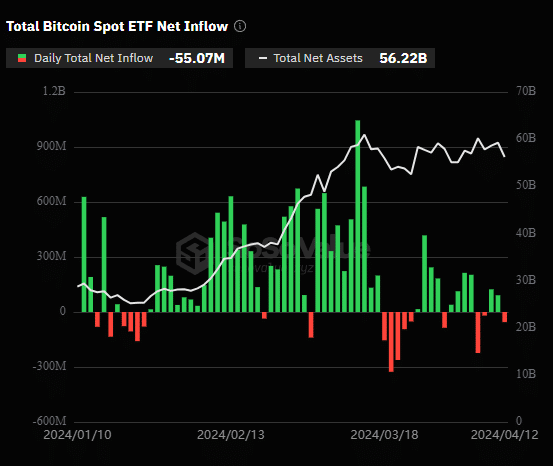

Spot Bitcoin ETFs, or exchange-traded funds, saw a net outflow of $55 million on Friday, April 12.

The data signals a reversal after ETFs enjoyed two consecutive days of inflow worth nearly $215 million.

Bitcoin ETFs ahead of halving

According to data from SoSo Value, the largest outflow on Friday came from Grayscale’s GBTC, which saw $166 million withdrawn.

GBTC continues to see large outflows ahead of the halving, as the ETF also shed $154.9 million on Monday, April 8.

Conversely, the largest inflow on Friday came from BlackRock IBIT, with the ETF attracting $111 million.

The impact of Friday’s outflow has been evident in the crypto market. Bitcoin lost nearly 5% in the past 24 hours, dropping to $65,000. The overall market followed suit, as nearly $900 million was liquidated.

Bitcoin ETFs saw three days of net outflow last week, with a total of $298.4 million in funds exiting from the market.

Despite the consecutive outflows from GBTC, Grayscale’s CEO, Michael Sonneshein, remains optimistic. Recently, Sonneshein emphasized that the withdrawals from GBTC have likely reached equilibrium. He believes that the outflow will significantly slow as Grayscale decreases its Bitcoin ETF fees.

The continuous outflows from the ETF market could also be driven by a pre-halving pullback. There is a common anticipation that the Bitcoin halving generally leads to a larger bull market for the largest cryptocurrency. So, a pullback occurs when investors start taking profits in the short-term and tend to invest again when there is a dip.

However, it’s also likely that investors are cautious about the halving not producing substantial rallies like previous years, as Marathon Digital recently predicted that BTC has already reached its peak after the approval of ETFs earlier this year.