[Sponsored article]

It is 50 years since two Harvard College graduates were inspired to set up an investment companyafter they realised what they were learning at business school was not being widely applied to the way institutions were handling their own capital.

The launch of Cambridge Associates in the United States in 1973 saw it focus on building and managing diversified investment portfolios for clients that would not only meet each client’s specific objectives, but also have a positive impact on the world.

Initially, the company offered investment advice to endowments and foundations, first for Harvard University, then other Ivy League and leading US colleges and universities. Later, it expanded its client base to other institutional investors, including pensions, sovereign wealth funds and family offices globally. The firm is independently owned and privately held by its employees and a select group of clients, including the Rothschilds and the Hall family, the owners of the Hallmark greetings card business.

“We are proud of our origins and – 50 years later – we’re a global company with over 1,000 institutional and family clients worldwide, 11 offices and close to 1,500 employees,” Judy Zhang, managing director and head of China client business at Cambridge Associates, says.

Zhang, who is now based in Asia and has worked in asset allocation and wealth management since 2012 at Cambridge Associates’ headquarters in Boston, says: “Unlike Western family offices, which usually have existed for multiple generations, Asian family offices are mostly starting out and in their first or second generation. Legacy and succession planning are increasingly becoming top of mind, and many families are now thinking about how to institutionalise their family office for the long term.”

This phenomenon is compounded by recent market volatilities, which have seen some families’ investment portfolios taking a hit. Owing to these factors, Zhang says that the firm has seen a surge in demand from Asian families inquiring about its investment management services.

Zhang, who has written a report on the governance and policies surrounding intergenerational family wealth in Asia, says families need to differentiate between two distinct approaches.

“For many Asian families, the family business is the main source of wealth generation,” she says. “Entrepreneurs have great skill and insight to create and manage their business empire. While successful management of significant wealth requires similar attributes, not all the characteristics fundamental to entrepreneurial success translate to effective portfolio management. This is where we come in, to help transform them from great entrepreneurs to great investors.”

The firm begins by conducting an enterprise review, which involves working with family members to understand their needs, aspirations, risk tolerance and constraints for setting up an “investment policy statement”. Zhang says this includes outlining guidelines on strategic asset allocation, setting an investment manager structure, as well as defining risk and return parameters.

Next comes the rigorous due diligence process, where Cambridge Associates draws on its 50 years of accumulative data and knowledge on money managers, as well as the expertise of 300 senior investment professionals worldwide, to identify and select leading investment managers for the portfolio.

“In our experience, clients who are successful entrepreneurs often have investment referrals from their peers, friends, or family members,” Zhang says. “Some of these referrals may not be of institutional investible quality, so it can get quite complex at times, especially if the client does not have the capacity to conduct due diligence or sometimes simply can’t say ‘no’ due to peer pressure. We can help to take the emotions out of the investment process and provide an objective approach.”

Rather than keeping a client’s investments within a region that the wealth owner is familiar with, or concentrated in sectors that the family’s businesses are in, Zhang emphasises that having a diversified investment portfolio is key to navigating market volatilities and generating wealth for the long term.

“We have had access to top performing and emerging investment managers globally, which has allowed us to allocate our clients’ capital across the public and private markets in different asset classes and markets effectively,” she says. “We also monitor the performance of the portfolio and upgrade the roster of global investment managers daily. On average, we conduct about three to five manager meetings in a day.”

Besides having a diversified portfolio, an investment governance framework is also a critical part of any family’s investment programme.

