Hedera (HBAR), the open-source Proof-of-Stake (PoS) blockchain network, has made significant strides in the fourth quarter (Q4) of 2023, according to a recent report by Messari. The network’s performance showcased notable growth in key metrics, outpacing the crypto market.

Hedera Outpaces Crypto Market With 78% QoQ Increase

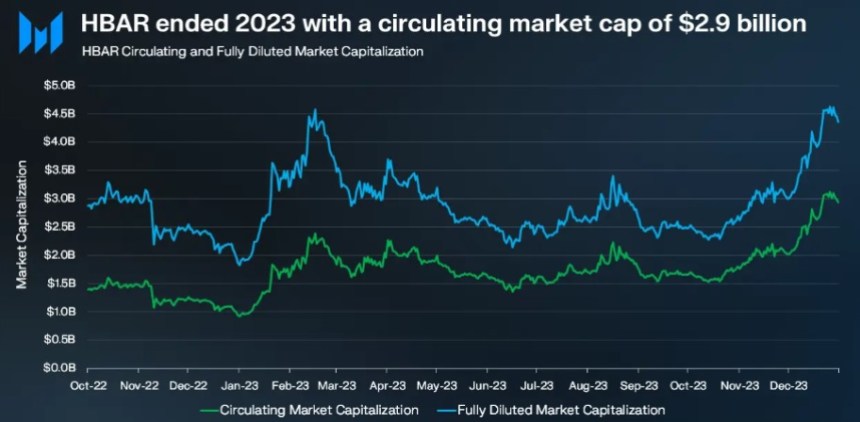

During Q4 2023, Hedera’s circulating market cap experienced a 78% quarter-over-quarter (QoQ) increase, reaching $2.9 billion. This growth surpassed the overall crypto market’s growth rate of 54%, signifying Hedera’s growing influence. The year-on-year (YoY) change for HBAR stood at 211%, reflecting the network’s progress and adoption.

In the same line, Hedera Network’s revenue witnessed a substantial 59% QoQ increase, amounting to $1.6 million in Q4 2023, primarily driven by a 66% QoQ surge in transactions, notably propelled by the Hedera Consensus Service.

Furthermore, the revenue generated from Token and Smart Contract Services contributed approximately 14% of the total revenue, exemplifying a healthy distribution in Hedera’s revenue streams.

With a fixed total supply of 50 billion HBAR, Q4 2023 saw 33.6 billion HBAR, or 67% of the total supply, in circulation.

The quarterly distribution of HBAR, reported through the Hedera Treasury Management Report, anticipates an additional 10% of the total supply to be unlocked in Q1 2024, including new ecosystem grants.

While the number of addresses experienced a decline in Q4 2023, with average daily active addresses decreasing by 22% QoQ to 6,600 and average daily new addresses dropping by 39% QoQ to 5,200, there was still substantial YoY growth. Active addresses were up 90% YoY, and new addresses witnessed a 123% YoY increase.

Hedera Network achieved a new record in transaction volume for the sixth consecutive quarter, with an impressive daily average of 164 million transactions in Q4 2023, marking a 66% QoQ surge. The Hedera Consensus Service remained the primary driver of this activity, accounting for 99% of all transactions on the network.

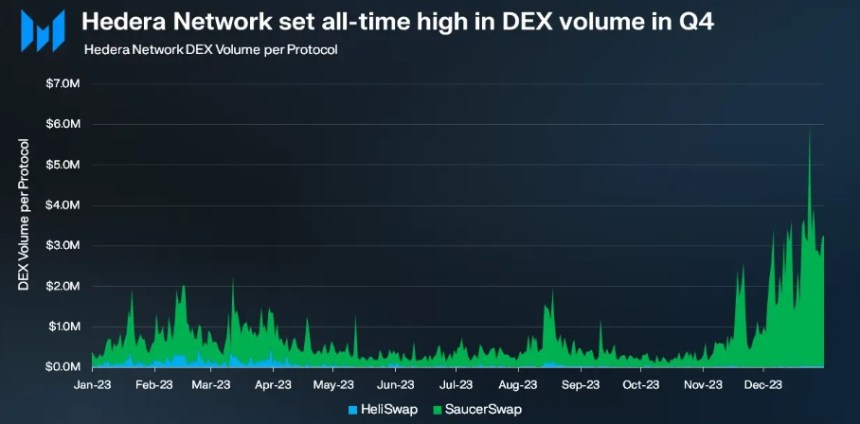

DEX Trading Volume Skyrockets 164% QoQ

In Q4 2023, the Hedera network reported 28 billion HBAR staked, representing 85% of the circulating and 56% of the total supply.

Entities such as Swirlds and Swirlds Labs played a significant role in staking their HBAR allocations, and the Hedera Treasury supported validators in meeting the minimum staking threshold for network consensus.

The Hedera network’s Total Value Locked (TVL) demonstrated positive growth, reaching $64 million by the end of 2023, reflecting a significant YoY increase of 169%. The TVL denominated in HBAR reached 733 million, indicating a 16% QoQ and YoY increase. Interestingly, Hedera’s TVL ranked among the top 40 blockchain networks.

Moreover, Hedera Network experienced a 164% QoQ increase in average daily decentralized exchange (DEX) trading volume, reaching $1.3 million, an all-time high. SaucerSwap dominated DEX trading volume on the Hedera network, accounting for most of the trading activity, as seen in the chart below.

Lastly, the stablecoin market cap on the Hedera network grew by an impressive 73% QoQ, culminating in a year-end total of $6.3 million. Circle’s USDC stood as the sole stablecoin available on Hedera.

The network’s rank in the stablecoin market cap among blockchain networks improved by four spots QoQ, solidifying Hedera’s position in the stablecoin market.

Under current market conditions, the price of HBAR stands at $0.0736, showcasing substantial growth in the past 24 hours, with a 5% increase.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.