Hong Kong’s capital market, which had wallowed in a bear market for three years during the Covid-19 pandemic, has picked up since Chan’s appointment. The city’s benchmark Hang Seng Index rose 11 per cent in her first 100 days, while the market’s average daily turnover jumped 35 per cent to HK$121 billion (US$15.5 billion).

Eighteen IPOs have raised a combined HK$8.7 billion since April, a notable pickup from the five that raised HK$2.18 billion in January, and a fallow February.

New IPO applications have surged since the CSRC announcement, with 19 submissions in May alone, compared with 10 a month earlier, according to the exchange’s data.

Even before then, the HKEX had been laying the foundation to build what Chan called “resilience”, to ensure that the financial marketplace would always be available to connect businesses with capital, instead of being merely a fair-weather exchange.

“As an exchange operator, we face a unique set of challenges,” she said. “We operate in an environment where things surrounding us are fast-changing. We need to stay resilient because the entire market relies on us. We also anticipate changes and get ourselves ready for those changes.”

One month into her new role, she kicked off the development of a proprietary technology platform called the Orion Derivatives Platform that can offer round-the-clock derivatives trading for global investors when it goes into service in 2028.

“This will be a multi-year exercise, but we think it is very crucial that we embark on this journey so that we can cater to the needs of our global clients” and enhance Hong Kong’s position as Asia’s risk management centre, she said.

Green financial and carbon credit trading platforms would be other key strategies of development for the HKEX to meet the goal of Hong Kong to act as a green financing hub.

About 80 per cent of the shares that change hands everyday in Hong Kong belong to companies based in mainland China, a connection with the world’s second-largest economy that Chan described as the HKEX’s “trump card” and “something that works”, compared with other global exchanges.

Chan said a key strategy is to continue to attract Chinese and international listings, as well as to entice mainland and overseas investors to trade here. She also wants to introduce home-grown technology platforms and products.

“We will continue to build on our China strength,” she said. “It is essentially a very targeted focus in terms of building the ecosystem, which involves three main elements – issuers, investors and products. Once you have built a very robust ecosystem, then the vibrancy will be enhanced, and then the liquidity will come.”

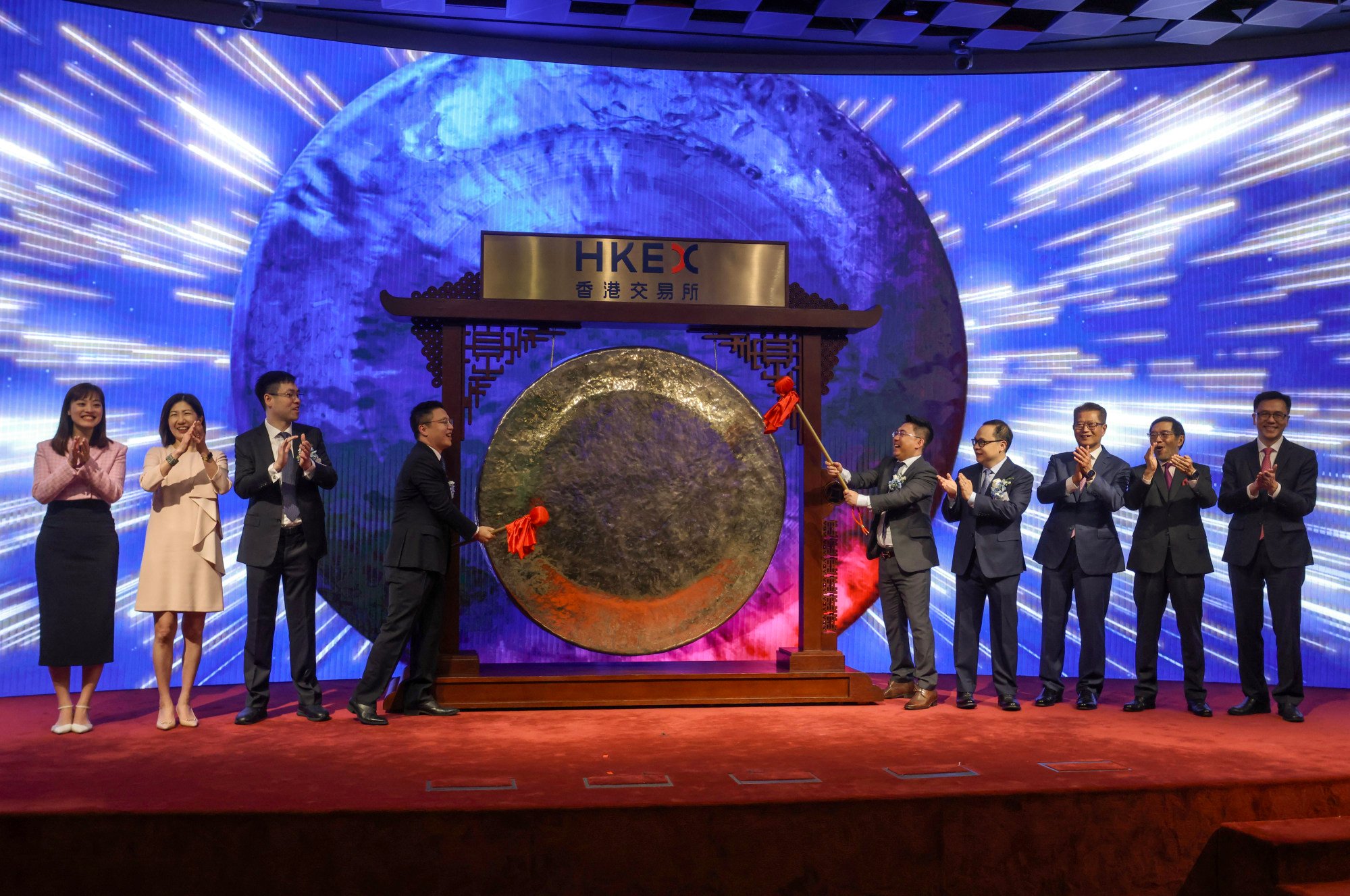

She was partly vindicated with the successful listing last week by QuantumPharm, an unprofitable start-up that uses artificial intelligence and quantum physics in the discovery of pharmaceuticals.

QuantumPharm was the first listing under the exchange’s Chapter 18C framework, which allows technology pioneers in strategic fields to raise capital even before they meet revenue and profit targets. The company’s retail shares were overbought 103 times before they began trading at a premium to their IPO price.

“The significance of that is huge because we are opening a totally new channel for pre-revenue companies engaging in the technology intensive areas to seek public funding,” said Chan, who wrote the 18C rules while she was the head of listing at the exchange.

“We want to make sure that we continue to create listing frameworks” that offer bespoke fundraising rules to attract companies, she said.

“We want to improve our listing regime to meet the needs of exciting companies, and new champions of the future to develop and fund their business,” she said.