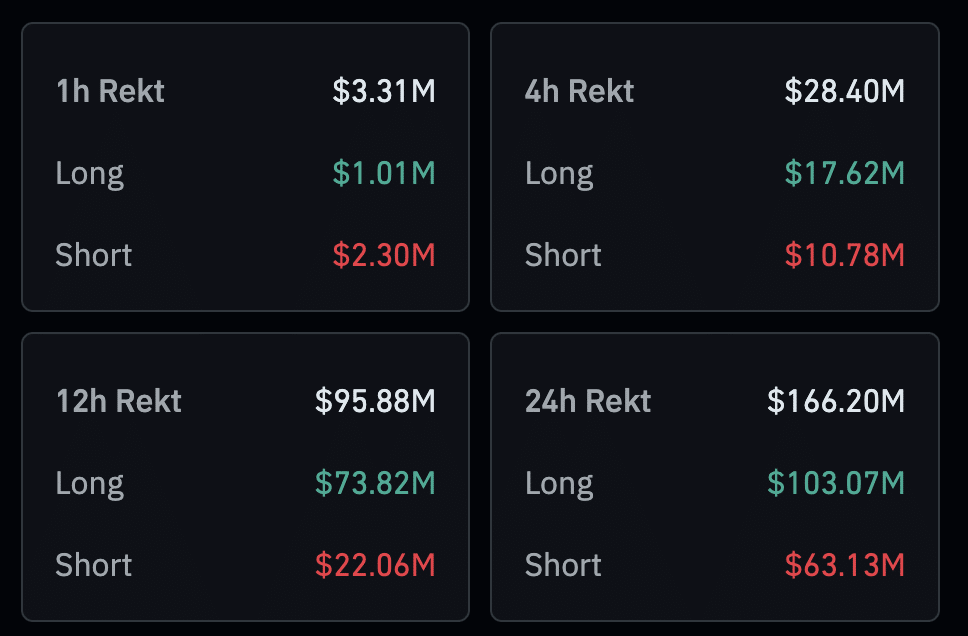

Between Dec. 25 – 26, the volume of liquidations in crypto markets exceeded $166 million.

According to CoinGlass, altcoins account for a significant share of losses. At the time of writing, the daily volume of liquidations is $166.2 million, with a predominance of long positions.

In addition to the traditional Bitcoin (BTC) and Ethereum (ETH), trading pairs with Solana (SOL) and ORDI are among the leaders in terms of loss volume.

The most significant liquidations occurred on the Binance, OKX, and Bybit exchanges. As with the market, these are predominantly long positions – more than 60%.

A series of liquidations occurred against the backdrop of a falling BTC rate. The cryptocurrency sank by 2%, reaching $42,750.

In 2023, Bitcoin outperformed almost all other asset classes including the global stock market and gold in growth dynamics.

BTC growth stood out this year growing by 163% in 2023.

Amid expectations of an imminent decline in interest rates, easing regulatory pressure from the United States and the expected approval of a Bitcoin ETF by the U.S. Securities and Exchange Commission (SEC), analysts expect continued growth in crypto assets in 2024.