“Just as theories of nuclear deterrence account for the concept of second-strike capabilities, so too must we consider economic retaliatory measures in assessing the deterrence character of sanctions.”

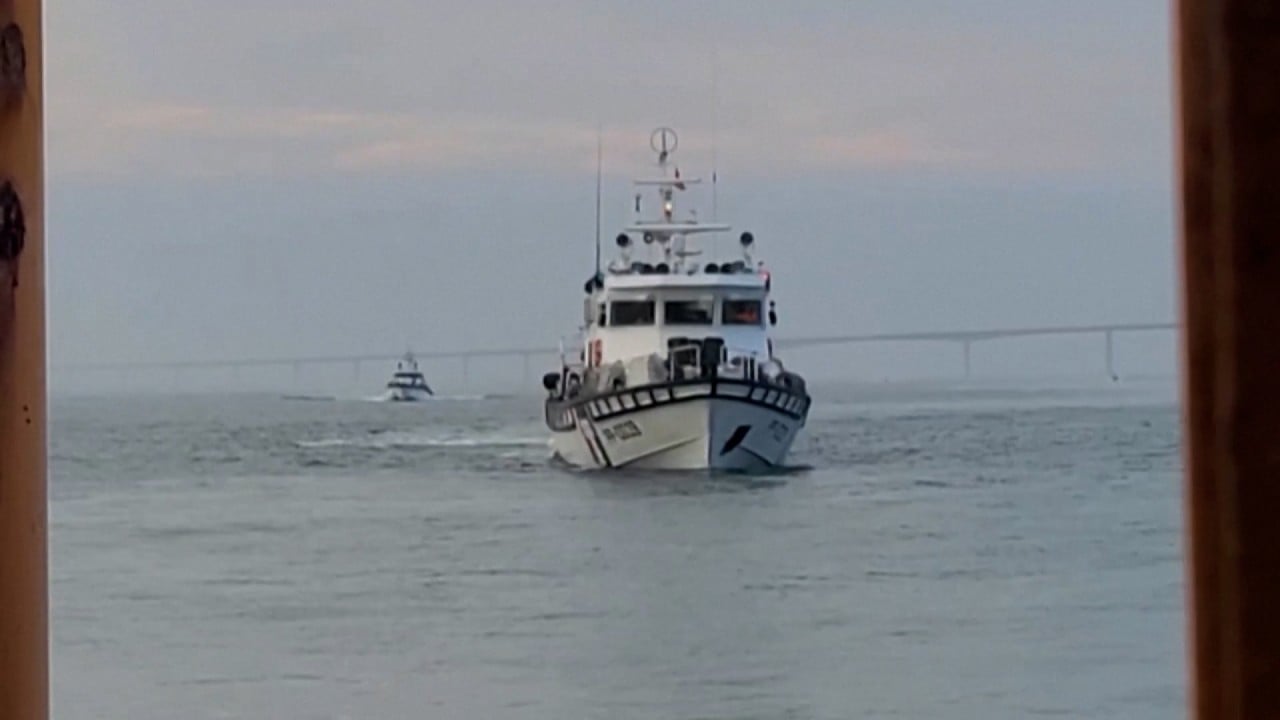

Cross-strait ties have declined since August 2022, when former US House speaker Nancy Pelosi paid a visit to Taiwan in defiance of Beijing’s warnings. The mainland responded with a week of military drills around the island.

Concerns over further escalation of tensions across the strait, including but not limited to military conflict, have pushed some companies to make arrangements to mitigate possible disruptions to business operations and supply chains.

But for Frank Huang, chairman of Taiwan-based Powerchip Semiconductor Manufacturing Corp, even a hot war could not break investment and supply chain links.

There won’t be a war between the two sides – it’s too big a deal … We have to live together

His firm has no contingency plan for a conflict, and plans are in motion to expand investment in a mainland joint venture, Nexchip Semiconductor, the chairman told the Post.

“If you go down to the bottom line of the supply chain of Taiwan, you will find there won’t be a war between the two sides – it’s too big a deal, nothing the military can repress,” he said. “We have to live together.”

But Huang is eyeing India for future expansion, too. The populous, fast-growing South Asian country has its own tech ecosystem and ample educated talent, he said.

‘Bitter fruit’ for foreign supporters of Taiwan independence, Beijing warns

‘Bitter fruit’ for foreign supporters of Taiwan independence, Beijing warns

The Atlantic Council evaluated the mainland’s would-be response to G7 sanctions imposed under two scenarios for cross-strait tensions, “moderate” or “higher-escalation”.

G7 members may impose sanctions ahead of any military fight, the report said, and officials in Beijing are already “developing capacities” to become more resilient to Western sanctions after taking note of restrictions brought against Russia over the past two years – even if that resilience would hurt employment at home.

In a “higher-escalation scenario” of G7-wide sanctions, about US$358 billion in G7 exports to the mainland “could be at risk” as a consequence of imposing those measures as well as projected reprisals, the Atlantic Council said.

“On the import side, we estimate that the G7 depends on more than US$477 billion in goods from [mainland] China which could be made the target of export restrictions. Regarding investment, at least US$460 billion in G7 direct investment assets would be at immediate risk from the combined impact of G7 sanctions and retaliatory measures by Beijing,” the report read.

“While export restrictions would be one of [mainland] China’s most impactful economic statecraft tools, it would also be among the costliest options,” the report’s authors said.

Over 100 million jobs in the mainland depend on foreign final demand, with nearly 45 million premised on demand from G7 countries.

“Many multinational corporations would be executing plans to exit the market even before considering retaliatory action,” the Atlantic Council said. “[Mainland] China would have little to gain from holding back on retaliatory actions on a pretence of maintaining ‘investability’.”

The mainland would try to divide the G7, stop any “cohesive” responses outside the G7 and leverage yuan internationalisation to wriggle out of the worst outcomes related to sanctions, the researchers said.

But the mainland may be preoccupied with other economic problems to fight back, said Chao Chien-min, dean of social sciences at Chinese Cultural University in Taipei. The world’s No 2 economy is struggling with a property crisis, youth unemployment and curtailed consumption, among other issues.

The economic interdependence between the two parties has been too complicated

“Total sanctions, that would create a huge impact on the Chinese economy,” Chao said. The mainland, he added, needs Western markets.

However, that need is reciprocal, and G7 economies would suffer in tandem, said Huang Kwei-bo, professor of diplomacy at National Chengchi University in Taipei.

“The economic interdependence between the two parties has been too complicated to tell whether economic sanctions by the G7 and export reorientation by [mainland] China will work as each party wishes,” he said.