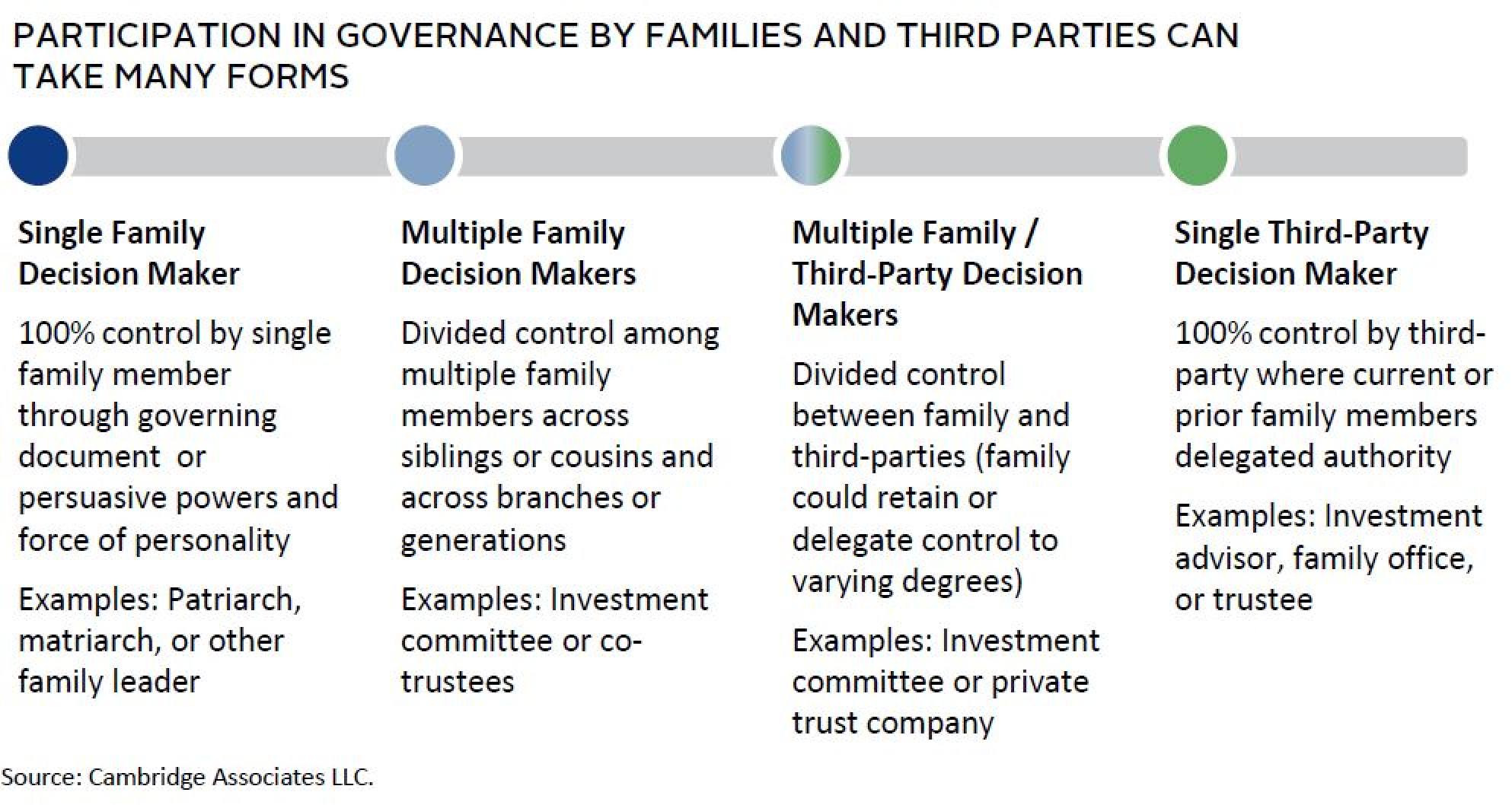

“For example, a first-generation wealth creator may reserve the right to make decisions to maintain control,” Zhang says. “However, as the family grows and the number of portfolio stakeholders increases over time to include the second- or third-generation members, how do you reconcile the different world views and aspirations? This is where the investment governance framework comes into play, and we can work with the different family branches to help achieve their investment goals.”

Zhang says a trend that Cambridge Associates has observed is that Asian families are interested in global innovation, which “not only can change the world, but also has a huge potential for value creation and wealth accumulation”. This includes sectors such as healthcare, information technology, energy transition and climate technologies.

Some families may also draw up plans that ensure their investments put greater emphasis on philanthropy and sustainability.

“We believe Cambridge Associates is at the forefront of sustainable and impact investing,” Zhang says. “We play to our strengths in helping our family clients who have this strong interest.”

The firm is also pleased to support the “virtuous cycle” that some clients create, she says.

“We have helped some of our clients to build and manage a dedicated sustainable investment portfolio to fund their philanthropy needs, which also supports sustainability,” she says. “It feels good to know that our efforts are making a positive impact.”

Disclaimer from Cambridge Associates:

The terms “CA” or “Cambridge Associates” may refer to any one or more CA entity including: Cambridge Associates, LLC (a registered investment adviser with the US Securities and Exchange Commission, a Commodity Trading Adviser registered with the US Commodity Futures Trading Commission and National Futures Association, and a Massachusetts limited liability company with offices in Arlington, VA; Boston, MA; Dallas, TX; New York, NY; and San Francisco, CA), Cambridge Associates Limited (a registered limited company in England and Wales, No. 06135829, that is authorised and regulated by the UK Financial Conduct Authority in the conduct of Investment Business, reference number: 474331); Cambridge Associates GmbH (authorised and regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht (‘BaFin’), Identification Number: 155510), Cambridge Associates Asia Pte Ltd (a Singapore corporation, registration No. 200101063G, which holds a Capital Market Services Licence to conduct Fund Management for Accredited and/or Institutional Investors only by the Monetary Authority of Singapore), Cambridge Associates Limited, LLC (a registered investment adviser with the US Securities and Exchange Commission, an Exempt Market Dealer and Portfolio Manager in the Canadian provinces of Alberta, British Columbia, Manitoba, Newfoundland and Labrador, Nova Scotia, Ontario, Québec, and Saskatchewan, and a Massachusetts limited liability company with a branch office in Sydney, Australia, ARBN 109 366 654), Cambridge Associates Investment Consultancy (Beijing) Ltd (a wholly owned subsidiary of Cambridge Associates, LLC which is registered with the Beijing Administration for Industry and Commerce, registration No. 110000450174972), and Cambridge Associates (Hong Kong) Private Limited (a Hong Kong Private Limited Company licensed by the Securities and Futures Commission of Hong Kong to conduct the regulated activity of advising on securities to professional investors).