During the G20 leaders’ summit, U.S. President Joe Biden called on G20 leaders to support the World Bank and other multilateral development banks to increase their ability to support low and middle-income countries. From left, World Bank President Ajay Banga, Brazil’s President Luiz Inacio Lula da Silva, India’s Prime Minister Narendra Modi, South Africa’s President Cyril Ramaphosa and U.S. President Joe Biden in New Delhi on Sept. 9, 2023.

Evan Vucci | Afp | Getty Images

World leaders have called for the World Bank’s expansion to boost its lending capacity — but that can’t happen without funding from the private sector, the bank said.

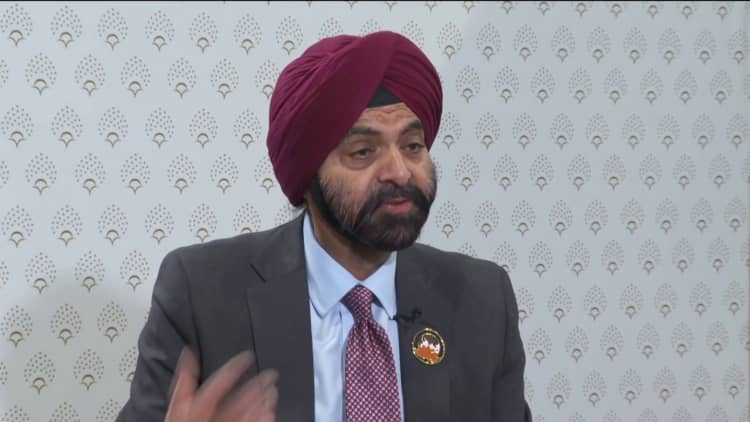

The World Bank is no longer just focused on eradicating poverty, but also on other impending global challenges — like pandemics, climate change and food insecurity, its president Ajay Banga told CNBC’s Tanvir Gill on Saturday.

“There’s no way there’s enough money in the multilateral development bank, or even in governments … that can drive the kinds of changes we need for this polycrisis. Getting the private sectors’ capital and ingenuity into the game is going to be very important,” he told CNBC in an exclusive interview on the sidelines of the Group of 20 nations leaders’ summit in New Delhi.

“We are digging deep to boost our lending capacity, but we are going further, creating new mechanisms that would allow us to do even more,” Banga said at the G20 leaders summit.

“We’re working to expand concessional financing to help more low-income countries achieve their goals, while thinking creatively about how to encourage cooperation across borders and tackle shared challenges,” he added.

Biden backs World Bank

Leaders at the summit agreed that this isn’t something the World Bank can tackle alone.

During the summit, U.S. President Joe Biden called on G20 leaders to further support the World Bank and other multilateral development banks over the next year in order to increase the institution’s ability to support low and middle-income countries.

Biden has asked Congress to increase the World Bank’s financing by more than $25 billion, a move that will enable the bank to further help developing countries achieve their development and economic goals.

The world needs institutions to work together.

Kristalina Georgieva

Managing Director, IMF

“This initiative will make the World Bank a stronger institution that is able to provide resources at the scale and speed needed to tackle global challenges and address the urgent needs of the poorest countries,” the White House said.

The World Bank was created in 1944 to help rebuilding efforts in Europe and Japan after the Second World War. It started with just 38 members but today includes most of the countries in the world.

Biden has previously said that developing countries need more funding options to reduce their dependency on China, and help them recover from the effects of Russia’s war on Ukraine. The administration asked for $3.3 billion to increase development and infrastructure finance by the World Bank.

“It is essential that we offer a credible alternative to the People’s Republic of China’s (PRC) coercive and unsustainable lending and infrastructure projects for developing countries around the world,” the White House said in August.

Apart from providing more resources to help developing countries reduce poverty, the World Bank’s expansion also aims to help these nations in their renewable energy transition.

“I do have the idea that if I could get a certain amount of money in the bank to put into say, renewable energy, could I get the private sector to put one-is-to-one, two-is-to-one, three-is-to-one?” Banga said.

He highlighted that investors are keen on investing in renewable energy in developing countries, and are confident that solar, wind and geothermal projects “can be built to make money.”

‘Work together’

Both the World Bank and IMF have pledged to form a stronger partnership to help countries with their debt struggles, sustainability goals, and digital transition.

In a separate interview with CNBC’s Martin Soong at the G20 summit, the IMF’s Managing Director Kristalina Georgieva said: “The world has changed. the horizon of how many different lenders there are and different conditions they provide their resources, is much, much broader that it was 10 years ago.”

“We need this conversation because if you don’t have it, we have no solutions and the debt problem is very pressing,” Georgieva said Sunday.

She added that “25% of debt of emerging markets is treading in distressed territory.”

“We now have more than half of of the low income countries either in or close to that distress.”

The IMF Chief reiterated that the World Bank and the fund must work to complement each other and promote synergies.

“The bank has very deep sectoral expertise. We don’t and we would never ever get into sectoral investments,” she explained.

“What we bring is how you can use fiscal policies to advance the transition to digital economy; how you can use monetary policy to assess the new types of risks — including from crypto from climate; and how you can use data to cover what matters to policymakers today and in the future.”

“The world needs institutions to work together,” she added, pledging that both the IMF and World Bank will work with others to “set the right example of what it means for the whole to be bigger than the sum of individual parts.”