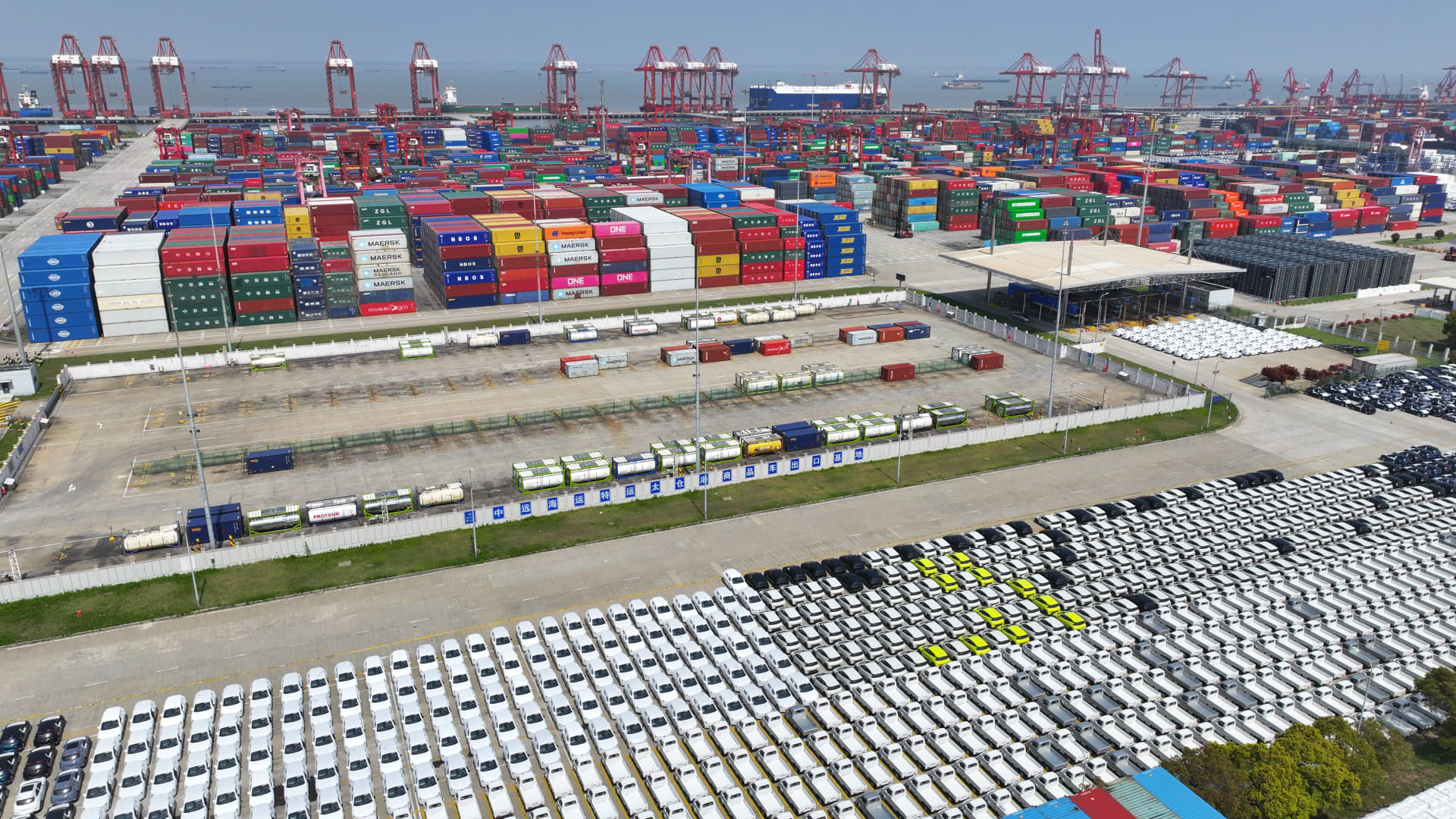

A batch of cars are ready to be shipped to overseas markets at the port of Taicang, Jiangsu province, China, April 9, 2024.

Future Publishing | Future Publishing | Getty Images

Asia-Pacific markets extended their declines as the world awaits Israel’s response to Iran’s air assault over the weekend.

On Tuesday, China’s first-quarter gross domestic product numbers will be in focus, with the world’s second-largest economy expected to grow 4.6% from a year ago.

China’s industrial production and retail sales figures are also expected Tuesday.

Futures for Hong Kong’s Hang Seng index stood at 16,430, pointing to a weaker open compared to the HSI’s close of 16,600.

Japan’s Nikkei 225 plunged 1.5% at the open, while the broad based Topix was down 1.04%. Overnight the yen crossed 154 against the U.S. dollar, its weakest level since June 1990.

South Korea’s Kospi also fell 1.31% and the small-cap Kosdaq saw a smaller loss of 0.86%.

In Australia, the S&P/ASX 200 was 0.86% lower.

Overnight in the U.S., stocks retreated on Monday as rising yields and worries over the conflict in the Middle East overshadowed strong Goldman Sachs earnings and hot retail sales data.

The Dow Jones Industrial Average lost 0.65%, to mark its sixth straight losing day, a streak not seen since June.

The S&P 500 slipped 1.2% despite trading up as much as 0.88% earlier in the session. The Nasdaq Composite tumbled 1.79% as Salesforce and other technology stocks dropped.

Higher rates also poured cold water on the market bounce, with the yield on the 10-year Treasury rising above the key 4.6% level in the session and reaching its highest point since mid-November.

— CNBC’s Hakyung Kim and Alex Harring contributed to this report.