The sources declined to be identified as Nvidia has yet to make a public announcement.

A spokesman for Nvidia declined to comment. Inspur did not respond to requests for comment.

Shares of Nvidia rose 1.4 per cent to US$119.67 in US premarket trading.

Since then, Nvidia has developed three GPUs tailored specifically for the China market.

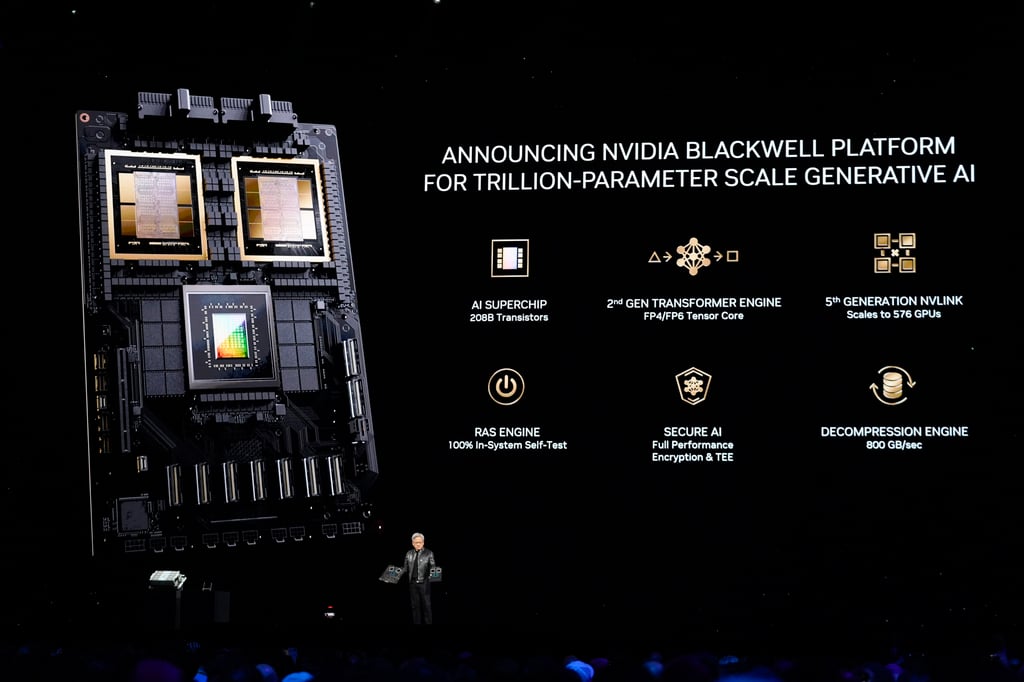

A version of a chip from Nvidia’s Blackwell series for China would boost the Santa Clara, California-based firm’s efforts to fend off those challenges.

China accounted for around 17 per cent of Nvidia’s revenue in the 12 months to end-January in the wake of US sanctions, sliding from 26 per cent two years earlier.

But sales are now growing rapidly, two of the sources said.

Nvidia is on track to sell over 1 million of its H20 chips in China this year, worth upwards of US$12 billion, according to an estimate from research group SemiAnalysis.

Expectations are high that the US will continue to keep up the pressure on semiconductor-related export controls.

The US wants the Netherlands and Japan to further restrict China’s access to advanced chip-making equipment, sources have said.

Chip stocks globally tumbled last week after Bloomberg News reported that Biden’s administration was weighing a measure called the foreign direct product rule that would allow the US to stop a product from being sold if it was made using American technology.