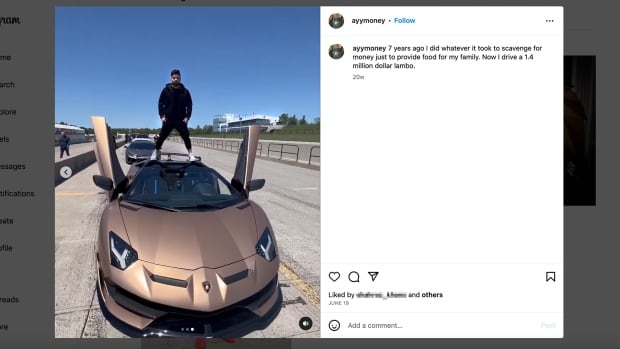

In his social media videos, Anas Ayyoub has painted a rags-to-riches story in which he says he went from having to “scavenge” for money to provide food for his family to a lifestyle that now allows him to drive a Lamborghini he says is worth $1.4 million.

But offline, a number of Canadians — mostly seniors — accuse Ayyoub of defrauding them, allowing him to enjoy that luxurious way of life.

They allege he is part of a scheme involving door-to-door equipment rental contracts, questionable renovations and high-interest mortgages worth hundreds of thousands of dollars that many homeowners didn’t know they had and can’t afford.

- You can watch the full investigation, Housing Heist II, Friday, Nov. 24, at 8 p.m., 8:30 in Newfoundland, on CBC-TV and anytime on YouTube or CBC Gem.

CBC’s Marketplace reported on the scheme back in March, and since then, the Ontario Provincial Police (OPP) executed a search warrant at Ayyoub’s home in Mississauga, which included seizing that Lamborghini earlier this year. Ayyoub hasn’t been charged.

Lawyer Greg Weedon represents many of the alleged victims and says that as far he knows, despite the search warrant, Ayyoub is no longer in Canada.

“The fact that he was able to get out of the country with all these victims’ … funds, at the end of the day, it is just a complete failure,” said Weedon.

In a statement provided to Marketplace through his lawyer, Ayyoub notes that he continues to be a Canadian resident. He says he has “always conducted his business dealings lawfully and in accordance with the advice and guidance of senior counsel and consultants.”

Ayyoub’s social media pages have been private following Marketplace‘s outreach to him.

In a statement to Marketplace, an OPP spokesperson said due to the ongoing criminal investigation, the Serious Fraud Office cannot provide specific details regarding this case. They added they are working with victims to ensure their needs and rights are a priority and that “enhancing awareness and education on this fraud is paramount to prevent or limit further victimization”.

Since Marketplace‘s investigation aired, professional discipline has been initiated against two lawyers and a mortgage brokerage connected to some of the cases.

WATCH | Marketplace’s March 2023 investigation into mortgage fraud:

Featured VideoIt started with a knock on the door, but became a high-interest mortgage that 79-year old Karl Hoffmann’s family says he never asked for or understood.

But in the meantime, several homeowners could face foreclosure, including Sherri Clarke, who says she only realized she had been scammed after watching Marketplace‘s investigation last March and thinking that “sounds a lot like what just happened to me.”

Offers of debt help

Each situation is unique, but many seem to follow a pattern where homeowners — usually seniors — who have previously been duped into various door-to-door HVAC equipment rental contracts are again approached at home by people who say they can help the homeowner consolidate their debt.

In some cases, the homeowners are told they are eligible to receive money back if they buy more equipment or have renovations done on their homes. In reality, their home is used as collateral and they are allegedly tricked into signing mortgage papers that many say they did not want, or understand.

Sherri Clarke emailed Marketplace writing “I have been the victim of fraud.”

Clarke lives with multiple sclerosis and previously received renovations from the charity March of Dimes Canada to make her home accessible and safe. So when she got a phone call from someone last November offering free work, it seemed normal to her.

It turns out the work wasn’t free. Clarke ended up paying $192,500 for renovations to her home. She says she had been assured the work was not going to cost her anything. “I was signing papers as we were going along, but I thought it was just papers to give the contractors permission to go ahead and do the work.”

