Bitcoin prices are hovering near $70,000, bouncing from a critical dynamic support line, evident in the daily chart. Even though bulls have yet to breach $72,000 and break above March 2024 highs, traders are optimistic about what lies ahead.

Bitcoin Bulls In Charge: Analyst Targets $85,000

Taking to X, one analyst believes the world’s most valuable coin is preparing for a decisive breakout above the local resistance levels and all-time highs at around $74,000. In a post, the analyst notes that Bitcoin has been consolidating, moving sideways and even lower for the past three months since mid-March.

Related Reading

If buyers succeed, the near 100-day consolidation could set the base for prices to spike, ushering a “next leg higher” that would likely take BTC to $85,000. Still, even amid the optimism, traders should be cautious.

Technically, the upside momentum has been fizzling. Even with gains on June 3, buyers’ failure to confirm the gains of May 20 is slowing down the uptrend. So far, the $72,000 level on the upper hand must be conquered for any hopes of further gains. On the lower end, support lies at $66,000.

Even so, the dynamic 20-day moving average is emerging as a worthy support. Any breakout in either direction, most preferably in alignment with Q1 2024 gains, would be fundamentally driven.

Inflation, Spot BTC ETF Inflows Fanning Demand

Looking at fundamental data streaming from the United States, the stage is being set for optimistic buyers. Cooling inflation and the uptick in M2 money supply could hint that buyers are getting ready.

The United States Federal Reserve has closely monitored inflation, among other metrics. With inflation dropping, the Fed may decide to slash interest rates, fueling a bull run like it did in 2021.

Related Reading

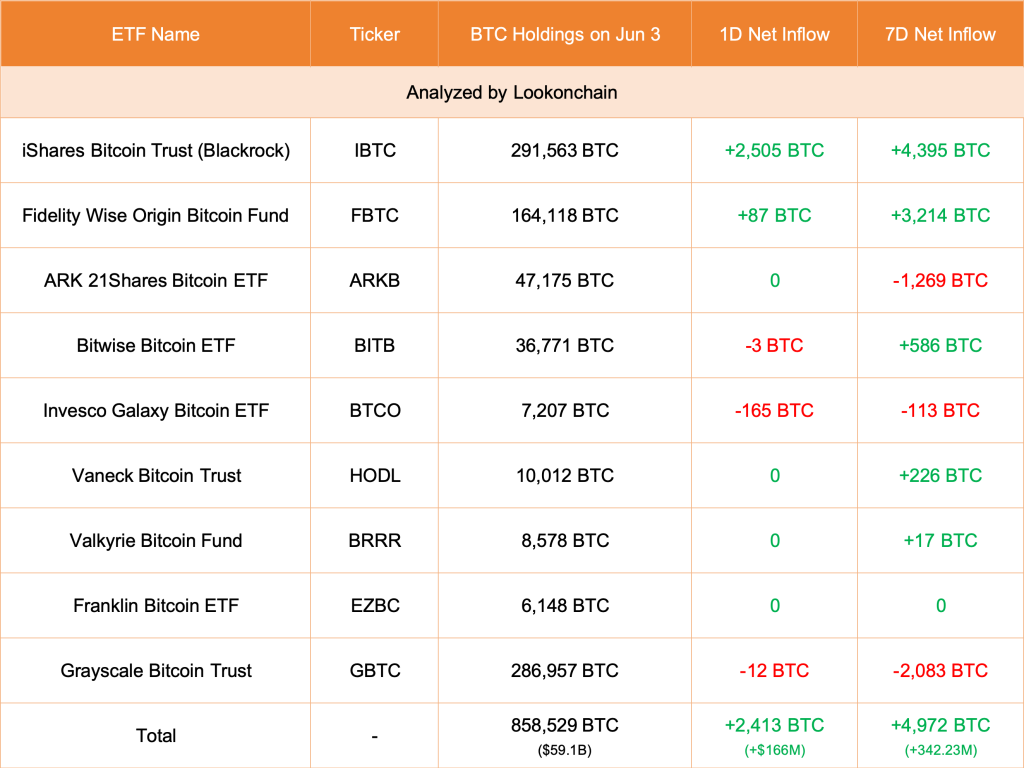

Other key drivers would include the encouraging flow into spot Bitcoin ETFs. As BTC soared to register March 2024 highs, inflow spiked, driven chiefly by institutional demand. After prices broke higher on May 20, inflows have picked up momentum.

On June 3, Lookonchain data revealed that spot BTC ETF issuers in the United States added 2,413 BTC. Grayscale’s GBTC reduced just 12 BTC.

Launching the Monochrome Bitcoin ETF (IBTC) in Australia and a similar product in Hong Kong and globally will only increase the demand for BTC. The newly launched IBTC spot ETF in Australia will directly hold BTC, which will be under the custody of Coinbase.

Feature image from DALLE, chart from TradingView