And some legal experts worry that if the judge goes out of his way to punish the former president with that worst-case scenario, it could make it easier for courts to wipe out companies in the future.

“This is a basically a death penalty for a business,” said Columbia University law professor Eric Talley. “Is he getting his just desserts because of the fraud, or because people don’t like him?”

A review by Associated Press of nearly 150 reported cases since New York’s “repeated fraud” statute was passed in 1956 showed that nearly every previous time a company was taken away, victims and losses were major factors.

Customers had lost money or bought defective products or never received services ordered, leaving them cheated and angry.

What’s more, businesses were taken over almost always as a last resort to stop a fraud in progress and protect potential victims.

They included a phoney psychologist who sold dubious treatments, a fake lawyer who sold false claims he could get students into law school, and businessmen who marketed financial advice but instead swindled people out of their home deeds.

Trump’s cash stockpile at risk from US$450 million dual verdicts

Trump’s cash stockpile at risk from US$450 million dual verdicts

In Trump’s case, his company stopped sending exaggerated financial figures about his net worth to Deutsche Bank and others at least two years ago, but a court-appointed monitor noted that was only after he was sued and that other financial documents continued to contain errors and misrepresentations.

And although the bank offered Trump lower interest rates because he had agreed to personally guarantee the loans with his own money, it is not clear how much better the rates were because of the inflated figures.

The bank never complained, and it is unclear how much it lost, if anything. Bank officials called to testify could not say for sure if Trump’s personal statement of worth had any impact on the rates.

“This sets a horrible precedent,” said Adam Leitman Bailey, a New York property lawyer who once successfully sued a Trump condominium building for misrepresenting sales to lure buyers.

Trump’s fury over legal threat

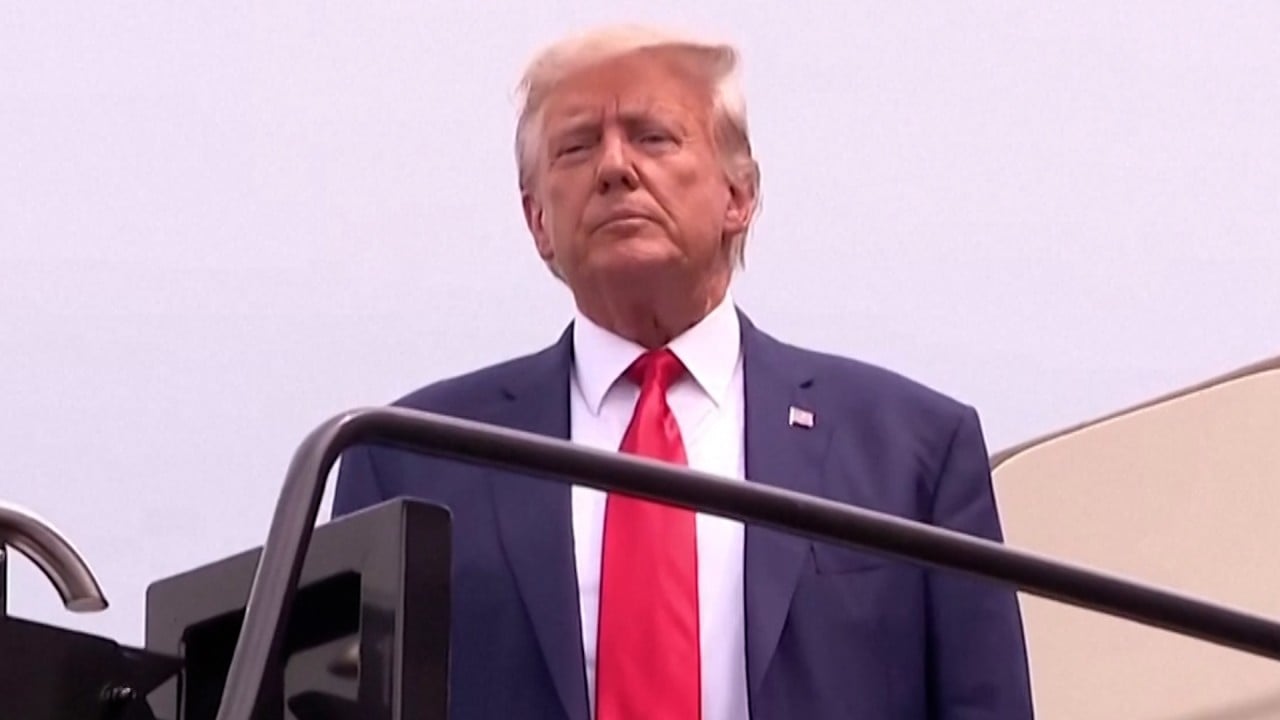

Trump, the Republican presidential front runner, has focused his ire at potentially losing his business at both the Democratic New York attorney general who brought the case and the judge presiding over it.

In an order last September that is currently under appeal, State Supreme Court Judge Arthur Engoron said Trump had indeed committed fraud and should have the state certificates needed to run many of his New York companies revoked.

He said Trump should then be stripped of control over those companies, which are the official owners of his Fifth Avenue headquarters and other marquee properties, and have them turned over to a receiver who will manage the “dissolution” of them.

What the judge left unclear is what he meant by “dissolution”, whether that referred to the liquidation of entities that control properties or the properties themselves. Asked specifically in court whether Trump’s buildings would be literally sold as in a bankruptcy, Engoron said he would clarify at a later date.

