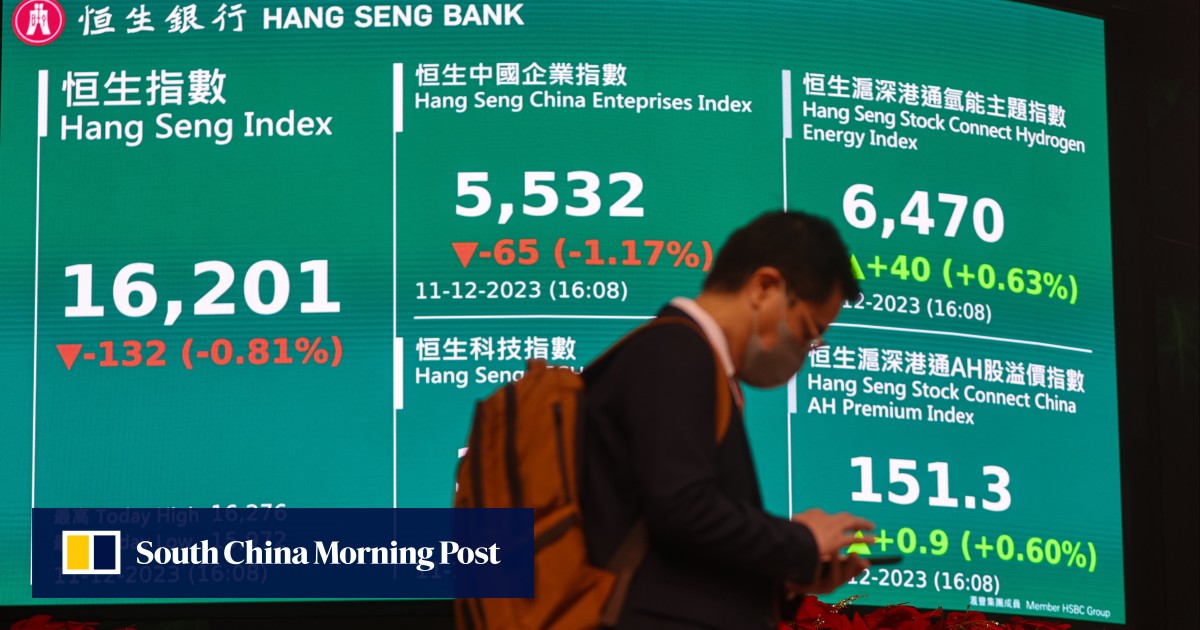

The Hang Seng Index lost 0.5 per cent to 15,308.69 on Friday to near the lowest since October 2022, taking the cumulative decline this week to 5.9 per cent. The index erased an earlier rally of as much as 1 per cent. The Tech Index lost 1.5 per cent and the Shanghai Composite Index slipped 0.5 per cent to the lowest level since May 2020.

Tencent retreated 2.3 per cent to HK$271.20, Alibaba slipped 1.7 per cent to HK$65.55 and peer JD.com tumbled 2.5 per cent to HK$84.15. EV maker BYD weakened 0.4 per cent to HK$195.60 while rival Li Auto tumbled 2.7 per cent to HK$110.20. Hansoh Pharma slid 3.9 per cent to HK$12.36 and Wuxi Biologics dropped 2.6 per cent to HK$28.35.

China’s central bank this week kept its key lending rates unchanged for a fifth month, while government reports showed growth trailed forecasts last quarter and home prices fell again in December by the most since 2015.

Chinese stocks listed in Shanghai, Hong Kong have never been cheaper. Here’s why

Chinese stocks listed in Shanghai, Hong Kong have never been cheaper. Here’s why

“The past week has been very painful,” said Eva Lee, head of Greater China Equities at UBS Global Wealth Management. “We will stay on the defensive side” until there’s more policy visibility from the National People’s Congress in March, she added.

Foreign investors have sold 5.2 billion yuan (US$730 million) of Chinese stocks on Friday, a sixth straight day of net outflows, Stock Connect data showed. The net selling has snowballed to 31.5 billion yuan in 2024, adding to a record US$26.2 billion sell-off in the previous five months.

The three-week sell-off in Hong Kong has pushed the valuation of local stocks deeper to historical lows. The average price to book value of the 82 members in the benchmark fell to 0.85 times, near the record 0.82 times seen in October 2022, according to Bloomberg data.

One stock started trading on Friday. Shandong Tengda Fasten Tech, which makes stainless steel fastener products, jumped 43 per cent to 24.23 yuan in Shenzhen.

Other major Asian markets all rose. Japan’s Nikkei 225 advanced 1.4 per cent, while South Korea’s Kospi added 1.3 per cent and Australia’s S&P/ASX 200 gained 1 per cent.