CNGR Advanced Material, a Chinese battery-component maker and Tesla supplier, is looking to buy major stakes in Argentina brine deposits to extend its foray into the lithium-rich region as it builds its own supply chain outside the Asian nation.

Senior CNGR executives visited at least three deposits in Argentina last week, according to people familiar with the matter. Those include the Jama project in Jujuy province and the Rincon project in Salta province, said one of the people, who asked not to be named as the information isn’t public.

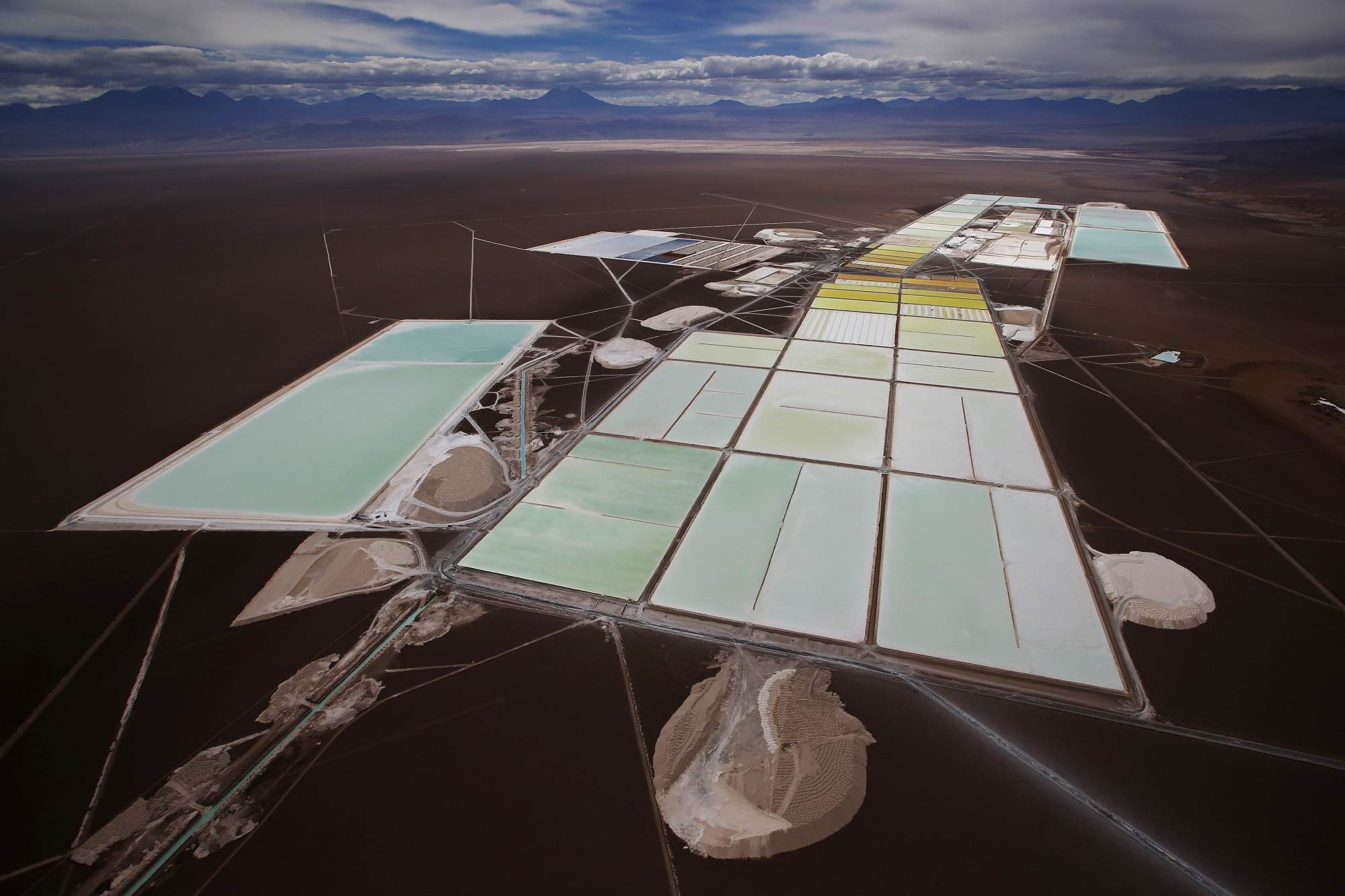

CNGR is building an upstream lithium supply chain to serve customers in the Western world, just as the US and allies are stepping up efforts to decouple from China’s global dominance over battery metals. The firm partnered with African private investment fund Al Mada in September to build an industrial base in Morocco and bought a 90 per cent stake in Lithium Energy’s Solaroz Lithium brine project in Argentina for US$63 million in April.

The structure of CNGR’s investment will be similar to the one it made in April, according to the people. CNGR declined to comment when contacted by phone.

Prices of lithium – a key metal in electric-vehicle batteries – have fallen more than 80 per cent from a late-2022 record as the market whipsawed from shortage fears to a supply glut. That has happened amid a growing backlash against EVs in some markets. Lithium’s collapse is creating havoc among producers, with stalled projects, scrapped deals and output cuts. Still, analysts have said low prices may create opportunities for acquisitions.

Argentina has the world’s third-largest lithium reserves after Chile and Australia, but the country has long struggled to lure the consistent, hefty international capital flows needed for mass development of oil, natural gas, gold and silver locked underground.

China’s manufacturing activity expanded at the fastest rate in almost two years in May, according to a private survey, contrasting with weak official data that dented the country’s growth outlook.

Australia has ordered Chinese-linked Yuxiao Fund and its associates to sell their stakes in rare earths miner Northern Minerals, part of an effort by US allies to counter the Asian nation’s dominance of critical minerals.

China’s shrinking carbon dioxide emissions – evident in their 3 per cent March decline – suggest policymakers are getting tougher on fossil fuel use as they push toward 2030’s climate goals.