Trump test could prove toughest challenge for Taiwan’s next president

Trump test could prove toughest challenge for Taiwan’s next president

In a worst case, as interpreted by legal experts, Engoron could decide dissolution means stripping Trump of not only his New York holdings such as Trump Tower and his 40 Wall Street skyscraper, but his Mar-a-Lago club in Florida, a Chicago hotel and block of flats, and several golf clubs, including ones in Miami, Los Angeles and Scotland.

For her part, New York Attorney General Letitia James has asked that Trump be banned from doing business in New York and pay US$370 million, what she estimates is saved interest and other “ill-gotten gains”.

But she did not ask for a property sale and may not even want one. Said one of her lawyers, Kevin Wallace, in his closing argument: “I don’t think we are looking for anything that would cause the liquidation of business.”

Engoron has indicated that within the next couple of weeks he will issue a ruling expected to decide on the cash penalty and business ban and clarify his “dissolution” order.

How the anti-fraud law is written

Notably, New York’s anti-fraud statute, known as Executive Law 63 (12), is clear that a finding of fraud does not require intent to deceive or that anyone actually gets duped or loses money. The attorney general must only show “repeated fraudulent or illegal acts”.

But the Associated Press analysis, based on a search of reported 63 (12) cases in legal databases LexisNexis and Westlaw, found that victims and losses were factors when it came to deciding whether to take over a business.

A breast cancer non-profit was shut down 12 years ago, for instance, for using nearly all of its US$9 million in donations to pay for director salaries, perks and other expenses, instead of funding free mammograms, research and help for survivors.

A mental health facility was closed for looting US$4 million from public funds while neglecting patients.

There may be more dissolved companies than Associated Press found. Legal experts caution that some 63 (12) cases never show up in legal databases because they were settled, dropped or otherwise not reported.

Trump must pay E. Jean Carroll US$83.3 million in defamation case, jury finds

Trump must pay E. Jean Carroll US$83.3 million in defamation case, jury finds

Still, the only case Associated Press found of a business dissolved under the anti-fraud law without citing actual victims or losses was a relatively small company closed in 1972 for writing essays for university students.

In that case, the attorney general said the victim was “the integrity of the educational process”.

This is not Trump’s first run-in with New York’s anti-fraud law. His non-profit Trump Foundation agreed to shut down in 2018 over allegations he misused funds for political and business interests.

And his Trump University was sued under the law in 2013 for allegedly misleading thousands of students with false promises of success but it had shut before it could be closed by the courts. Trump eventually settled this and related cases for US$25 million.

Decades of 63 (12) legal history also showed many cases where defendants socked customers with big losses and still got to keep running their businesses.

What lies did Trump tell to get in trouble?

Trump’s case involved 11 years of financial statements with values based on disputed and sometimes outright false descriptions of properties used as collateral should his loans go bust.

Among them: Trump exaggerated the size of his Manhattan penthouse apartment by three times. He listed unfinished buildings as if they were complete, and flats under rent control as if they were free of such rules.

He showed restricted funds as if they were liquid cash. And Trump valued Mar-a-Lago as a single residence, even though he had signed away rights to develop it as anything but a club.

In making her case against Trump, Letitia James called to the stand a lending expert who estimated that Deutsche Bank gave up US$168 million in extra interest on its Trump loans, basing his calculations as if Trump never offered a personal guarantee.

Hong Kong’s Jimmy Lai told Apple Daily not to target Donald Trump, court hears

Hong Kong’s Jimmy Lai told Apple Daily not to target Donald Trump, court hears

But Trump did offer a guarantee, even if his estimate of his personal wealth was exaggerated. In fact, the bank made its own estimates of Trump’s personal wealth, at times lopping billions from Trump’s figures, and still decided to lend to him.

And testimony from Deutsche officials responsible for the loans suggested that deciding the right rate at which to lend, even absent Trump’s personal guarantee, isn’t so simple.

Trump has repeatedly said in impromptu rants at his trial that the case is a meritless, political “witch hunt” because he is richer than the statements sent to banks suggest, and lenders did not care about those figures anyway because they always did their own analysis, always got paid back in full and continued to lend to him.

“What’s happened here, sir, is a fraud on me. I am an innocent man,” Trump said in a six-minute statement in court earlier this month before the judge cut him off.

Larger issues at play

To be sure, the attorney general’s office has argued that there are larger issues than victim losses at play in Trump’s case.

When big loans are issued with an inaccurate picture of risk, said state lawyer Kevin Wallace, it damages the public and business community, “distorts the market” and “prices out honest borrowers”.

Plus, Wallace suggested, letting such lies to banks slide if those banks do not take legal action on their own would amount to saying, “if you are rich enough, you are going to be allowed to do it.”

Or as New York lawyer and Fordham University adjunct law professor Jerry H Goldfeder put it, “Just because no one is complaining doesn’t mean there hasn’t been a fraud.”

‘Witch hunt!’ says Trump, on indictment of trying to overturn election result

‘Witch hunt!’ says Trump, on indictment of trying to overturn election result

In a footnote in a 94-page summary document filed earlier this month, Letitia James suggested a compromise decision for Engoron: appoint an independent monitor to oversee Trump’s operations for five years, after which the court could decide whether to revoke his business certificates and possibly put him out of business.

University of Michigan’s Thomas says he thinks Engoron may pull back from his shutdown order, but he is still concerned.

“Those who want to see Donald Trump suffer by any means necessary,” he said, “risk ignoring the very commitment to a rule of law that they accuse him of flouting.”