The move comes on the heels of an agreement struck last week by the developer’s subsidiary to sell its last investment in Australia.

The Foshan-based developer, once China’s largest home builder by sales, is auctioning five properties in the capital of the southern Guangdong province, according to a recent listing on Guangzhou Enterprises Mergers and Acquisitions, a property-transaction platform.

“At the moment, investors in the mainland, especially those owned by the state, still have plenty of dry powder, so they might consider [picking up] property projects, especially the good ones,” said Shen Meng, a director at Beijing-based investment firm Chanson & Co. “One main thing to consider is whether the listing prices are attractive enough. In Country Garden’s case, there will definitely be room for negotiation.”

The assets – two office towers, a hotel, a residential building and commercial property – have a combined base price of 3.82 billion yuan (US$530 million), marking Country Garden’s most ambitious attempt at divestments in the city.

Country Garden Phoenix City Hotel, a 573-room five-star hotel, has an asking price of 1.3 billion yuan, while an office building in the southern district of Panyu, is listed at 1.2 billion yuan, according to data available on the platform.

Country Garden did not reply to the Post’s queries regarding the asset sale.

China home sales to disappoint in January, may fall by up to 15 per cent in 2024

China home sales to disappoint in January, may fall by up to 15 per cent in 2024

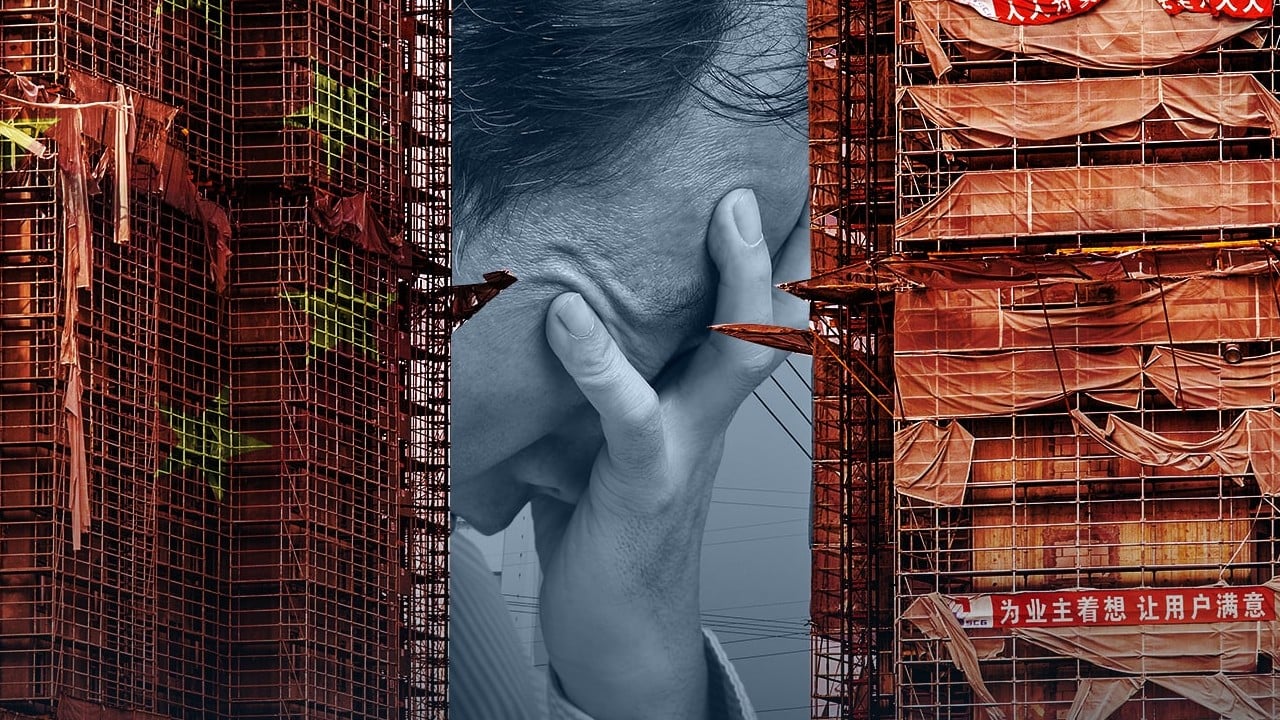

Country Garden’s debt woes show no signs of ending. It is among a host of mainland developers mired in financial trouble since Beijing began targeting the industry with its “three red lines” policy in August 2020. Saddled by debt of 257.9 billion yuan as of last June, nearly 109 billion yuan of the company’s borrowings are due by June 2024, according to its financial statement.

Country Garden has been working on a debt restructuring proposal since defaulting on US$11 billion of offshore bonds. On January 16, the company appointed KPMG China as its principal financial adviser to help with the restructuring of its offshore liabilities.

China property: why an uptick in Beijing, Shanghai home sales is unlikely to last

China property: why an uptick in Beijing, Shanghai home sales is unlikely to last

Country Garden also pledged to deliver more than 480,000 homes in 2024, after failing to achieve its goal of 700,000 units in 2023.