At a closed-door meeting with representatives of domestic and overseas financial institutions, Pan Gongsheng said real estate – long a bellwether for the economy at large – has shown “positive signals”.

“It has a solid foundation for long-term healthy and stable development,” he said during the China Development Forum, which drew dozens of executives from major multinationals including tech giant Apple.

“Property market volatility has a limited impact on China’s financial system,” he added, according to a statement posted on the website of the People’s Bank of China (PBOC).

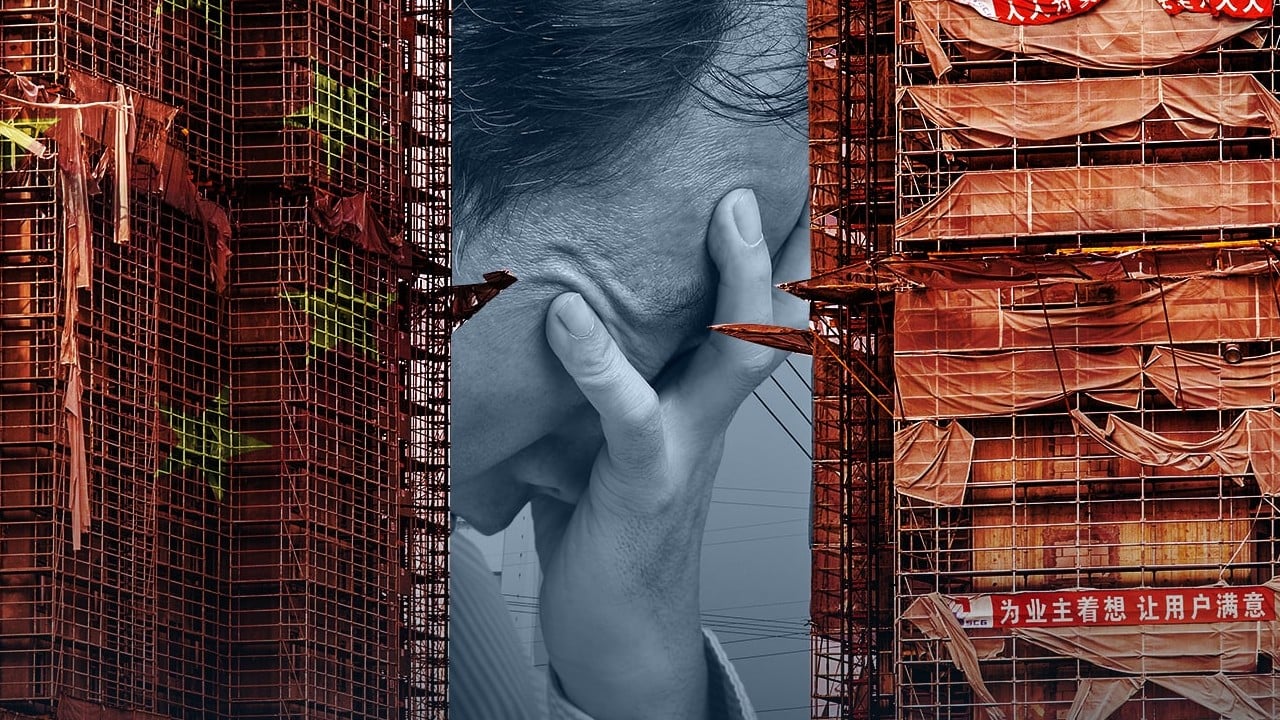

The downgrade further darkened the shadow looming over the sector, initially precipitated by revelations of financial trouble for China Evergrande, Country Garden and many other developers.

However, data show the housing market slump has largely continued unabated.

Property investment dropped by 9 per cent year on year in the first two months of 2024 and new home sale values plunged by 29 per cent compared with the year prior, according to the National Bureau of Statistics.

China’s home prices fall at a slower pace as Beijing moves to resuscitate sector

China’s home prices fall at a slower pace as Beijing moves to resuscitate sector

“The weakness from the property sector has persisted. In order for Beijing to reach its GDP growth target for this year, more easing is needed and likely to be implemented in a coordinated way,” HSBC said in a research note earlier this month.

The bank called for “a stronger push to stabilise the property sector, essentially using a holistic method to push forward the dual track model and reverse the current track of a continuous deterioration in the new home market segment.”

China has set an ambitious target to grow its economy by around 5 per cent this year, a challenging goal to meet as other factors complicate the country’s situation in addition to the trepidations of the property market.

S&P Global Ratings on Monday announced it would maintain its economic growth estimate of 4.6 per cent for China in 2024, compared with last year’s actual rise of 5.2 per cent.

“Our forecast factors in continued property weakness and modest macro policy support. Deflation remains a risk if consumption stays weak and the government responds by further stimulating manufacturing investment,” the rating agency said.

The PBOC governor, however, expressed more optimism, saying he believes the country still has “ample policy space and a rich reserve of tools”.

China’s financial system is operating soundly, with generally healthy institutions

“China’s economy [is on] an upward trend and is capable of achieving the expected growth target,” said Pan at Monday’s meeting. “We’ll continue to provide a favourable monetary environment for economic recovery.”

“The debt level of the Chinese government is in the lower mid-range internationally, and policies to address local government debt risk are gradually proving effective,” he said.

“China’s financial system is operating soundly, with generally healthy institutions and strong risk resistance capacity.”