Moscow said its economy rose by 5.5 per cent in the third quarter of 2023 year on year, and Russia is expected to see full-year growth of 3.5 per cent.

The European Commission also upgraded its forecast to a rise of 2 per cent from the previous estimate of a contraction of 0.9 per cent. The bloc expects Russia’s economy to expand by 1.6 per cent this year, and in 2025.

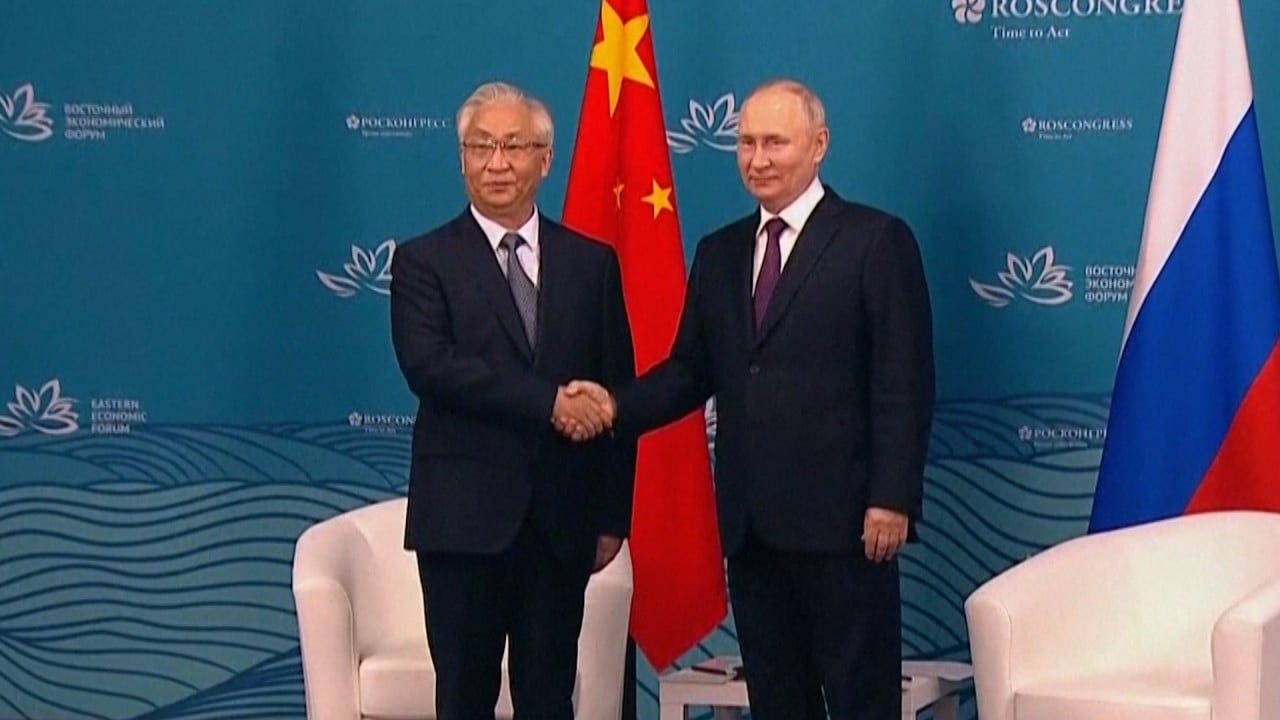

‘A decent level’: Putin extols China trade as US$200 billion target shattered

‘A decent level’: Putin extols China trade as US$200 billion target shattered

The data showed China, India and the European Union (EU) were the top buyers of Russian crude oil, while the EU also led the purchases of Russian liquefied natural gas (LNG), followed by China and Japan.

But despite the expected uptick in economic growth, headwinds are expected to continue, and central bank governor Elvira Nabiullina has warned that Russia must be prepared for more sanctions from the West.

Russia is also still facing capital exodus, high inflation and a shrinking workforce.

And despite many differences in the two economies, Russia’s economic performance since the war started may still offer some references for China, which has upped the ante in its economic and technological rivalry with the United States.

If there is anything that China can draw from, it is the need to keep leading companies and key parts of supply chains within China

China is also seeking to strike a balance between a push for self-reliance and increased integration with the global market.

Oleg Deripaska, the former richest man in Russia and founder of aluminium producer Rusal, said in an interview with China’s Phoenix Weekly magazine in early December that Russia’s experience could provide China with a reminder to diversify its trade, making the domestic economy more resilient to guard against possible sanctions.

And according to Liu, Chinese manufacturers should strive to expand the domestic market as quickly as possible, outside semiconductors and other high-end technologies, that would take considerably more time.

“If there is anything that China can draw from, it is the need to keep leading companies and key parts of supply chains within China in the worst-case scenario of a big power play, such as a war,” he said.

Escaping possible sanctions can only be achieved once there is room for trade volumes from new markets and industries and support from resource-rich partners, a lesson that many Chinese industry insiders like Liu and Russian insiders see in Russia.

Russia is resource rich in terms of oil, natural gas, coal, metals and woods, and it is a major supplier of crops and fertilisers, but it is heavily reliant on imports for everything from manufacturing equipment to consumer goods.

