Are you tired of traditional savings accounts not yielding the results you need? One alternative is to look to investing as the key to growing your wealth! But managing investments can be time-consuming, especially when you’re always on the go. That’s where stock-trading apps come in. With features like real-time market data and mock practice accounts, investment apps make investing accessible to investors at every level.

To help you make the most of your investments, we’ve compiled a list of the best stock-trading apps available for both iPhone and Android phones. Don’t forget that investing always carries risk, so only invest money you can afford to lose. But if you have money you’re comfortable investing, these are the 10 best investing apps you should use.

Looking for other financial apps? See our picks for the best personal finance apps and best cryptocurrency apps, too!

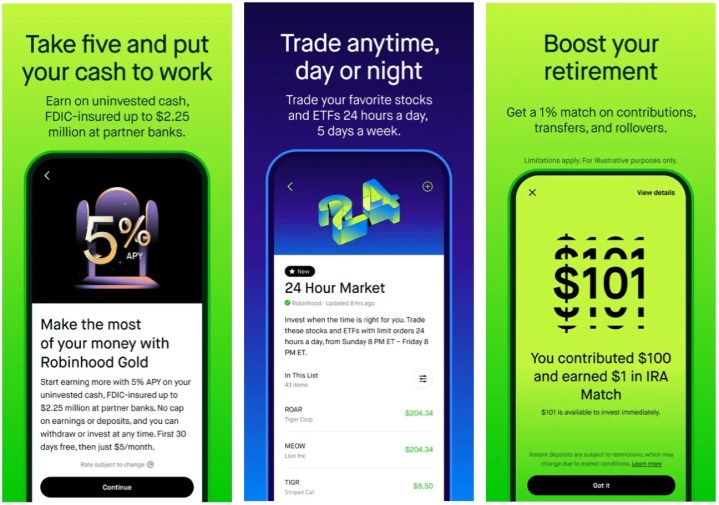

Robinhood

Hailed as one of the most popular stock-trading apps, Robinhood boasts a slick interface and zero commissions. There’s no minimum amount, so you can start with whatever you want, and there’s no waiting period. Trade U.S. stocks, cryptocurrency, and commodities, and learn how to trade as you go, thanks to Robinhood’s personalized feedback and recommendations.

The app also offers trading lessons to new investors so you can learn on the go. Robinhood has launched a new rewards program that offers a weekly bonus of 10% to 100%, and you’re eligible for up to $250K in FDIC insurance. Refer friends, and you’ll both get free stock from some of the world’s largest companies. Serious traders can buy the Gold membership ($5 per month), which gives you advanced tools and better rates.

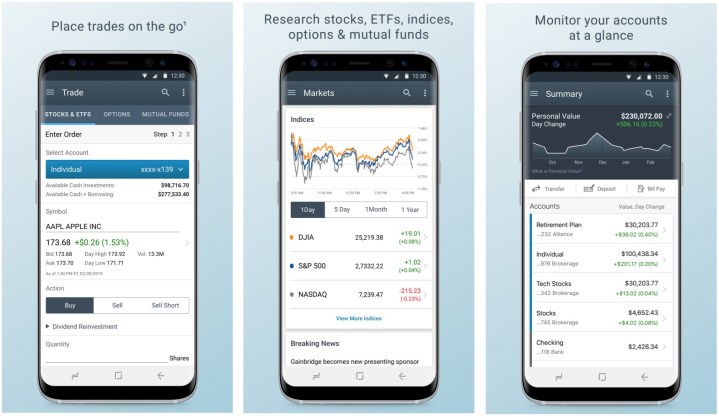

Schwab Mobile

Charles Schwab is a well-known name in the finance and investing world, so it makes sense that its app is one of the best for stock trading. Called Schwab Mobile, the app lets you trade stocks, ETFs, mutual funds, and much more. The dashboard is comprehensive, offering real-time updates, breaking news, and price charts for easy analysis. You can also build custom lists to keep an eye on your favorite options. New traders can benefit from the wide variety of videos, podcasts, and investing guides the app offers.

SoFi

SoFi is an all-in-one finance app that lets you manage your budget and make more money by trading stocks and other commodities. You can also get loans within the app, so everything is in one place. There are no commissions and no minimums, so anyone can start investing, even if you can only afford to put up $5 right now. You can invest in whole stocks, fractional shares, crypto, IPOs, and more.

SoFi also has a great reward program offering you fractional shares and even cold hard cash. You also get free stock just for opening an account, so there are rewards all around.

