Bank of New York is the trustee for the defaulted bonds and is taking legal action under the instructions of a group of international bondholders who own 49. 1 per cent of the offshore convertible bonds issued by the Chengdu-headquartered company.

The convertible bonds issued in March 2021 allowed holders to demand the company redeem all of the bonds on March 2, but the company allegedly failed to meet the redemption requirements.

After the default, the company and the bondholders held a meeting on March 14 but the bondholders said XJ “presented no concrete or credible plan” to repay the bonds, prompting them to sue. Kirkland & Ellis is representing the bondholders, and the first petition will be heard on June 19.

XJ, which was renamed last month, closed 3 per cent lower on Thursday at 24.7 HK cents before the announcement was issued after the market closed. The company’s share price has tumbled 60 per cent over the last year.

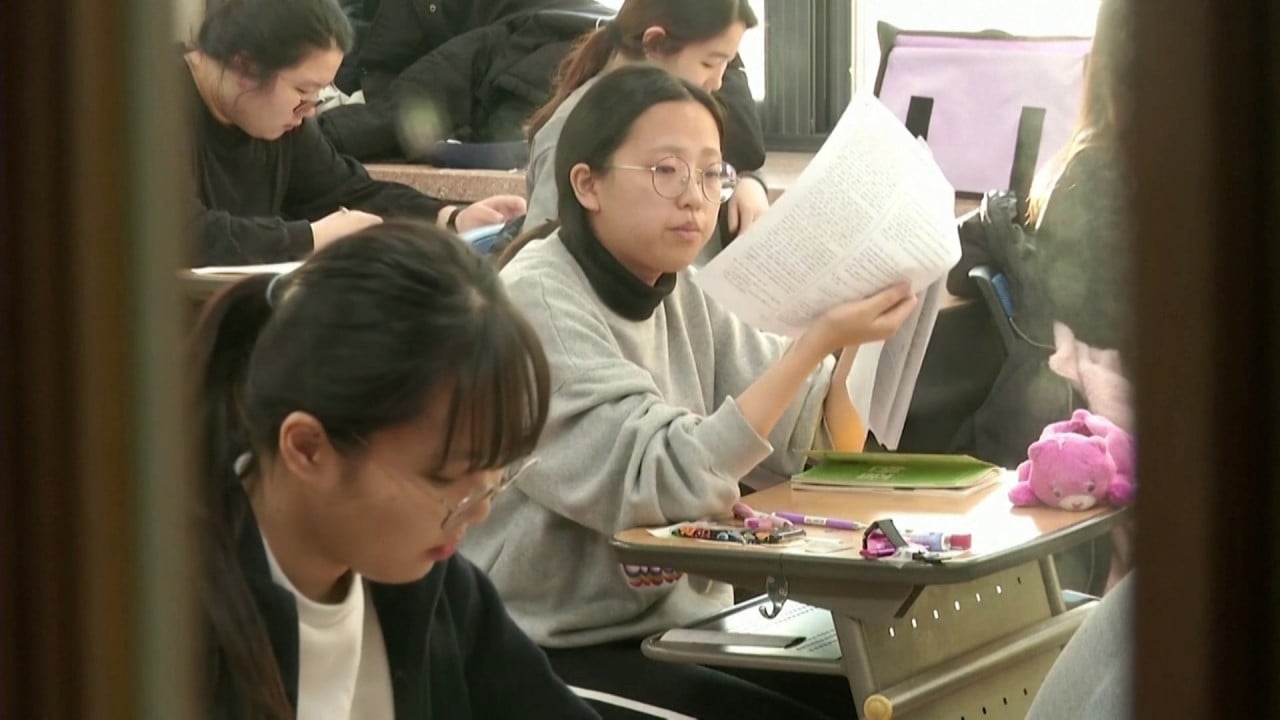

It is based in Sichuan and operates vocational schools and universities across mainland China with about 300,000 students and 20,000 staff. One of its major shareholders is Hope Education Investment which is a subsidiary of West Hope Group, a large agriculture conglomerate in the mainland.

Zhang Bing, chairman of XJ, said the company is seeking legal advice “to take the appropriate course of action.”

“The petition has had no material impact on the business operation of the company, and its subsidiaries and the operation of the company and its schools remain normal,” Zhang said in the exchange filing.

He admitted XJ is “experiencing difficulty in redeeming the relevant bonds” due to “the impact of the external environment, industry policies and the company’s current financial conditions.”

The company will continue to work with the bondholders to try to achieve a settlement, Zhang added.