Tsang joined JLL in 1984, at a difficult time for the property market. Negotiations between China and the United Kingdom over the future of Hong Kong had led to a crisis of confidence among investors.

However, property prices rose once again, before dropping by more than 40 per cent during the Asian financial crisis, he said. Then the market recovered at an accelerated pace before crashing during the global financial crisis in 2008.

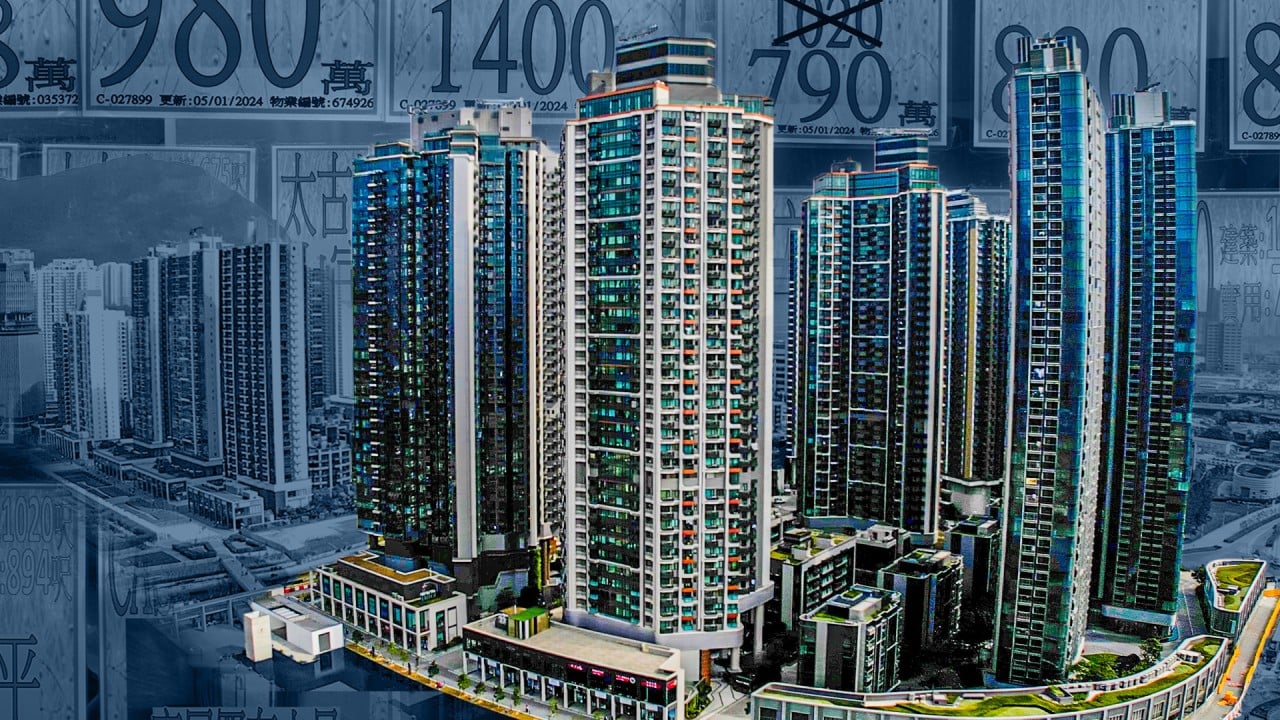

Then Hong Kong’s property market recovered once again, with the prices of lived-in homes rising 271.7 per cent between 2009 and September 2021, an all-time peak, according to a widely tracked government index.

Mainland F&B brands’ influx may boost Hong Kong retail property market: analysts

Mainland F&B brands’ influx may boost Hong Kong retail property market: analysts

In the current downturn, which started in 2021, “we have been affected by factors that Hong Kong cannot get over on its own”, Tsang said.

“The tension in US-China relations is unlikely to be resolved within the next 10 years, and Hong Kong is being sandwiched in between and will inevitably suffer,” he added.

But Tsang said, “US interest rates are no longer a tool to adjust the economy, but a weapon, impacting the rest of the world, especially China.”

Property developers are pessimistic about Hong Kong’s housing market, which has been reflected in their attitudes towards land tenders, Tsang said. The investment duration of such plots is typically three to six years, and if developers are lukewarm towards land tenders, “it’s obvious they have no confidence in Hong Kong’s market as a whole”, he added.

Besides being conservative when it comes to land tenders, developers will also continue to speed up the launches of new projects at lower prices in the current high interest rate environment, with inventory levels at a historical high, Tsang said.

There were 86,300 unsold units in completed projects and those under construction, as of the end of the third quarter last year, according to JLL.

“Another price war will kick-off among new projects, especially in Kai Tak and the New Territories, which have major supplies,” Tsang said. “These projects will be selling at least 10 to 15 per cent discounts on the market price.”

Some smaller developers will even sell their projects at a loss, depending on their opportunity costs and financial situation, he added.

Hong Kong mansion at The Peak sells for US$107 million at 35% discount

Hong Kong mansion at The Peak sells for US$107 million at 35% discount

“And there are also some developers, which will not join the price war but stay on the sidelines.”

But the proactive ones are in majority. “That is to say, Hong Kong’s home prices are still under pressure this year,” Tsang said.

Eligible overseas professionals are no longer required to pay stamp duty on property purchases, unless they fail to qualify as permanent residents.

Tsang said Hong Kong’s talent scheme should come with more policy support, such as mortgage relaxations and relaxations of capital outflow controls, to boost housing transactions.

Chinese buyers return to Hong Kong’s luxury property market as activity picks up

Chinese buyers return to Hong Kong’s luxury property market as activity picks up

“The only light at the end of the tunnel is an economic recovery in mainland China” Tsang said.

“Although the recovery is on its way, it is going to take some time. In the long run, Hong Kong will recover, but it’s going to be bumpy and I don’t know how long it’s going to last.

“I am cautiously optimistic about whether we could still go back to the good old days, when the property market was on fire, back in 2019.”