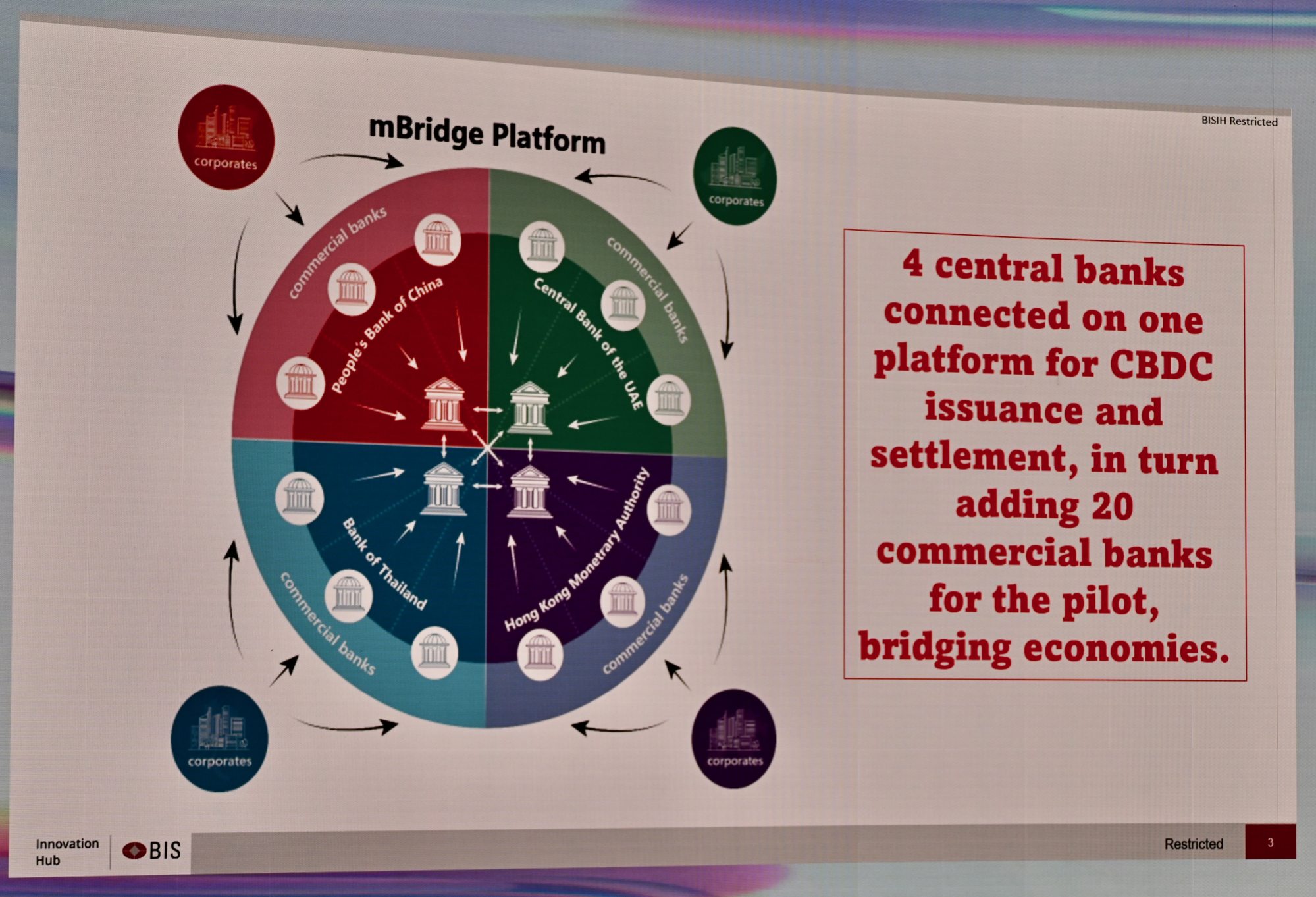

A multi-country central bank digital currency (CBDC) project involving mainland China, Hong Kong, Thailand and the United Arab Emirates has made a breakthrough by launching its minimum viable product (MVP) platform, which will serve as a proving ground for more use cases in cross-border transactions.

Since the project began in 2021, the four founding monetary authorities and the Bank for International Settlements (BIS) Innovation Hub have worked to utilise digital currencies built on distributed ledger technology (DLT) to enable instant cross-border payments and settlement.

The MVP platform, based on a new blockchain called mBridge ledger, will serve as a “test bed for add-on technology solutions, new use cases and interoperability with other platforms”, the BIS and the Hong Kong Monetary Authority said in separate press releases on Wednesday.

Private sector firms are also invited to propose solutions and use cases to further develop the platform.

During a pilot phase in 2022, 20 banks from the four jurisdictions used the mBridge platform to conduct and settle 164 payment and foreign exchange transactions, totalling more than US$22 million over six weeks.

Five commercial banks in Hong Kong have been onboarded to the platform: Bank of China (Hong Kong), Bank of Communications Hong Kong, HSBC, Industrial and Commercial Bank of China (Asia), and Standard Chartered Bank (Hong Kong).

“The continuous development of mBridge exemplifies that CBDCs are a viable means to enable real-time cross-border payments and foreign-exchange transactions that are high in speed, low in cost, more transparent and less complex,” said Lewis Sun, global head of domestic and emerging payments at HSBC’s global payments solutions.

Standard Chartered’s Hong Kong CEO Mary Huen also applauded the latest development of the mBridge project, which will prepare for “the launch of a new generation of cross-border payment ecosystems”, she said in a statement on Wednesday.

BOCHK’s deputy CEO, Xing Gui-Wei, said the bank would “further optimise product processes and provide new channels for corporate customers’ cross-border transactions” under the mBridge MVP platform.

Governance and legal frameworks, including a rule book, have been formulated to match the decentralised nature of the platform.

In March, the HKMA launched a “wCBDC” pilot to improve interbank wholesale settlements using tokenised money, a stablecoin sandbox to allow companies to trial cryptocurrency tokens pegged to fiat currency in the city and the second phase of its retail e-HKD pilot.