China also has high overseas reliance on resources and energy to fuel its economic growth, but it is facing growing challenges caused by geopolitical complications and the Western-led realignment of global supply chains as part of efforts to reduce over-reliance on the Chinese market.

Beijing has long aimed to diversify its imports of energy and resources, while aiming to increase self-reliance by expanding domestic exploration and mining of precious metals and marine resources and via green energy transition.

China, Russia to strengthen ‘no-limits’ partnership, pledge to cooperate on AI

China, Russia to strengthen ‘no-limits’ partnership, pledge to cooperate on AI

It has also doubled down on security efforts on almost all economic fronts, becoming alert to increasing risks caused by global market turbulence and geopolitical complications, particularly growing US-led restrictions and containment efforts.

China is aiming to expand the potential of a resilient and large domestic market, backed by a burgeoning middle class of at least 400 million people, as a key pillar for its dual-circulation strategy.

The strategy places a greater focus on the domestic market, while becoming less reliant on its export-oriented development strategy, but without abandoning it altogether.

China is also aiming to further integrate into the global market, with a particular focus on rules, industrial standards and high value-added sectors.

Russia still faces challenges such as building up and upgrading its own production capacity and technologies

In terms of banking and finance, Russia has been able to weather the storm created by the Western sanctions, and become more self-contained.

Russia has also managed to diversify its economic relations and find alternative sources for imports, as well as its exports, said Anna Kireeva, an associate professor in Asian and African studies at the Moscow State Institute of International Relations.

Such diversification “is likely to stay at least in the medium term, and more likely in the long term as well,” Kireeva said.

“However, Russia still faces challenges, such as building up and upgrading its own production capacity and technologies under the framework of import-substitution policy or constructing new infrastructure to expand its export capacity in order to avoid infrastructure bottlenecks in the Far East,” she said.

Kireeva said China needs to seek indigenous technologies, reduce dependence on technological transfers from the West and expand the use of the Chinese yuan in the global payments network.

Amid their respective tensions with the US-led West, trade between China and Russia under their so-called the no-limits partnership have soared since the Ukraine war started.

During the same period, China’s exports to its northern neighbour soared by 51 per cent, while its shipments to other trading partners fell, including a drop of 13.8 per cent to the US and a fall of 11 per cent to the EU.

China, Russia pave even stronger ‘financial track’ with a new deal, state visits

China, Russia pave even stronger ‘financial track’ with a new deal, state visits

If the momentum continues, trade between Russia and China for the whole of 2023 is on course to reach a record high of US$240 billion.

“It is very impressive,” said Gong Jiong, a professor at the University of International Business and Economics in Beijing.

Russia is, Gong added, quickly catching up with South Korea and Japan in terms of trade value with China, and it may surpass the two Asian heavyweights “within one year or two”.

To cope with the impact of the next round of sanctions, the Russian Ministry of Finance said in mid-December that it would abolish the export duty on oil from the start of January, while also cutting the tariffs on LNG exports.

But Gong said that it remains to be seen whether Russia can sustain its economic growth over the long run.

China’s economy, he added, is significantly more integrated into the global economic system, and Beijing should properly manage relations with its major trading partners.

It is important to avoid decoupling, to stay neutral in international affairs and to maintain friendly relations with resource-rich countries, while striving to consolidate economic links with the Western nations, Gong said.

“Markets on both sides are important.” he said. “Equally important, it is necessary to be self-reliant and continue to diversify suppliers.”

Let’s not exaggerate Russia’s situation, while China is still firmly committed to openness

Economists and policy advisers also said unwavering openness is still important, and is the core to China’s strategic goal of becoming a medium-developed country.

“Let’s not exaggerate Russia’s situation, while China is still firmly committed to openness,” said Zheng Yongnian, a prominent political scientist at the Chinese University of Hong Kong, Shenzhen.

“Energy, military and food, Russia’s self-sufficiency is an inherent advantage, China is difficult in this regard.”

In addition, China is a highly market-oriented country, unlike Russia, he added.

Canberra ‘will not oppose’ China’s CPTPP trade-pact bid

Canberra ‘will not oppose’ China’s CPTPP trade-pact bid

“Those who don’t open up will only fall behind in the long run,” said Zheng.

Beijing is also aiming to boost global cooperation in technology and innovation, and attract more international experts.

Aleksei Chigadaev, a former visiting lecturer in comparative area studies at the Higher School of Economics in Moscow, said China also needs to be better prepared to handle unexpected risks.

You’re on your own. Sink or swim

“China’s economy needs controlled economic shocks – bankruptcies of major companies followed by legal proceedings, and the closure of inefficient banks,” said Chigadaev.

“This could serve as a demonstration that during complex geopolitical moments, governments won’t have the luxury of manually solving problems, and entities will need to find solutions independently.

“You’re on your own. Sink or swim. China enjoys more friendly regimes than Russia and possesses a more developed transportation and financial infrastructure, making sanctions less effective.”

Russia relies mainly on oil and mineral resources, while China boasts a vast array of goods influencing markets globally, including the US and the EU, he added.

“Sanctions against Russia are a shot in the arm, affecting ordinary consumers in the EU due to rising fuel costs. Sanctions against China, however, are a frontal assault,” Chigadaev said.

Additional reporting by Mia Nulimaimaiti