Construction of one of Russia’s key natural gas projects to ensure a financial lifeline overseas is likely to be slower than expected as China seeks to leverage its “bargaining stance”, according to a Russian source and Chinese analysts.

The discussions with Beijing over the construction of the Power of Siberia 2 natural gas pipeline, a long touted signal of bilateral cooperation, have progressed slowly.

The pipeline, if completed, would divert 50 billion cubic metres (1.8 trillion cubic feet) of natural gas per year that previously supplied Europe to north China, offering a significant boost to Beijing’s energy security.

To export at least 98 billion cubic metres per year of gas from Russia to China as promised by Russian President Vladimir Putin, figures from Spanish multinational financial services firm BBVA showed that the new pipeline is needed because the Power of Siberia 1 is limited to 67 billion cubic metres per year.

It’s a specific presidential-level of pressure. It’s about cheaper payment. They can demand deep discounts

A source with knowledge of the issue in Russia said China is showcasing a “bargaining stance”.

“[Beijing] understands really well their bargaining power and the country is in a much stronger position,” the source said.

“It’s a specific presidential-level of pressure. It’s about cheaper payment. They can demand deep discounts.”

The source also noted that Putin is under “enormous pressure” to build the pipeline or otherwise “a huge amount of gas” will be wasted and Russia will lose money.

‘Highly complementary’: China, Russia lay out plans for regional integration

‘Highly complementary’: China, Russia lay out plans for regional integration

“In terms of construction, [Beijing] wants to make sure that they have no risks and no costs. Russia is the side that foots the entire bill,” added the source, who was unwilling to disclose their name due to the sensitivity of the issue.

Li Lifan, a Russia and Central Asia specialist at the Shanghai Academy of Social Sciences, said the proposed pipeline would be favourable for Russia as it is shorter and construction costs would be lower.

However, Li said that China once insisted on building the pipeline through the Altay prefecture in the Xinjiang Uygur autonomous region as it would not pass through Mongolia.

China has shown a prudent attitude towards the project, with the Power of Siberia 2 seldom mentioned in government documents or state media.

During her visit to the Mongolian capital of Ulaanbaatar in October, Russian deputy prime minister Viktoria Abramchenko mentioned that feasibility research had been completed and design work would finish this year.

She estimated that the construction of the Power of Siberia 2 could start after the design work is approved in the first quarter of 2024.

It is estimated that it will take six years to complete. The deal for Power of Siberia 1 was signed in 2014 and it started operations in 2019.

Munkhnaran Bayarlkhagva, a former official at the National Security Council of Mongolia, said that Ulaanbaatar may delay the process as it is not a necessity.

Now the Power of Siberia 2 gas pipeline is the cooperation of three parties … abundant negotiation is needed

“We haven’t even talked about the pricing, tariffs, taxes, et cetera,” he said. “So [it is] safe to say nothing will happen in the 2024 construction season.”