Not only was Clarke charged for the renovations, she says much of the work never happened.

The company behind the financing for Clarke’s renovations is Alternative Finance Group (AFG). The sole director of that company is Anas Ayyoub.

AFG charged Clarke for the work using a legal tool to place a financial claim against her home in Ontario — it’s called a Notice of Security Interest (NOSI). A NOSI can be registered on the title of a property by companies when they finance or lease equipment on a property as a form of assurance that the contract will be paid.

Similar to liens, NOSIs usually stay attached to the property until the contracts come to an end or are paid off.

Calls for elimination of NOSIs

Homeowners may not be aware that they have NOSIs registered on their homes. In some cases, they may be charged large fees to have them removed.

The NOSIs on Clarke’s property from AFG were paid for through a $570,000 mortgage taken out on her property by another company, not AFG. The mortgage has a 12.99 per cent interest rate.

Clarke acknowledges that she signed that mortgage, but says she was told she’d never have to pay. She says she was told signing the paperwork was “just to make the lawyers happy.”

Clarke’s lawyer, Greg Weedon, wants the Ontario government to get rid of NOSIs.

“They’re completely useless,” said Weedon. “They’re only being used for these types of situations for these fraudulent schemes. There’s no legitimate reason that these even to exist today.”

In October 2023, the Ontario government announced it is seeking public input on ways to address and “reduce the harmful and inappropriate use of Notices of Security Interest (NOSIs) against unsuspecting consumers.”

Suspicious mortgages

In its original investigation, Marketplace spoke to several homeowners who say they were misled into high-interest mortgages of 25 per cent interest and found there are several companies providing services and knocking on doors and multiple lenders on the mortgage documents.

While not involved in every mortgage Marketplace reviewed, one lender came up consistently in the research — Canada’s Choice Investments (CCI).

The sole director of that company is Anas Ayyoub.

At the time, through his lawyer, Ayyoub denied all allegations and said his company has no connection to any door-to-door scheme. He said the mortgages were signed voluntarily. The company also said that it may be a victim of a concerted group of seniors who are refusing to pay back their loans.

For most mortgage transactions, there’s also a lawyer representing the borrower’s interest.

Marketplace is aware of four seniors with CCI mortgages with 25 per cent interest rates who were represented by Anant Jain and his firm, and who have named Jain in their lawsuits. All allege professional negligence.

In statements of defence, Jain denies wrongdoing, saying his clients understood the documents, and that he acted diligently and in good faith.

In October 2023, the Law Society of Ontario suspended Jain’s licence while they investigate mortgage fraud schemes, saying “there is serious risk of harm to the public interest.”

Jain’s lawyer representing him at the law society told Marketplace in a statement that there has been no admission or finding of wrongdoing and that Jain is co-operating with the investigations and will continue to do so.

Brokerage licences at risk

Documents show three seniors with mortgages connected to CCI who Marketplace spoke to dealt with a common brokerage: Centum Mortgage Smart Inc., whose registered head office was listed in Brampton, Ont.

Centum Financial Group, the national mortgage network, terminated its relationship with Centum Mortgage Smart, its licensee, earlier this year. In an email to Marketplace at the time, Centum Financial Group said it was “deeply concerned” about the situation and noted that licensees are independently owned and operated by a licensed broker.

In October 2023, the Financial Services Regulatory Authority of Ontario (FSRA) initiated enforcement action against Mortgage Smart. The FSRA is proposing to revoke or refuse to renew licences for the brokerage and three of its affiliated workers, as well as issue fines. The brokerage and workers have requested a hearing before the FSRA tribunal about this proposal.

In a statement to Marketplace, Mortgage Smart alleges it was victimized in what it calls a “predatory lending fraud” and that it believes the brokerage was used “to shift blame.” The brokerage says its sympathies are with the clients and their families.

There is no indication that either Jain or Mortgage Smart worked on Clarke’s case.

With files from Caitlin Taylor and Katie Swyers