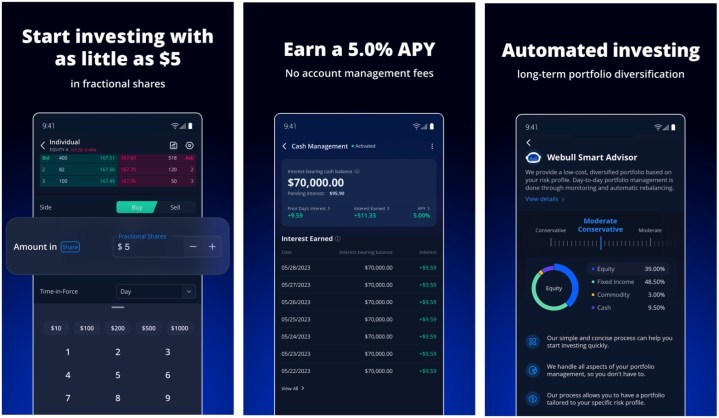

Webull

Webull has a lot to offer to investors at all levels. You can start trading stocks, crypto, and pretty much anything for as little as $1. Customizable charts, graphs, and real-time data help you stay updated and make wise decisions at key moments in the market. Like most other apps on this list, Webull lets you buy fractional stocks starting at just $5, so you don’t need huge savings to start trading.

New investors can also experiment with trading methods without spending real money to learn how everything works. It’s a great app to get started with if you’re new to stock trading, and there’s plenty of room to grow as you become more experienced.

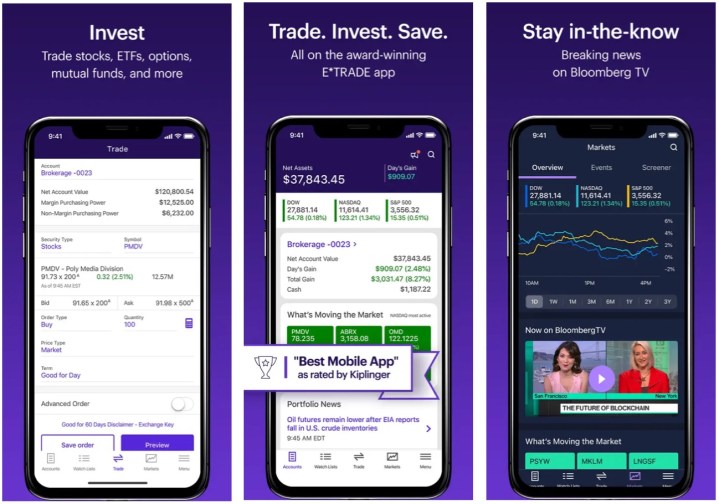

E*TRADE

Interested only in the U.S. market? The E*TRADE app might be the one for you. You can trade stocks, ETFs, and mutual funds. You also get multiple research and education tools to help you spot the best opportunities. What sets this app apart is the handy banking feature where you can deposit money, transfer cash, add checks, and even pay bills. Such a wide variety of features make it an attractive, all-rounder app for investors at various stages of their journey.

Trading 212

Trading 212 is a well-rated U.K.-based trading app that gives you access to trading in a wide variety of markets in the U.S., U.K., Germany, Spain, France, and the Netherlands. You can also trade cryptocurrency, and there’s access to a live chat for support. New investors can practice with a real-market simulator to learn the ropes before they invest any real money. The best part? Everything is commission-free, so you’re not paying hefty agent or platform fees.

