Crypto options exchange Deribit is poised for a record-breaking week with over $15 billion in options set to expire for Bitcoin and Ethereum.

The statement highlighted that “over USD 15 billion in options notional open interest (OI) will expire this week,” marking a historic event in Deribit’s operational history. This Friday is poised to witness one of the platform’s largest expirations of options contracts.

The expiration includes $9.5 billion in BTC options open interest out of $26.3 billion and $5.7 billion in ETH options open interest out of $13.2 billion, accounting for 40% and 43% of the total OI, respectively.

Further details provided by Deribit reveal the impact of current market conditions on these expirations.

“For BTC options, at a price level of [$70,000], USD 3.9 billion will expire in the money. Similarly, for ETH options, USD 2.6 billion will expire in the money,” Derebit explained.

The figures are considerably higher than typical, attributed to the recent price rally in both cryptocurrencies. This is expected to induce upward pressure or volatility on the underlying assets due to the higher in-the-money (ITM) expiries and the diminishing influence of the lower max pain levels.

Analyzing the market’s volatility aspect, Deribit notes a contango in the volatility surface for both BTC and ETH. Current implied volatility (IV) levels for March 29 options stand at 63% and 67%, respectively, anticipating reaching a healthier 80% further along the curve. The observation suggests market participants do not foresee significant price fluctuations until expiration.

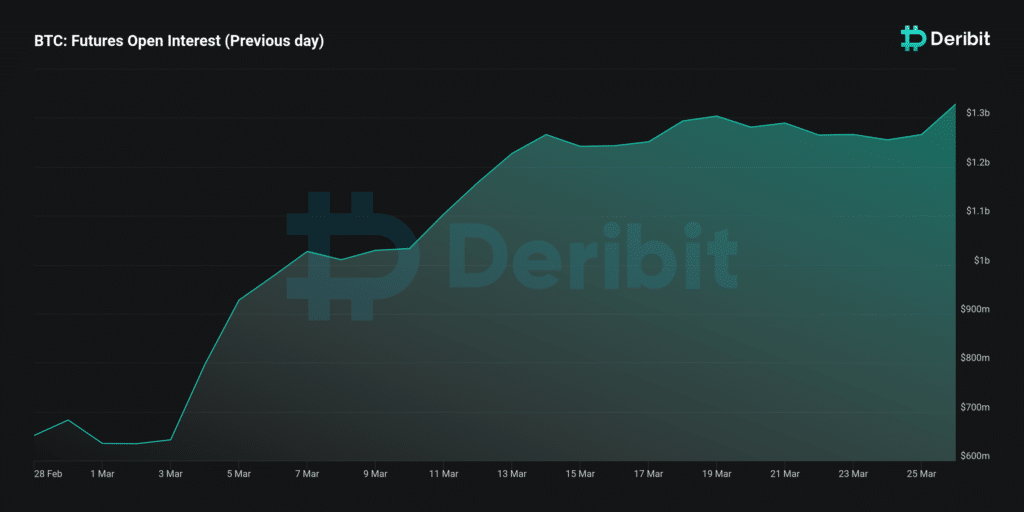

“$465 million in BTC March Future plus $230 million in the March ETH future will expire,” Derebit additionally disclosed, totaling approximately $695 million of the $1.9 billion currently outstanding.

The platform also highlighted the current open interest in its dated futures, stating that the current OI in their dated futures of $1.9 billion is the highest OI number of any crypto market, driven by an annualized basis of about 15% – 20%.

The high level of interest is caused by the significant returns generated, sparking considerable anticipation for substantial trading activity around the expiry period.