Share this article

Ethereum’s transaction fees have reached a six-month low, caused by the shift of transactions to layer-2 (L2) blockchains, according to the latest edition of IntoTheBlock’s “On-chain Insights” newsletter.

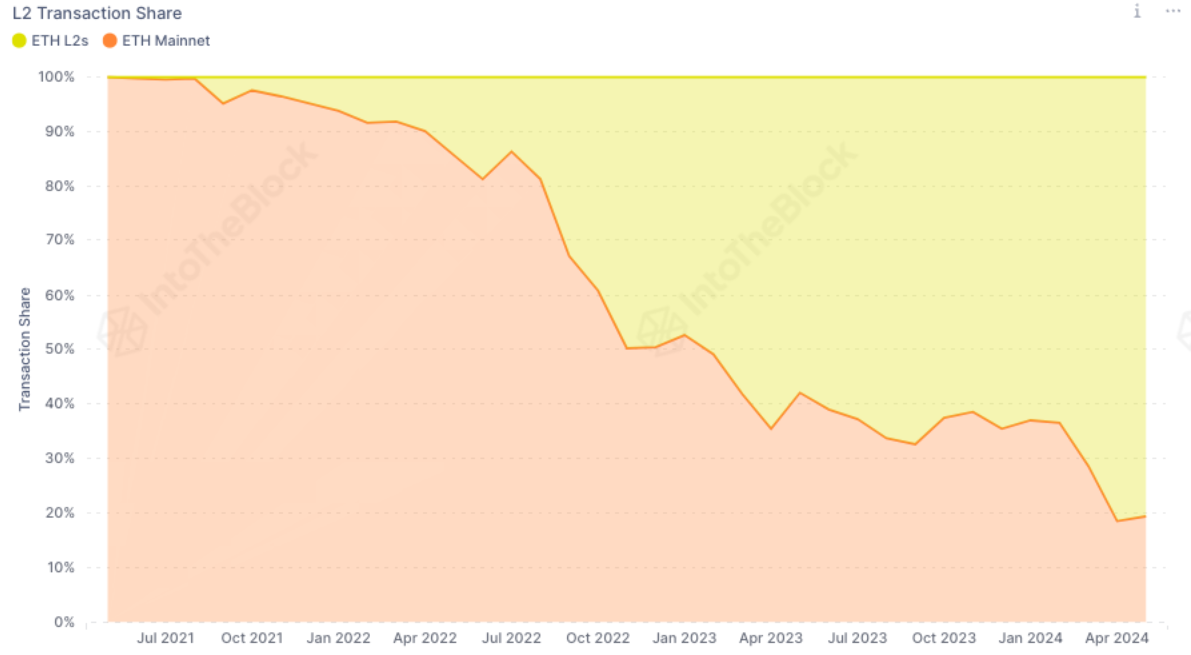

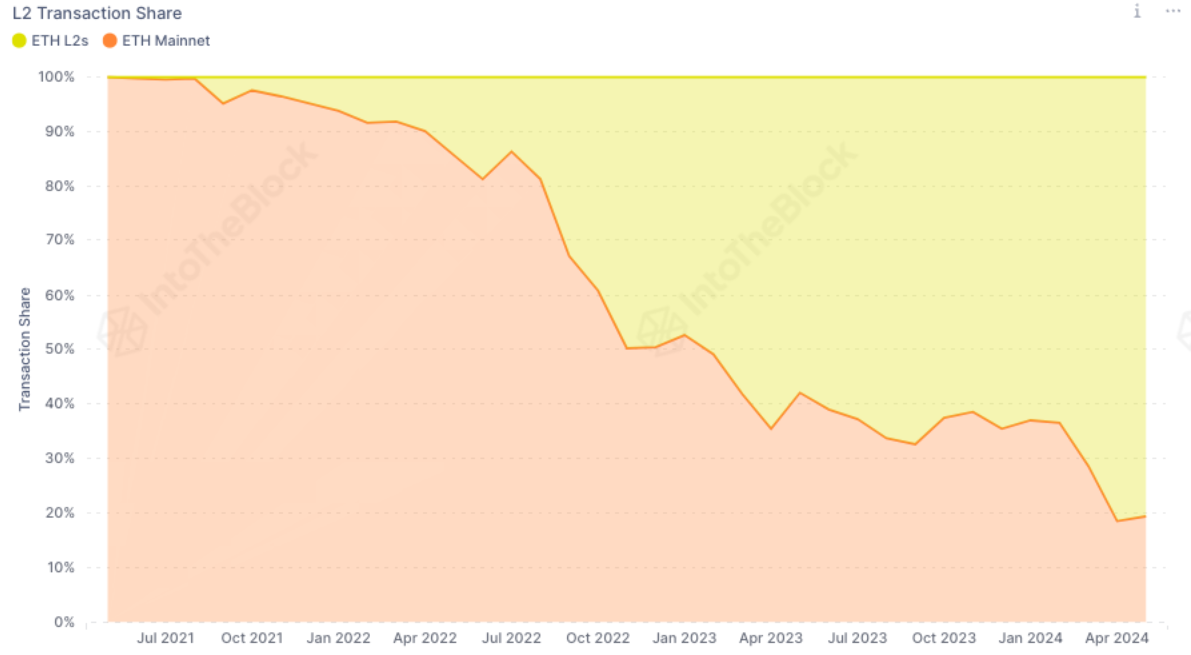

This migration has contributed to a decrease in the total fees accrued by Ethereum. In April, transactions on the largest three L2s, Arbitrum, Optimism, and Base, accounted for an unprecedented 82% of all Ethereum transactions.

With the inclusion of additional L2s, this percentage is likely even higher. The launch of EIP-4844 on March 13 played a crucial role in this transition by slashing L2 fees by more than tenfold, leading to a 10% drop in mainnet transactions and a shift in Ethereum’s token economics.

In the competitive landscape of L2s, different platforms are carving out their niches. Institutions have shown a preference for Arbitrum, which dominated 73% of Ethereum’s transaction volume among the top L2s. Conversely, Arbitrum accounted for only 39% of the number of transactions, while Base captured a 50% share. Notably, Blackrock and Securitize have recently applied to introduce the BUIDL real-world assets fund on Arbitrum.

On the retail side, Optimism’s OP Stack has been gaining traction through “SocialFi” applications. Coinbase’s Base L2 experienced a surge in transactions following FriendTech’s airdrop, and the social media-based card game Fantasy.top generated $6 million in fees this week on the Blast L2. This diversification of applications has intensified the competition among L2s, particularly in terms of market capitalization.

Optimism’s OP token has seen a 48% increase from its April lows, outperforming ARB’s 22% gain. The OP token now surpasses ARB in both circulating market cap and fully diluted valuation. Additionally, venture capital firm a16z’s $90 million investment in OP has bolstered the project’s resources and credibility.

The ongoing competition among L2s is leading to lower fees for Ethereum in the short term. However, it is simultaneously fostering a rich ecosystem of applications that promise to stimulate economic activity and offer long-term benefits, concludes IntoTheBlock.

Share this article