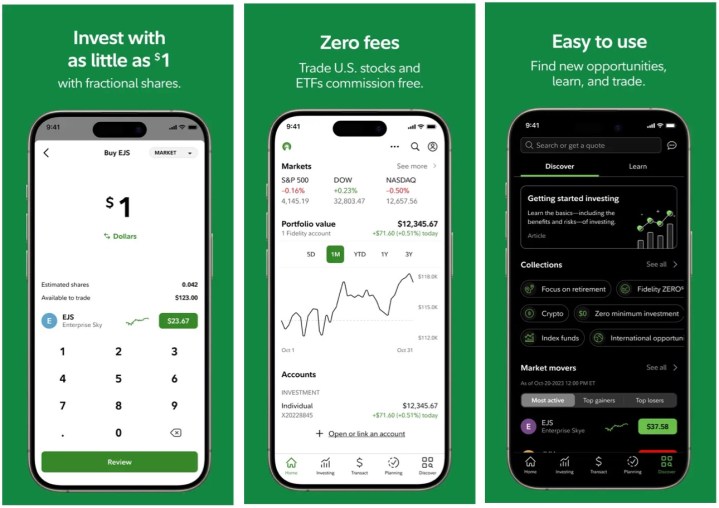

Fidelity Investments

Founded in 1946, Fidelity Investments is one of the big boys of investments and stock trading, and the app it offers reflects those years of experience. The app allows you to trade stocks, exchange-traded funds, mutual funds, and more while also offering more general fiscal management. Everything is commission-free, so you’re only paying for the trades. Anyone can start investing for as little as a dollar, and the app offers real-time market data to help you make your decisions. You can set price triggers and chat with a support assistant at any time of the day.

Capital.com

Get a more personal edge with Capital.com’s personalized AI-driven app, which provides you with all the news and guidance you need to ensure your investments mature and grow. Capital.com has access to a huge amount of investment areas, including more than 5,000 markets, cryptocurrencies, and commodities. You’ll also get real-time tracking of your investment, instant withdrawals, zero commissions, and no inactivity fee, so you can be as active or passive as you’d like. Customer support is available 24/7 in 31 different languages, so all your queries can be resolved quickly.

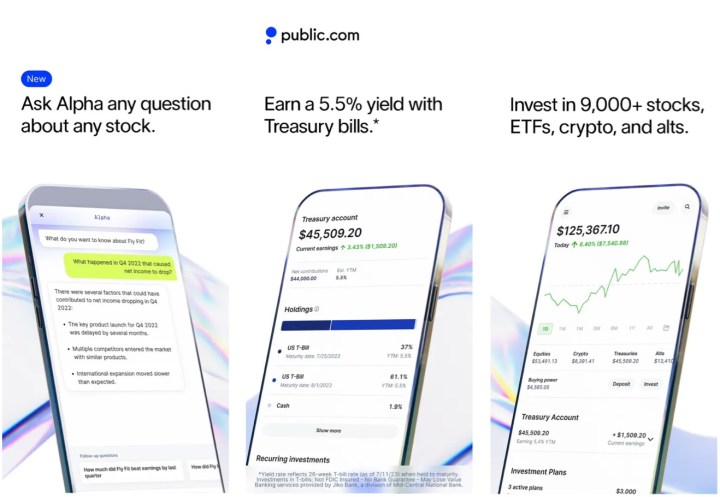

Public

Public was launched in 2019 with a primary focus on fractional investing. However, it has now expanded its platform to offer a multi-asset investing experience. You have the option to create a diversified Public portfolio with a range of investment options, including stocks, Treasuries, exchange-traded funds, crypto, and alternative assets. The platform provides you with various tools, data, and AI-powered insights to help you make informed investment decisions at every step of the way.

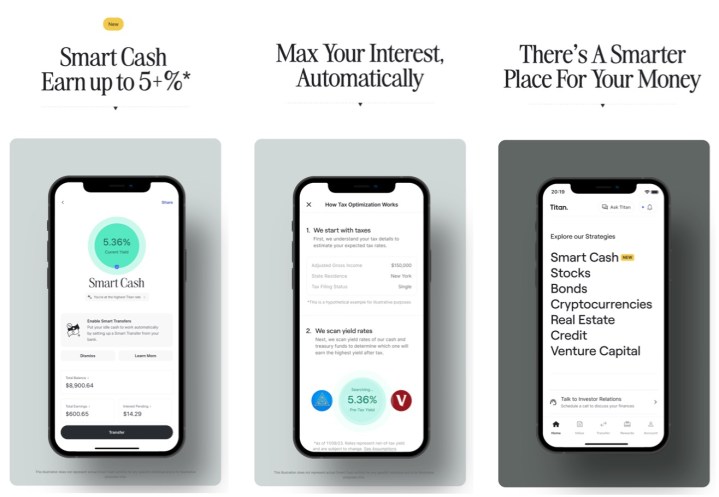

Titan

Titan is a company that offers curated portfolios managed by a team of skilled professionals who evaluate stocks and update portfolios based on potential risk and reward. They tailor investment options to meet investor objectives, including factors like risk tolerance, investment horizon, and financial goals. Titan’s commitment to personalized service has made it a leading company in the industry. It’s one of the more premium options out there, but if you want to get serious about your stock-trading journey, it’s one of the best you can use.

Editors’ Recommendations