MakerDAO, Ethereum’s first defi lending protocol, has captured a 52% share in the ETH lending market.

The milestone was highlighted in Steakhouse Financial’s MakerDAO Protocol Economics Report for January 2024, which revealed a 22% rise in ETH lending via crypto-vaults on Spark.

Much of MakerDAO’s market dominance throughout the past year can be attributed to Spark, which has provided high liquidity and competitive borrowing rates for DAI – the largest decentralized stablecoin. Spark is now the third-largest defi lending protocol regarding total value locked (TVL).

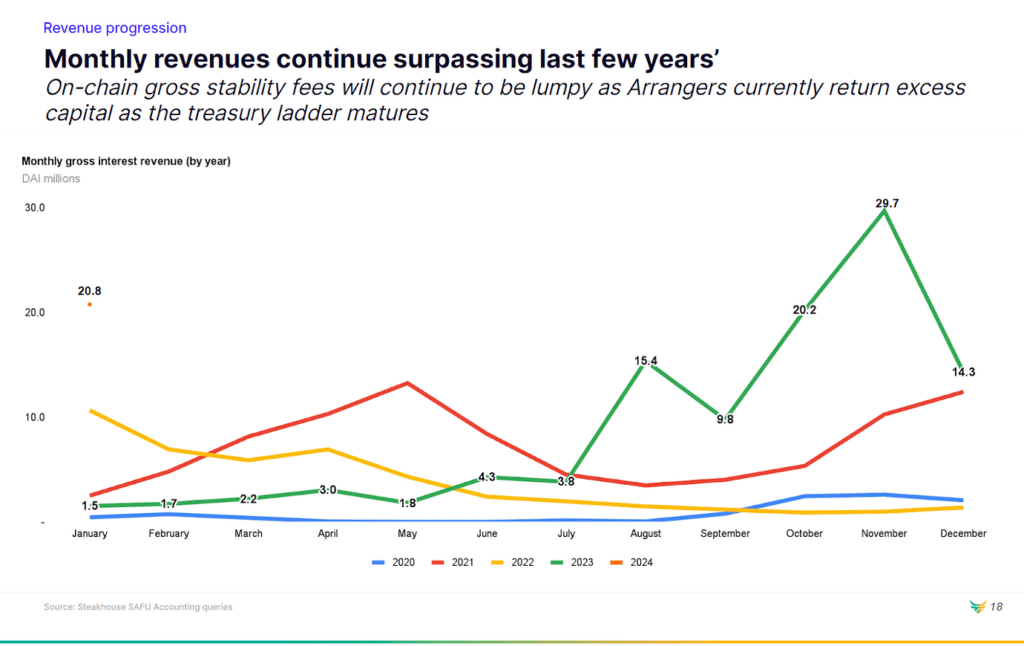

The report details MakerDAO’s financial performance, noting a gross monthly revenue of 20.8 million DAI in January 2024. Crypto vaults were a major revenue source, contributing 10.3 million DAI.

Revenue from Real-World Assets (RWA) also played a critical role, adding 10.5 million DAI to the total despite a 14% decrease in RWA exposure compared to December 2023.

The shift towards crypto-backed loans from treasury bills has been vital to leveraging the market rally.

MakerDAO continues to evolve with its governance structure through the Endgame Plan, aiming to further decentralize decision-making by introducing SubDAOs. Each SubDAO will have its governance token, process, and workforce, marking a significant step towards a more decentralized and efficient ecosystem.