Yuga Labs, the creator of the viral Bored Ape Yacht Club non-fungible tokens, announced a new round of layoffs on Friday as the NFT frenzy appears to cool.

Greg Solano, YugaLab’s CEO, announced that the startup would lay off an unspecified number of employees as it undergoes “restructuring.”

“To put it simply: Yuga lost its way,” he wrote in a statement posted on X. “Getting ourselves centered and on the right path means being a smaller more agile and cryptonative team.”

Bored Ape Yacht Club floor price declines

The news comes as the floor price for the popular NFT collection once touted by celebrities like Justin Bieber and Paris Hilton sinks to lows not seen since it was released in 2021.

The floor price is the lowest price an NFT in a given collection will sell for. As of May 1, Bored Ape Yacht Club’s floor price hovered around 13.395 ETH, according to OpenSea, which would be worth nearly $40,000 at the time of publication. That’s down from a peak floor price of 128 ETH on May 1, 2022, according to NFTPriceFloor, which would have been worth around $354,000 at that time.

That’s a far cry from the top prices Bored Apes once sold for. In September 2021, a Bored Ape was auctioned by Sotheby’s for a little over $24 million.

But despite Bored Ape Yacht Club’s substantially lower floor price, the NFT market is still showing some signs of life. On April 25, an anonymous collector shelled out close to $12 million worth of ETH for a CryptoPunk NFT, according to OpenSea.

How YugaLabs got started

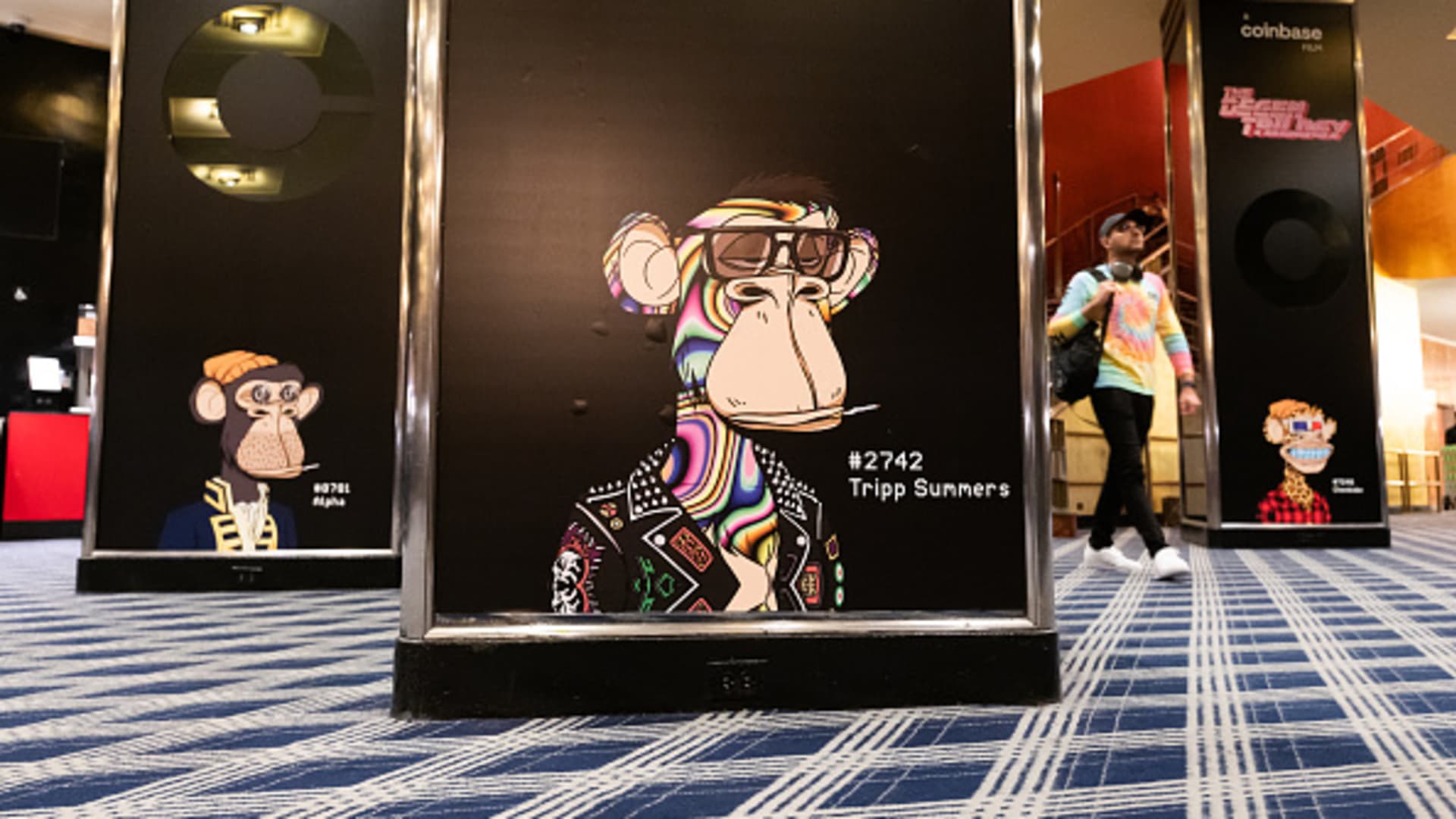

YugaLabs’ Bored Ape Yacht Club collection launched in April 2021 with 10,000 NFTs depicting the cartoon apes with various colors, clothing and facial expressions.

The startup went on to release several other NFT collections, including Mutant Ape Yacht Club and CryptoPunks. In 2022, YugaLabs raised $450 million in seed funding and was valued around $4 billion, according to its website.

However, the startup has faced its share of controversy over the past three years. In December 2022, YugaLabs was sued by investors who allege they were tricked into purchasing Bored Apes by celebrities who were promoting the NFTs without disclosing they had been paid to do so.

Collectors and investors should do their research

When it comes to digital assets such as NFTs, investors should do their homework.

Similar to collectibles like trading cards or Beanie Babies, NFTs can hold sentimental value. However, their monetary value only goes as high as someone else is willing to pay for it.

There’s no guarantee that you’ll earn a profit from selling an NFT, which is why financial experts advise against spending more money on them than you’re willing to potentially lose.

Want to make extra money outside of your day job? Sign up for CNBC’s new online course How to Earn Passive Income Online to learn about common passive income streams, tips to get started and real-life success stories.

Plus, sign up for CNBC Make It’s newsletter to get tips and tricks for success at work, with money and in life.