The SFC has 10 types of regulated activities, which include dealing in securities and asset management.

“Given that many multinational and local financial institutions operating in Hong Kong are not listed, all licensed financial institutions should be required to submit ESG reports covering overall greenhouse gas emissions data,” said a report called “Estimation of Financed Emissions in Hong Kong and Policy Recommendations” that was released on Thursday by CityU’s Research Centre for Sustainable Hong Kong. Disclosure of such data will facilitate the improved monitoring and assessment of the ecological footprint of financial activities, it added.

“Financial institutions can take a more active role in driving the low-carbon transition,” Phyllis Mo, the research centre’s associate director, said during the launch. “Asset managers should provide by-sector financial activity information, and also develop a localised by-sector asset turnover ratio database to facilitate the estimation of financed emissions.”

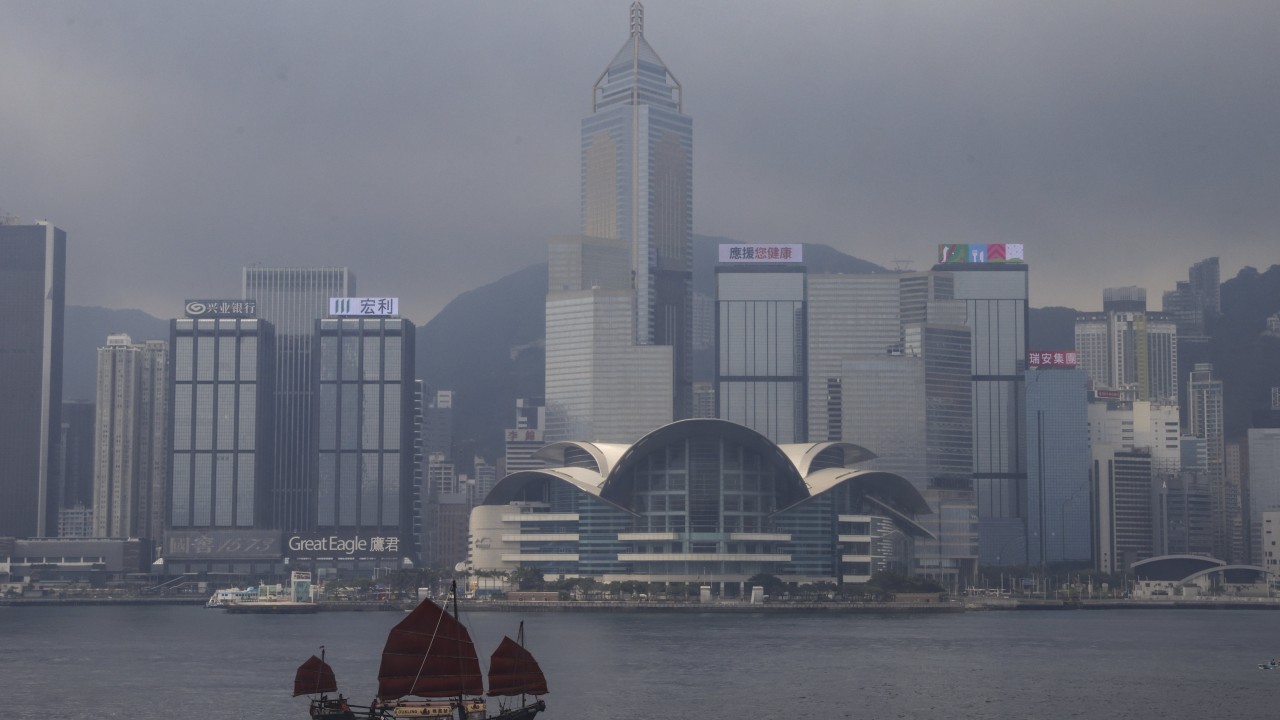

Strengthening climate-related disclosure requirements is important for the development of Hong Kong as a regional green finance hub, and will contribute to ongoing decarbonisation efforts in the city, according to the report.

Who needs carbon credits? Investors want nature-based projects to stand on own

Who needs carbon credits? Investors want nature-based projects to stand on own

While emissions from companies’ operations are reported currently, financed emissions – those resulting from the investment and lending activities of banks, investment managers and insurers – are mostly unreported, it added.

“The SFC will continue to work with the government and relevant stakeholders to support sustainability disclosures in Hong Kong,” a spokesperson for the commission said on Thursday. The Hong Kong Monetary Authority (HKMA) said it has been working to enhance disclosures about banks’ prudential risks associated with climate issues.

The CityU report estimated that Hong Kong’s financial institutions generated financed emissions totalling 380.27 million tonnes of carbon-dioxide equivalents, around 11 times the Hong Kong-wide emissions of 34.7 million tonnes in 2021, the year for which the most complete data is available.

‘Loopholes’ endanger Hong Kong’s status as green finance hub: Greenpeace

‘Loopholes’ endanger Hong Kong’s status as green finance hub: Greenpeace

The study used sector-wide data from the HKMA and the SFC, and official annual reports from major financial institutions to estimate financed emissions.

“Estimation of financed emissions is an important tangible step towards a full assessment of the impact of financial institutions’ financing and investment activities on climate change and the effectiveness of their climate-related initiatives,” the report said.

Estimated emissions can also provide benchmark information for science-based target setting on carbon mitigation and the design of climate-related disclosure metrics, according to the report.