Mergers and acquisitions are a major path for investment. The Middle East’s outbound M&A activity in China grew in 2023, with at least 16 deals worth US$8.5 billion, a significant increase compared to a single US$300 million deal in 2022, data from London Stock Exchange Group shows. This is the highest-ever annual total for Middle Eastern M&A activity in China since records began in the 1980s. In the other direction, Chinese companies also made more direct investment in Saudi Arabia in 2023 than ever before. All are foundations for the long haul ahead.

While the Sino-Arab investment flows are historic in scope, scale and pace, they still pale in comparison with those between the United States and the Middle East. In 2022, US foreign direct investment in the Middle East reached US$94.7 billion, while capital flows from the Middle East into the US totalled US$41.6 billion; manufacturing, mining, real estate and nonbank holding companies attracted the most capital.

Arab leaders’ foreign policies remain focused on the West for armaments, markets, technology and strategic support, despite these leaders’ efforts to assert greater latitude. This is true even as rivalries have sharpened among Saudi Arabia, the United Arab Emirates and Qatar. Meanwhile, the West is pivoting towards the Indo-Pacific to contain Beijing’s influence while diversifying suppliers away from China.

However, national security commitments typically follow financial transactions and vice versa. Military allies are likely to trade more with one another than with non-allies. Security arrangements assure those involved that they will be protected from disruptions. Trade is a carrot to lure a reluctant ally and it can increase wealth for all concerned, with any surplus being spent on building up defence. Eventually, security and trade become hard to untangle.

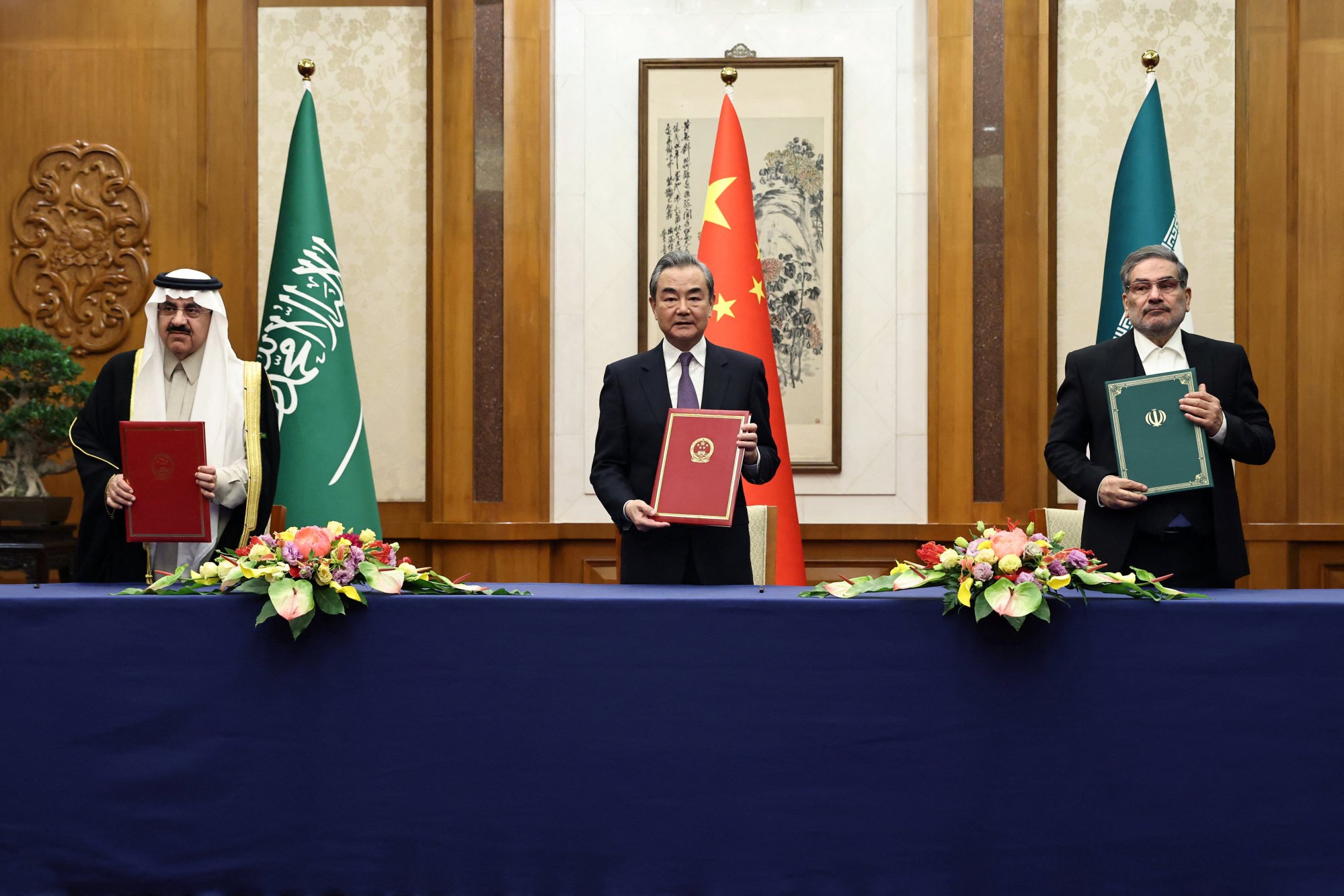

World needs China to take up diplomatic gauntlet in Middle East

World needs China to take up diplomatic gauntlet in Middle East

But China is finding clever ways to make its dependence on the Middle East less of a constraint by bartering its armaments for Gulf countries’ oil and gas.

Moreover, ties with Opec+ members provide China with another avenue to deepen relations with Russia, as US warnings about Chinese support of Russia’s military industrial complex grow louder.

Yet China is also trying to displace Russia as the preferred alternative source of armaments, against the complex backdrop of China and the Gulf States pursuing various triangulation strategies in the Middle East. Chinese arms sales to the region are up 80 per cent over the last decade, and involve every US ally there except Israel.

James David Spellman, a graduate of Oxford University, is principal of Strategic Communications LLC, a consulting firm based in Washington, DC