Gold looks ‘very vulnerable’ to a setback, veteran advisor says

Gold prices on Monday extended their record-breaking run, notching another all-time high amid robust U.S. economic data and elevated geopolitical tensions.

Spot gold prices rose 0.5% to trade at $2,342 per ounce at around 11:45 a.m. London time, after briefly hitting a fresh record of $2,353 earlier in the session. The yellow metal has repeatedly logged all-time highs in recent weeks.

However Bob Parker, senior advisor at trade body International Capital Markets Association, says that fundamentals for gold paint a bearish picture ahead. That includes U.S. dollar strength, rising bond yields, doubts creeping in over the Federal Reserve’s rate cutting plans and “reasonably” low inflation.

“All of those factors actually suggest that upside in gold, frankly, is minimal and I think gold is now very vulnerable to a setback,” Parker said.

Read the full story here.

— Sam Meredith

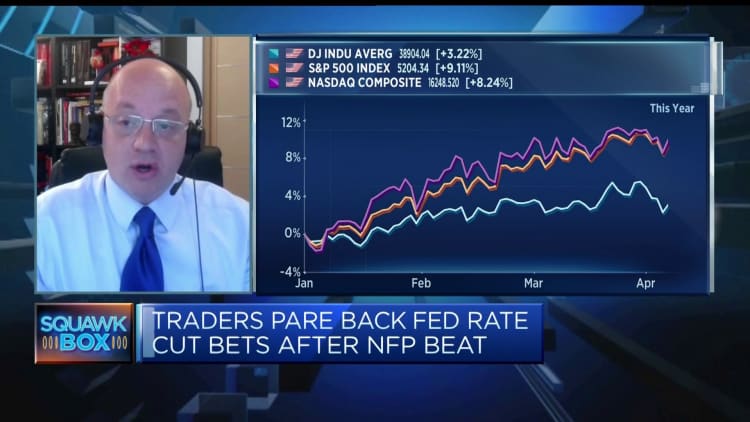

Economists are increasingly uncertain about Fed rate cuts this year

The Federal Reserve is determined not to reduce interest rates too soon — and some economists say recent data has pushed a summer cut completely off the table.

Friday’s jobs report reiterated the seemingly unwavering strength of the U.S. labor market and suggested further need for Fed caution. All eyes will now be on Wednesday’s consumer price index, after February’s annual inflation rate of 3.2% came in slightly higher than expected.

George Lagarias, chief economist at Mazars, told CNBC on Monday that rate cuts in the summer were now looking much less likely.

“This is a strong economy. Make no mistake, it is backed by debt and somewhat by overburdened credit cards, but it is a strong economy. So the Fed will struggle to find the case to cut rates soon,” Lagarias said.

“The Fed has been punishing itself ever since 2021 when ‘team transitory’ ostensibly got it wrong… What they feel is that they can’t get it wrong again, which means that they’re more likely to err on the side of caution,” Lagarias added.

Read the full story here.

— Jenni Reid

Atos shares leap 30% after Butler joins rescue consortium

Atos share price.

Shares of French IT consultancy Atos were 30% higher in mid-morning deals after leading shareholder Onepoint said investor Butler Industries was joining a consortium to rescue the firm.

French Prime Minister Gabriel Attal last week said it was a national priority to secure the financial security of the distressed company. Its projects involve communications for the French military and secret services and supercomputer manufacturing, and it is set to manage cybersecurity for this summer’s Paris Olympics.

— Jenni Reid

Stocks on the move: Zalando and Entain gain, BBVA lower

A Ladbrokes betting shop, operated by Entain Plc, in London, U.K., on Wednesday, Sept. 22, 2021.

Chris J. Ratcliffe | Bloomberg | Getty Images

Shares of German retailer Zalando were up 4.75% in early deals after Citi analysts upgraded the stock to “buy” from “neutral.”

Among the top risers, gambling firm Entain ticked 3% higher after a report in the Times newspaper suggested private equity firms are interested in some of its assets.

Bank BBVA slipped 3.4% after announcing a final dividend of 0.39 euros ($0.42) per share to be paid Wednesday.

— Jenni Reid

Europe stocks open mixed

European markets had a cautious start to the week, with the benchmark Stoxx 600 index 0.06% lower at 8:05 a.m. in London.

France’s CAC 40 and the U.K.’s FTSE 100 were both near the flatline, while Germany’s DAX nudged 0.2% higher.

Stoxx 600 index.

CNBC Pro: Goldman Sachs just updated its list of top global stocks, recommending a specific trading strategy

Despite logging a lackluster performance last week, the pan-European Stoxx 600 index is around 7.5% higher year-to-date and up over 15% over the last 12 months.

However, Goldman Sachs’ analysts noted that investors are “questioning how much upside is left” and recommended that investors consider a specific trading strategy.

They also updated their “conviction list” of top stock picks for April.

CNBC Pro subscribers can read more here.

— Amala Balakrishner

Bank of America says this week’s CPI should be ‘a confidence building report’

Bank of America economists believe Wednesday’s inflation report should show a moderation in price pressures, providing confidence to the Fed for a rate cut in June.

The Wall Street firm expects the core consumer price index to moderate to 0.2% in March after rising 0.4% in February and January. It sees declines in car prices that should lead to a drop in core goods. Meanwhile, the bank expects a bigger-than-usual rise in energy prices, however.

“The moderation in core CPI should reflect a drop in core goods prices and a more modest price increase in core services,” the bank’s economists said in a note. “A report in line with our expectations would provide confidence to the Fed and keep a June cut firmly in play.”

— Yun Li

CNBC Pro: ‘Big bargains’: Morgan Stanley names 3 overlooked global tech stocks to buy

Morgan Stanley names three “overlooked” global tech stocks that it says look cheap right now.

The bank said the theme of “broadening out” is set to become more important, and “investors will increasingly look to quality small caps at attractive valuations as sources of alpha.”

It is overweight-rated on all three stocks and gives one nearly 100% upside.

CNBC Pro subscribers can read more here.

— Weizhen Tan

European markets: Here are the opening calls

European markets are heading for a higher open Monday.

According to IG data, the FTSE 100 is set to open 11 points higher at 7,913, with Germany’s DAX up 29 points to 18,191 and France’s CAC 40 higher by 21 points at 8,078.

— Jenni Reid

U.S. adds 303,000 jobs in March, topping estimates

A “Now Hiring” sign for Nugget Markets is posted on the side of a Golden Gate Transit bus in San Rafael, California, on July 7, 2021.

Justin Sullivan | Getty Images

The March nonfarm payrolls came in stronger than expected Friday morning, which is another sign of a resilient U.S. labor market.

The U.S. economy added 303,000 jobs last month, topping the 200,000 expected by economists surveyed by Dow Jones. The unemployment rate was 3.8%.

Average hourly earnings rose 0.3% in March, and are up 4.1% over the past year. The average workweek ticked up to 34.4 hours.

— Jesse Pound