“Shippers could be facing months of very elevated rates and increased delays as higher demand combines with restricted capacity,” Judah Levine, head of research at Freightos, a global freight booking platform, said in a research note. “But the duration and scale of these disruptions and price spikes could be less severe than those unprecedented impacts seen during the pandemic.”

The additional tariffs have not yet come into effect.

The cost of shipping a 20-foot container from Shanghai to Europe currently stands at more than US$7,000, an increase of about US$1,000 from a month ago, according to Xiong Hao, assistant general manager at Shanghai Jump International Shipping.

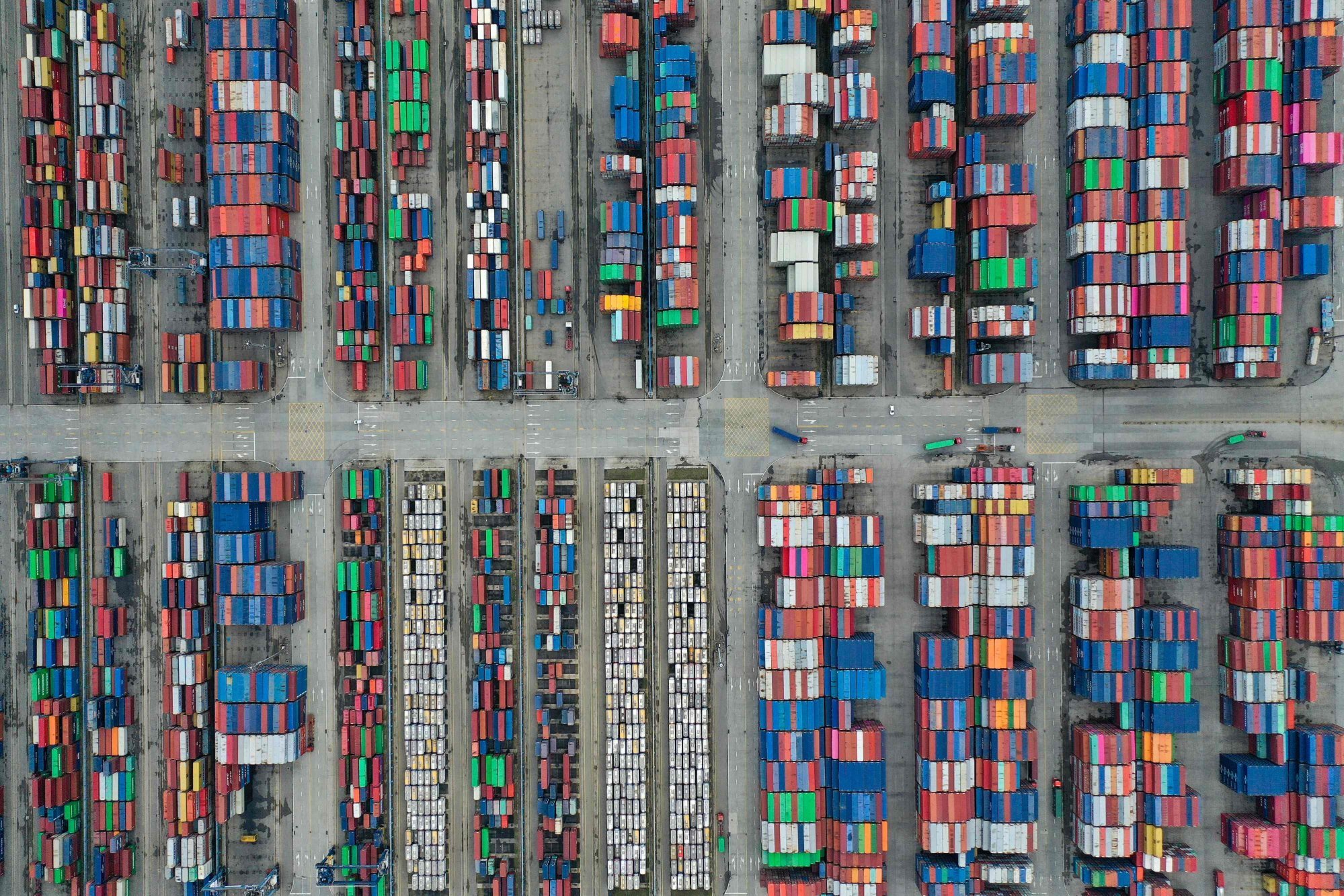

He added that there was a shortage of empty containers in Shanghai amid surging demand from exporters.

HSBC said in a research report on Monday that an exhaustion of inventories by US retailers meant that they now had to rely on imports to meet consumer demand, driving demand for container transport.

“Worries about an escalation of trade tensions between the US and China prompted manufacturers to arrange shipments of finished goods as early as possible,” said Yan Jun, a senior executive with Shanghai-based Jinghan Stainless Products, which makes and exports steel products.

Red Sea disruptions, caused by attacks on ships by Yemen’s Houthi rebels, are also a major concern, as exporters scramble to process shipments sooner rather than later, he added.

Chinese exporters have witnessed a roller-coaster ride on ocean transport costs over the past four years.

After China emerged from the first coronavirus lockdown in the second quarter of 2020, companies started manufacturing goods at full tilt to meet pent-up global demand, with the nation regaining its place as the world’s factory.

In August 2021, a peak season for container freight from China bound for the US and Europe ahead of the holiday season, slots were often fought over by dozens of exporters who were willing to pay as much as 10 times the normal rates to ship their cargo.

In September 2022, prices of shipping containers from Shanghai to the US plunged by nearly 90 per cent from the peak.

The mainland’s commercial and shipping hub was named the world’s busiest container port last year, a position it has held since 2010 when it overtook now second-placed Singapore.