Scammers posing as the Hong Kong Monetary Authority (HKMA) are tricking Hongkongers into paying fake fees, seemingly thumbing their noses at the regulator after it recently launched a campaign warning the public about phone scams and financial fraud.

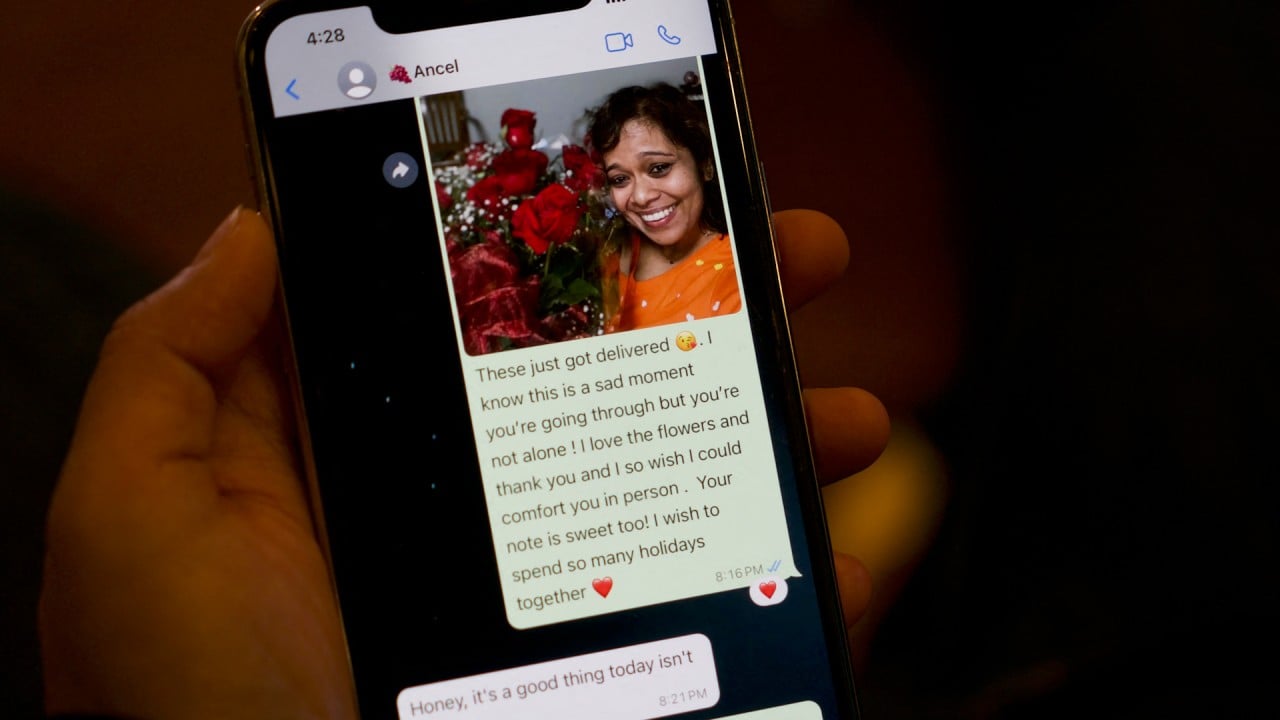

The city’s de facto central bank said on Thursday said it had contacted the police after some members of the public reported receiving messages via WhatsApp that purported to be issued by the authority.

“These messages and documents demand money transfers to pay charges or taxes in order to recover frozen assets or payments made to fraudsters,” HKMA said.

“The HKMA wishes to reiterate that it will not contact the public regarding personal financial matters, nor will it communicate with the public by forming groups on instant messaging applications.”

The HKMA urged people who have fallen victim to such fraudulent acts to contact the police hotline at 2860 5012 for further investigation.

The video, called Don’t indiscriminately click on links, showed how scammers trick individuals into divulging bank details and personal information.

Impostors use text messages and fake websites to urge citizens to provide account information through hyperlinks, enticing citizens with promotional offers and luring them into downloading counterfeit mobile applications that siphon off personal information and even passwords.

In its statement on Thursday, the HKMA said some of the fraudulent messages purportedly sent by the authority claimed that the supposed refund or unfreezing arrangement would be carried out through an overseas institution whose name is similar to that of an overseas bank’s representative office in Hong Kong. The HKMA did not name the institution.

Hongkonger in her 80s conned into buying iTunes gift cards in romance scam

Hongkonger in her 80s conned into buying iTunes gift cards in romance scam

The number of scam cases reported in Hong Kong last year rose by 40 per cent to 39,824, compared with 2022, and involved more than HK$9 billion (US$1.2 billion), nearly double the amount in the previous year, the Hong Kong police said in February.

Scams accounted for 44.1 per cent of all crimes reported last year, and around 70 per cent of these scams were internet-related, the police added.

ICBC Asia, the Hong Kong unit of Industrial and Commercial Bank of China, the country’s largest lender, plans to continue to use technology such as artificial intelligence to prevent and investigate fraud, Tony Mak Wing-yin, head of the financial crime compliance department at ICBC Asia, said in an interview with the Post in February.