Middle Eastern countries are eager to invest in Hong Kong mega projects such as the Northern Metropolis, while more time is needed to further explain opportunities available in mainland Chinese and other East Asian markets, the city’s finance chief has said.

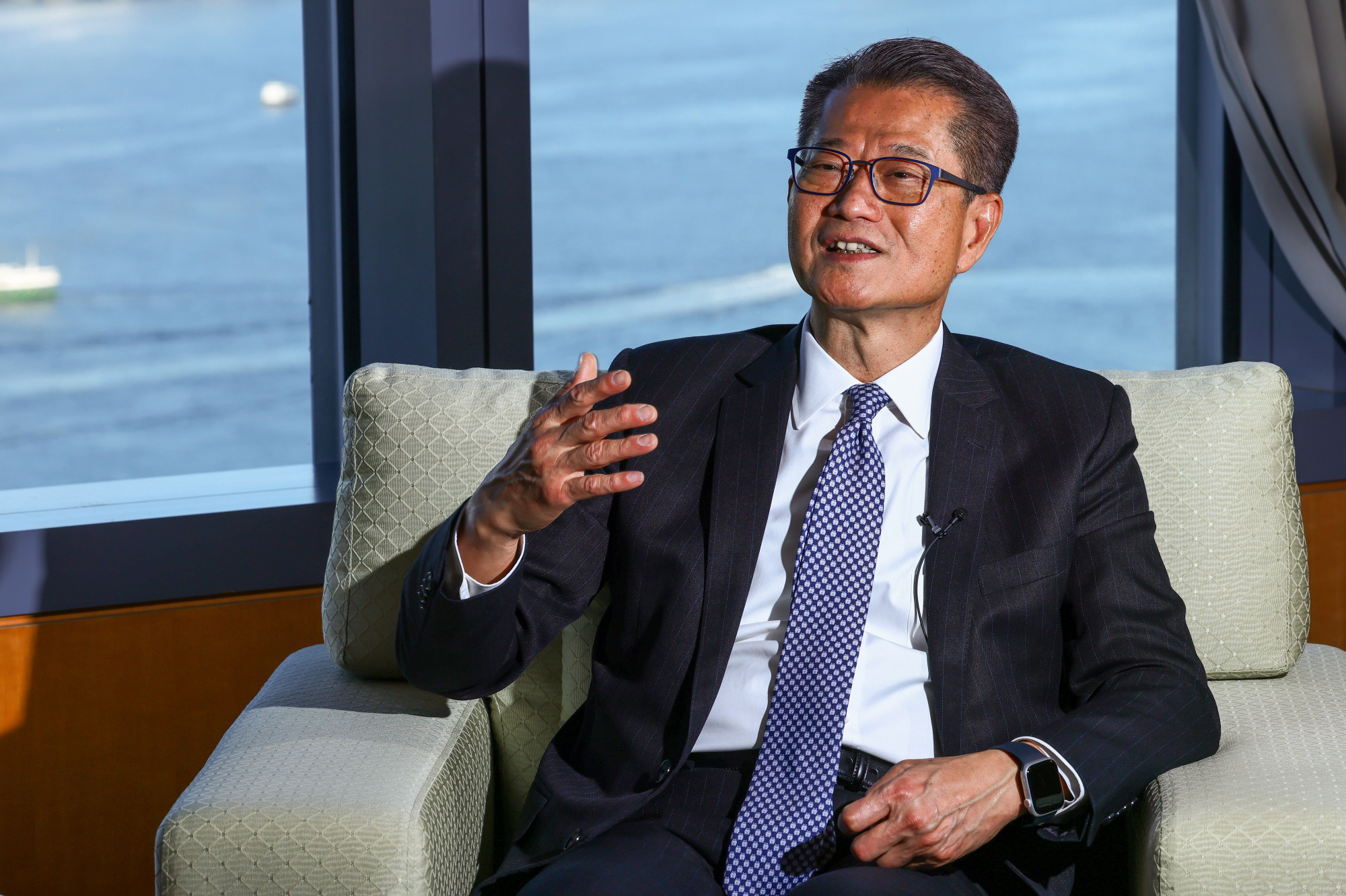

“They are very keen on investing in infrastructure, because these would be long-term stable investments,” Chan said in an exclusive interview on Thursday, citing the Northern Metropolis development as an example.

