China’s top securities regulators and stock exchange officials met with global fund managers in Europe in the first overseas roadshow, days after Beijing delivered its biggest rescue plan to overcome a three-year housing market crisis amid a rebound in stock prices.

Officials from China’s central bank, banking and insurance regulatory administration, foreign-exchange regulator and the Shanghai and Shenzhen bourse operators, also joined the meetings. Some 15 companies also made presentations.

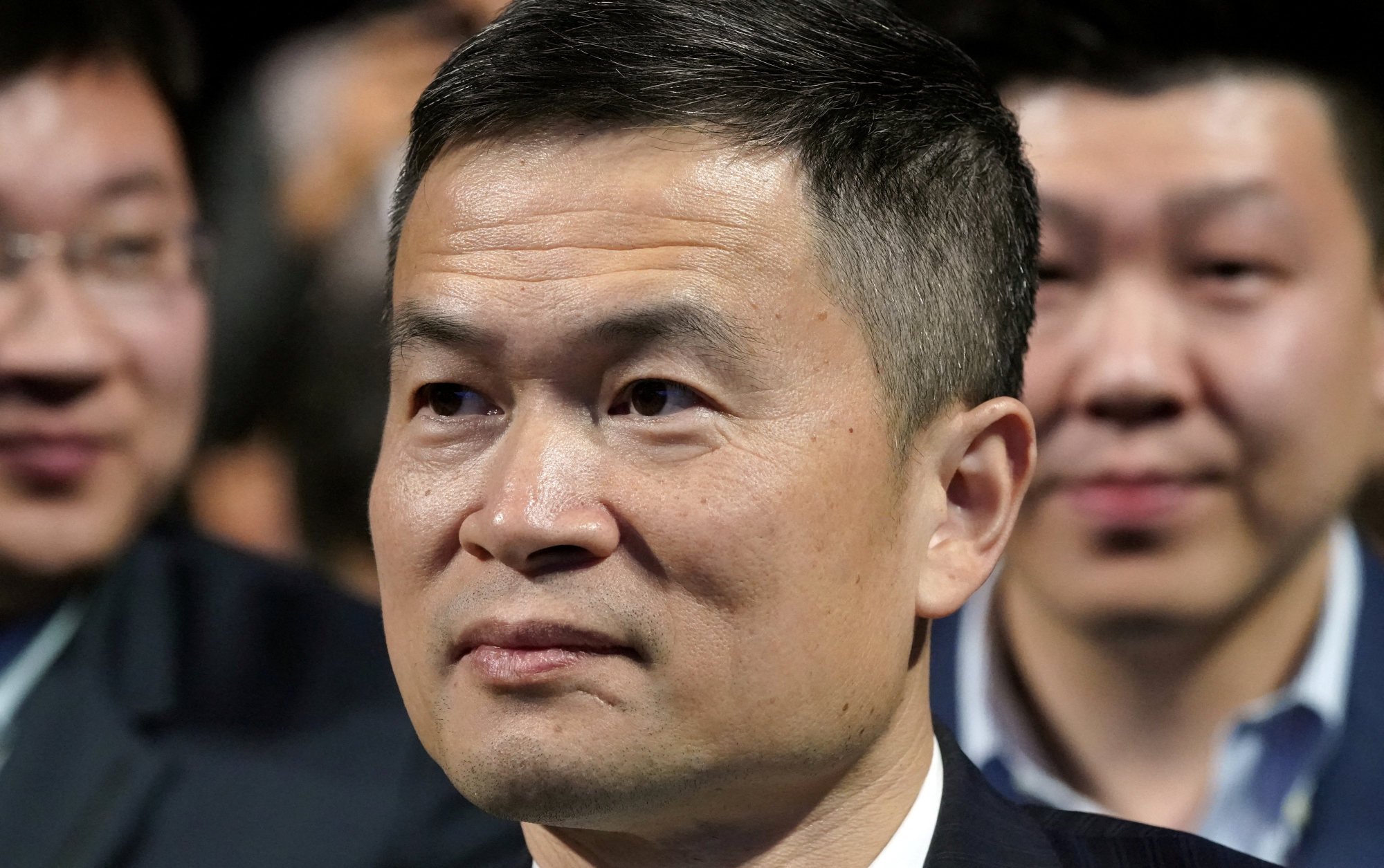

Known for his reformist credentials, Fang delivered speeches to convince investors of fairness and transparency on the onshore markets, the officials said on condition of anonymity. China is wooing global funds, after being deemed “uninvestable” by some analysts over its harsh treatment of tech companies.

“The officials must have been very eager to banish the perception that China’s stock market is uninvestable,” said Ding Haifeng, a consultant at Shanghai-based financial advisory firm Integrity. “It is unlikely to have great substance, since the property-market bust and overcapacity in the manufacturing sector are weighing on most foreign investors.”

Guangzhou Tinci Materials Technology, which produces lithium-ion battery materials, and Zhejiang Sanhua Intelligent Controls, a maker of heat control components, were among 15 companies which made presentations at the roadshows, the officials said.

Beijing and the central bank announced a 300 billion yuan (US$41.3 billion) funding support plan last week for state-owned companies to buy unsold homes and land to help cash-strapped home builders and local governments. The move came amid a rally that has lifted the Hang Seng Index by 26 per cent, and the Shanghai Composite Index by 15 per cent, from their lows this year.

Chinese assets were shunned by investors who fretted about draconian anti-Covid curbs, a costly crackdown on tech companies and Beijing’s common prosperity agenda that erodes corporate earnings. Analysts at JPMorgan called some parts of the market uninvestable due to policy risks.

The European Commission is separately investigating foreign state subsidies and is expected to impose tariffs higher than the standard rate of 10 per cent on Chinese-made electric cars.

China’s yuan-denominated shares are still mostly off-limits to overseas investors, except through an investment link with Hong Kong known as Stock Connect scheme and via China’s qualified foreign institutional investor (QFII) programme.

Global companies are also unable to raise funds on China’s onshore stock exchanges despite Beijing’s pledges to liberalise the world’s second-largest capital market.

In June, 2023, Fang told investors at the Lujiazui Forum in Shanghai that China was actively luring foreign funds to the A share market. Foreign capital would continue to pour into mainland-listed equities based on better fundamentals, despite souring US-China relations.

Zhu Haibin, chief China economist at JPMorgan Chase, said on Thursday that expectations of an extended decline in home prices and shrinking incomes among wealthy families, would keep buyers at bay. The ability of cash-strapped private developers to deliver homes are also causing jitters, he added.