Good morning! It’s Wednesday, May 22, 2024, and this is The Morning Shift, your daily roundup of the top automotive headlines from around the world, in one place. Here are the important stories you need to know.

1st Gear: China Responds To U.S. EV Tariffs

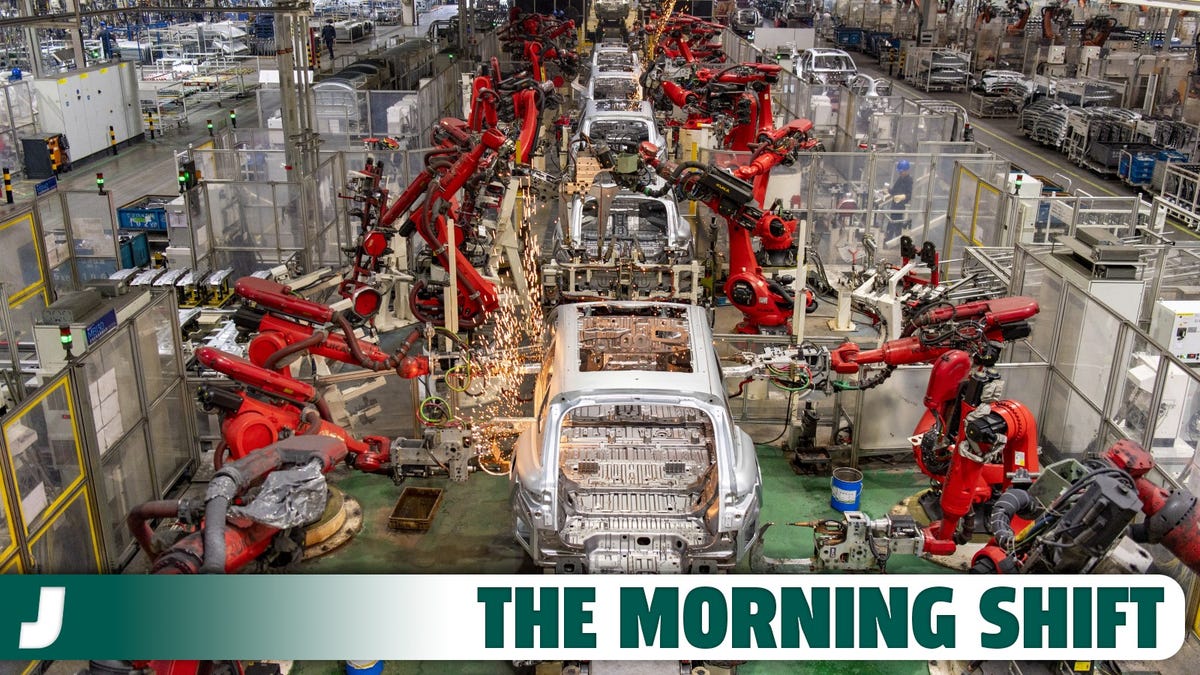

China has spent the past few years building really cheap electric cars that have been making their way across its borders and into markets like Europe and Australia. Before this cheaply priced menace can make it to America, the U.S. strapped a massive 100 percent tariff on Chinese EVs and now, it sounds like China is about to respond.

China is now considering imposing a 25 percent tariff on American and European cars imported into the country for sale, reports Bloomberg. The tariffs could hit American-made models fitted with large engines, the site reports. As Bloomberg explains:

China signaled it’s ready to unleash tariffs as high as 25% on imported cars with large engines, as trade tensions escalate with the US and European Union.

The China Chamber of Commerce to the EU said it was informed about the potential move by “insiders,” according to a statement posted on X. The levies would affect European and US carmakers and have a “significant” impact on relations with the EU, it added.

The U.S. has already strapped its tariffs on Chinese EVs, and it’s widely believed that the European Union could follow suit shortly. However, Stellantis boss Carlos Tavares warns that this might not be a smart move. The chief executive warned that increasing tariffs across the board could pose “significant consequences for jobs and production,” reports Reuters. As the site explains:

Tavares said tariffs on Chinese vehicles imported to Europe and the United States are “a major trap for the countries that go on that path” and will not allow Western automakers to avoid restructuring to meet the challenge from lower cost Chinese manufacturers.