Amid concerns over mega projects putting a strain on public coffers at a time when the city is expected to run a deficit for the second year in a row, the minister has sought to offer reassurances that the developments can attract investment.

Two of the biggest on the horizon are artificial islands off Lantau, at a cost of HK$580 billion (US$74.2 billion), and the Northern Metropolis along the border with Shenzhen. Once completed, the two projects will supply more than half of the 7,300 hectares (18,040 acres) of land needed by the city to cope with demand beyond 2048.

Hong Kong ‘pushing for deeper ties with Middle East, China’ to bring in new capital

Hong Kong ‘pushing for deeper ties with Middle East, China’ to bring in new capital

Meanwhile, Gulf governments have been investing heavily in infrastructure to transform their oil-dependent economies.

For example, Saudi Arabia, the world’s top crude oil exporter, hopes to diversify its economy through its “Vision 2023” strategy.

But the kingdom earlier in the week admitted for the first time that some projects had to be delayed to minimise inflationary pressures and supply bottlenecks.

Hong Kong has pushed for closer ties with Middle Eastern states over the past year to counter the impact of US-China tensions, with Saudi Arabia a prime example of those targeted because of its wealth and ambitions to diversify its economy beyond oil.

What can Hong Kong gain in its Middle East forays?

What can Hong Kong gain in its Middle East forays?

Chan said warming China-Middle East ties, the Gulf region’s ambitious development plans and its quest to become a cradle of innovation also offered plenty of opportunities for the city’s innovation and technology and professional services sectors.

But knowledge gaps remained a challenge, he said.

“Their understanding of our region, for example the mainland and East Asia, is … limited when compared with their counterparts in Europe or the United States,” he said. “I think it takes time.”

The city’s largest trading partner in the Middle East last year was the United Arab Emirates (UAE), followed by Israel, Saudi Arabia and Qatar.

Analysts have suggested doors have opened for Hong Kong thanks to Chinese President Xi Jinping’s meeting with Saudi Arabia’s Crown Prince Mohammed bin Salman in Riyadh last December and Beijing’s role in brokering a Saudi-Iran peace deal in March.

Chief Executive John Lee Ka-chiu kicked off the efforts to woo investment by embarking on a high-profile trip to Saudi Arabia and the UAE in February, followed by numerous business-level bilateral visits.

Hong Kong to help finance Northern Metropolis project with land exchange scheme

Hong Kong to help finance Northern Metropolis project with land exchange scheme

Last month, the first exchange-traded fund (ETF) tracking Saudi Arabian shares debuted in the city, allowing local and overseas investors to trade in Hong Kong dollars or in Chinese yuan.

Commenting on the ETF’s relatively low daily trading volumes and turnover so far, Chan told the Post that current stock market sentiment in the city could be a reason.

Hong Kong stocks are sitting at about a 13-month low, as the mainland’s gloomy economic data casts a shadow over the outlook for corporate earnings.

“Also, this is a new market,” Chan said. “It takes time for people to understand the market. And then to generate their interest.”

Hong Kong government to set up 2 bodies to seek private funding for mega projects

Hong Kong government to set up 2 bodies to seek private funding for mega projects

The finance minister was among the heavyweights in Hong Kong attending a two-day investment conference, running on Thursday and Friday, organised by the Future Investment Initiative Institute, a think tank backed by Saudi Arabia’s Public Investment Fund.

The event was the institute’s first Asia conference and was attended by Saudi Arabian Minister of Investment Khalid Al-Falih and sovereign wealth fund governor Yasir Al-Rumayyan.

Chan said the summit was a result of months of persuasion with his Saudi counterpart that also showed Hong Kong’s importance as a gateway between the mainland and the world.

He said the think tank had decided to host the event annually in Hong Kong.