Elon Musk’s net worth has slumped by US$30 billion this year to just under US$200 billion as Tesla mania fades.

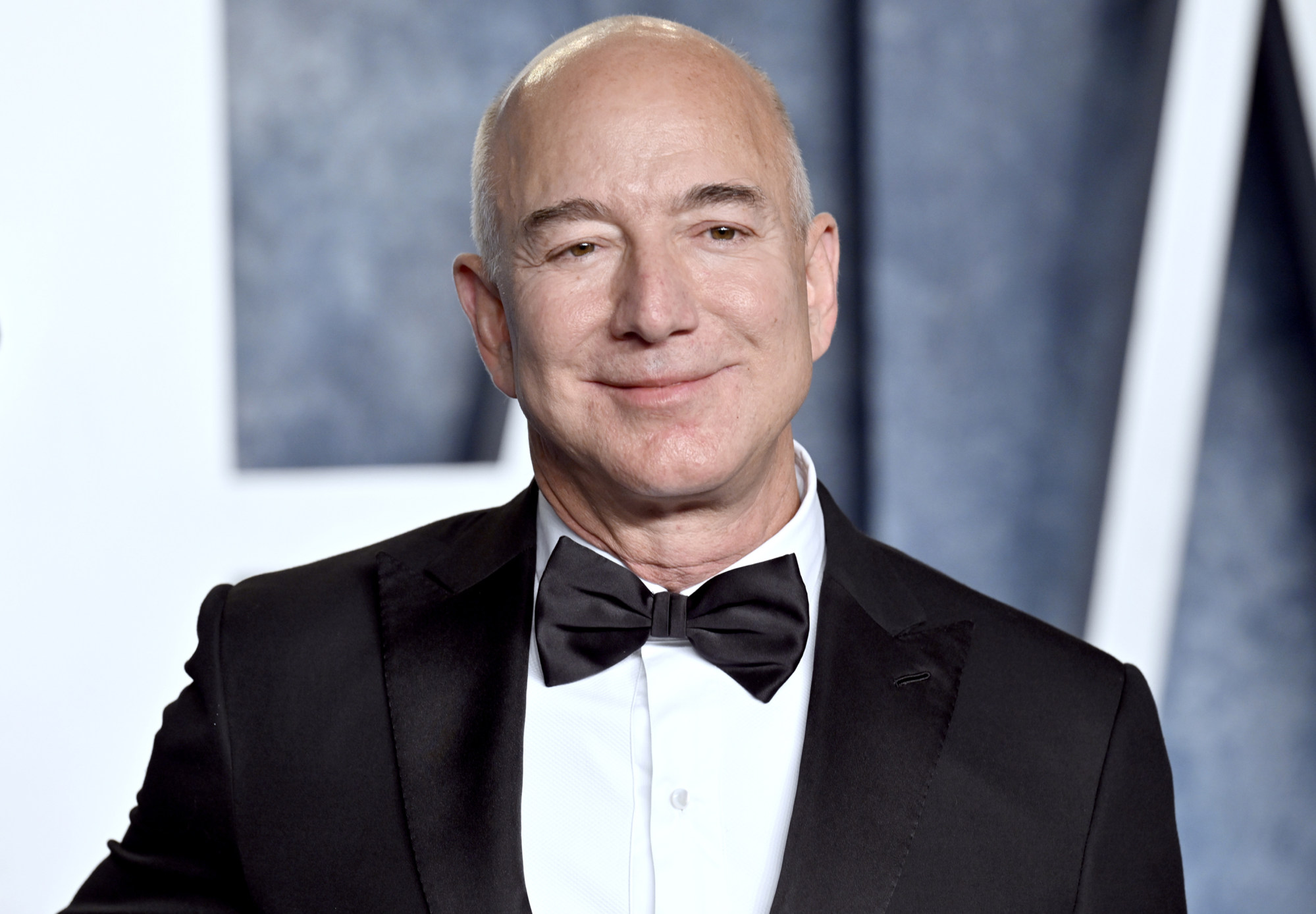

Musk’s fortune stands at US$199 billion, per the Bloomberg Billionaires Index. That’s just US$15 billion ahead of Amazon founder Jeff Bezos, with LVMH chief Bernard Arnault at US$183 billion, putting his status as the world’s wealthiest person under threat.

Musk is also only US$71 billion ahead of Warren Buffett (US$128 billion), who’s ranked ninth on the index.

He commanded more than triple the investor’s net worth in November 2021, when Tesla stock peaked at over US$400 on a split-adjusted basis.

The electric-vehicle maker’s stock has tumbled by 56 per cent since then to US$183, slashing its value from over US$1.2 trillion to below US$600 billion.

Musk owns 411 million shares, or about 13 per cent of Tesla, a stake worth more than US$100 billion at the start of this year. It’s now valued at about US$75 billion, reflecting a 26 per cent decline in the stock this year to its lowest levels since May.

The entrepreneur’s 42 per cent stake in SpaceX accounts for another US$74 billion of his fortune, based on the aerospace company’s US$175 billion valuation in December. Musk also owns other businesses including X, formerly known as Twitter, and The Boring Company.

Tesla stock has tumbled this year for a raft of reasons, including the EV maker falling short of Wall Street’s fourth-quarter revenue and profit forecasts and issuing a muted growth outlook, and Musk clamouring for more control over the company.

Elon Musk’s X becomes top trending topic on China’s Weibo after outage

Elon Musk’s X becomes top trending topic on China’s Weibo after outage

Musk also struck a cautious tone on the latest earnings call, flagging the threat posed by Chinese rivals and the pressure of higher interest rates on demand and profit margins.

Wedbush analyst Dan Ives bemoaned the “train wreck of a conference call,” while Deepwater managing partner Gene Munster said it was “the most sobering outlook I have seen from Tesla”.

Tesla’s rough start to the year is a striking reversal after its stock price more than doubled last year, making it one of the S&P 500’s best performers. The other six stocks in the “Magnificent Seven” have performed much better than Tesla in 2024, led by Nvidia and Meta, which are up 23 per cent and 11 per cent respectively this year.

Musk’s carmaker has also trailed the broader stock market: the S&P 500 is up about 3 per cent this year and hit a record high of more than 4,900 points last week.

Its gains have been fuelled by slowing inflation, resilient economic growth, and the prospect of the Federal Reserve slashing interest rates this year, which promises to boost corporate earnings and lift the appeal of stocks relative to bonds and savings accounts.

The divergence between Tesla and other stocks this year explains why Musk’s fortune has shrunk and his lead over the other centibillionaires has narrowed.

But it’s worth remembering Tesla stock is still up by more than 500 per cent since the start of 2020, making Musk one of the biggest wealth gainers in recent years.

Amazon is up 6 per cent this year, and 58 per cent over the past 12 months, leaving Bezos’ company worth US$1.64 trillion, or close to three times Tesla’s value.