US chip equipment companies are largely absent from the 1,100-exhibitor list at this week’s Semicon China, one of the country’s largest semiconductor industry events, as the China-US tech war continues to swirl.

Although major US chip tool companies Lam Research and Applied Materials have sponsored Semicon China for the second consecutive year, neither of them have a physical presence at the Shanghai-based trade fair, which kicked off on Wednesday.

KLA, a key US supplier of semiconductor defect inspection and metrology systems, is the only big US tool company to be present at the trade fair as both an exhibitor and sponsor.

US memory chip giant Micron, which has been affected by Chinese trade restrictions, was also listed as an event sponsor without having a booth to show off its latest products.

Amid rising geopolitical tensions and under rigid US export control measures, China is unable to directly buy advanced chips, such as the H100 and A100 graphics processing units designed by US-based Nvidia. However, the country is making solid progress in boosting local output of legacy chips, including those being used in cars and home appliances, to satisfy domestic demand.

A sales manager at Unicorn, a Shanghai-based distribution partner of KLA systems, said many US tool companies want to keep a low profile to avoid raising eyebrows in Washington. She asked not to be identified as she is not authorised to talk to the media.

However, the event has managed to sign up many Japanese firms, such as Tokyo Electron and Canon Optical Industrial Equipment, which are vital for Chinese foundries.

Dutch lithographic systems maker ASML, which has come under increasing US pressure not to supply Chinese customers, is absent from this year’s gathering. Cymer, a US company that provides light sources for ASML, is also absent despite both companies being exhibitors at last year’s event, according to information from Semicon China’s website.

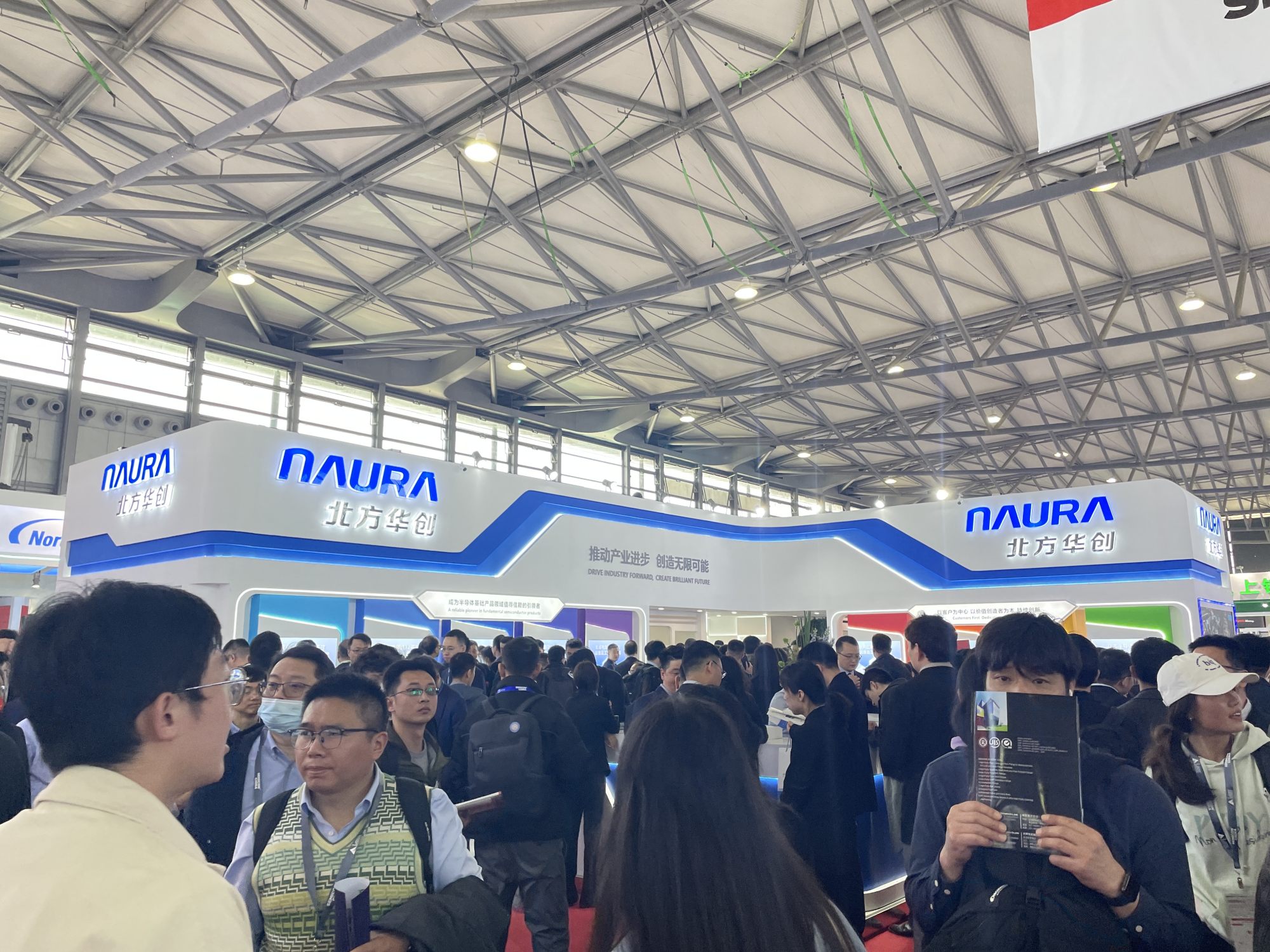

Most of the exhibitors are from mainland China, with a focus on semiconductor manufacturing equipment and materials. Chinese etching and deposition tool giants Naura Technology Group and Advanced Micro-Fabrication Equipment (AMEC) saw their exhibition booths mobbed by visitors.

AMEC, whose 2023 sales rose more than 30 per cent on strong demand from mainland semiconductor fabs, previously said 80 per cent of restricted, imported parts at the firm could be replaced domestically by the end of last year, with 100 per cent replacement in 2024.