As well as stopping homegrown automakers from tackling Chinese rivals on a level playing field, Tavares also warned that the tariffs would “fuel inflation” and could have a detrimental impact on sales and production across the auto industry.

2nd Gear: The Fully Electric Lamborghini Is Still A Way Off

One company that probably won’t be contributing to the affordable EV discourse is Lamborghini, not only because its cars are prohibitively expensive but also because it won’t be rushing to make an EV any time soon, according to company boss Stephan Winkelmann.

According to Winkelmann, an all-electric supercar from the Italian automaker is still a few years off, despite rivals Ferrari and McLaren suggesting that work is ongoing for their own battery-powered monsters. However, in a new interview with Bloomberg the Lamborghini boss said the project wasn’t a priority for the company, as the site explains:

While performance won’t be an issue in an EV, some emotional aspects — like the sound of the Huracan’s V10 engine — can’t be replicated, said Lamborghini boss Stephan Winkelmann. The Volkswagen AG-owned brand also remains open to use e-fuels if regulation becomes more favorable.

Fully electric sports supercars “is not something that is selling so far,” Winkelmann said in an interview. “It’s too early, and we have to see down the road if and when this is going to happen.”

Still, this doesn’t mean that Lamborghini isn’t open to moving with the times. It already has hybrid supercars out in the world and recently added a plug-in option to its best-selling Urus SUV. Bloomberg also reports that the company is eyeing e-fuels as a means of keeping its gas-powered cars running.

Sustainable e-fuels as well as a mammoth production overhaul at the company will help it cut emissions for its cars around 40 percent by 2030, reports Bloomberg.

3rd Gear: NHTSA Probes VW ID.4 Recall

It feels these days like no automaker is safe from the wrath of the recall. After Ford and Tesla were forced to call cars back in for repairs already this year, Volkswagen is now facing a probe over a recall affecting its ID.4 electric SUV.

VW’s ID.4 was recalled in 2023 after issues were found with the car’s doors, with some even opening at high speed. Now, the company’s fix of the issues is being investigated by the National Highway Traffic Safety Administration, reports Automotive News. As the site explains:

NHTSA’s Office of Defects Investigation said it received 12 reports for 2021-2023 model year ID4 vehicles alleging the “vehicle’s door intermittently opens while driving with no reasonable detectability.”

The agency also received reports that the door handles would prevent consumers from entering or exiting the vehicles, NHTSA said in its report filing.

The original recall required technicians to analyze ID4 door handles and assess if a replacement was needed.

NHTSA opened the probe — known as a recall query — to assess the effectiveness of the recall and its original remedy. The vehicles alleging the complaints had all received the correction, NHTSA said.

The original recall impacted more than 50,000 VW ID.4s and the probe into the fix is the first step in the NHTSA’s process to assess its effectiveness. If any issues are found with the fix, the agency could issue a recall request letter, or it could be closed if the fix is satisfactory.

4th Gear: Boeing Boss Faces Revolt

Boeing has had quite the year so far in 2024. After quality control issues were uncovered at its factory and a door plug burst out the side of one of its aircraft, the company’s boss is now facing a revolt among shareholders over his pay for the year.

Shareholders in the American planemaker voted on compensation for chief executive Dave Calhoun earlier this month, with a “sizeable” portion of them lodging protest votes and going against his $32.8 million pay pack, reports the Financial Times. As the site explains:

Though largely symbolic, the votes at the company’s annual meeting marked one of the biggest revolts this year against a CEO of a company in the Dow Jones Industrial Average. Pushback at this scale on a corporate vote is a sign of significant frustration from shareholders.

More than a third of investors withheld approval in an advisory vote on executive remuneration. Calhoun is expected to receive $32.8mn this year — a 45 per cent raise — but 35 percent of shareholders objected. And 22 per cent voted against keeping him as a director of the aircraft manufacturer as it struggles to address safety and quality lapses.

Calhoun had previously announced plans to step down at the end of 2024 following the bad press his company has received in recent months. The Boeing boss has been in the roll since 2020, during which time the company’s share price has almost halved.