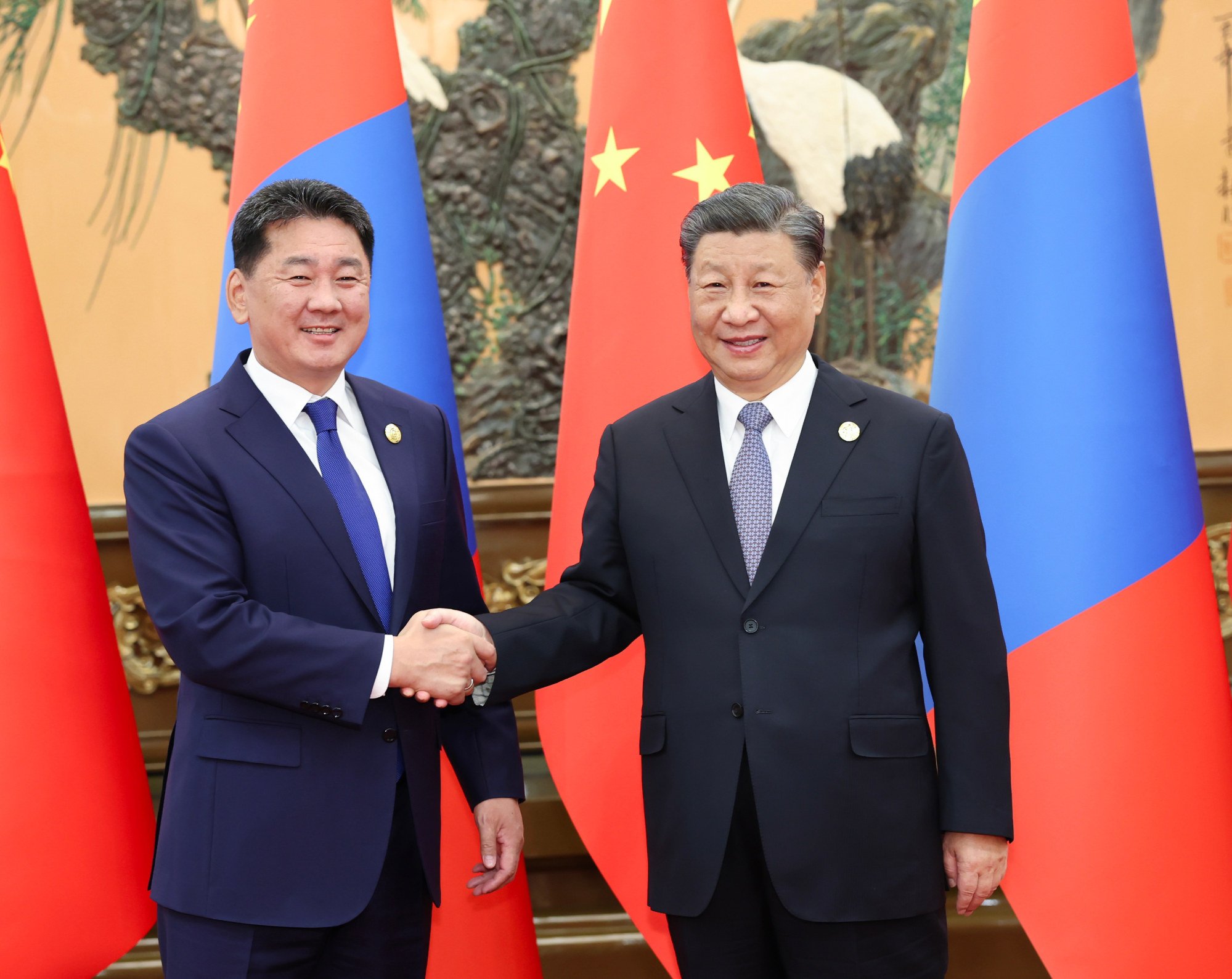

Bayarlkhagva added that Putin met Mongolian President Ukhnaa Khurelsukh on the sidelines of the belt and road forum in Beijing in October, with the Russian leader saying that “everyone agrees on the project” to obtain a confirmation from Mongolia, but no positive response was given.

The Office of the President of Mongolia declined a request to comment.

“Now the Power of Siberia 2 gas pipeline is the cooperation of three parties – China, Russia and Mongolia – abundant negotiation is needed by following the general market standard,” said Zhao Long, assistant director of the Institute for Global Governance Studies at the Shanghai Institutes for International Studies.

The project has a medium to long-term value that “[Beijing] has to make decisions based on the country’s actual demands, gas import layout, as well as the international and regional situations”, he added.

Despite the slow progress, geopolitics have reinforced Beijing’s strategy for diversification of imports, said Ma Bin, an associate professor at Fudan University’s Centre for Russian and Central Asian Studies.

With the snowy winter creeping into northern China, its annual natural gas consumption is estimated to increase by 5.5 to 7 per cent in 2023, year on year, to 390 billion cubic metres, according to a report by the National Energy Administration. This would reverse a 1.2 per cent decline in 2022.

“In order to ensure a stable and reliable supply of energy, China imports gas from Australia, Qatar, Central Asia and Russia,” added Ma.