Used car prices are steadily dropping, mostly due to oversupply, and while electric and luxury vehicles are being hit the hardest, other segments don’t always see a big savings gap between new and used.

For years, I’ve been fighting the myth that used cars will always save buyers money over a new car. Even though pre-owned models, for the most part, offer a better value proposition, often the most popular brands that get high marks for retaining their value can be some of the worst cars to buy in the pre-owned market. This is especially true once you factor in the difference between the interest rates on used models versus new ones.

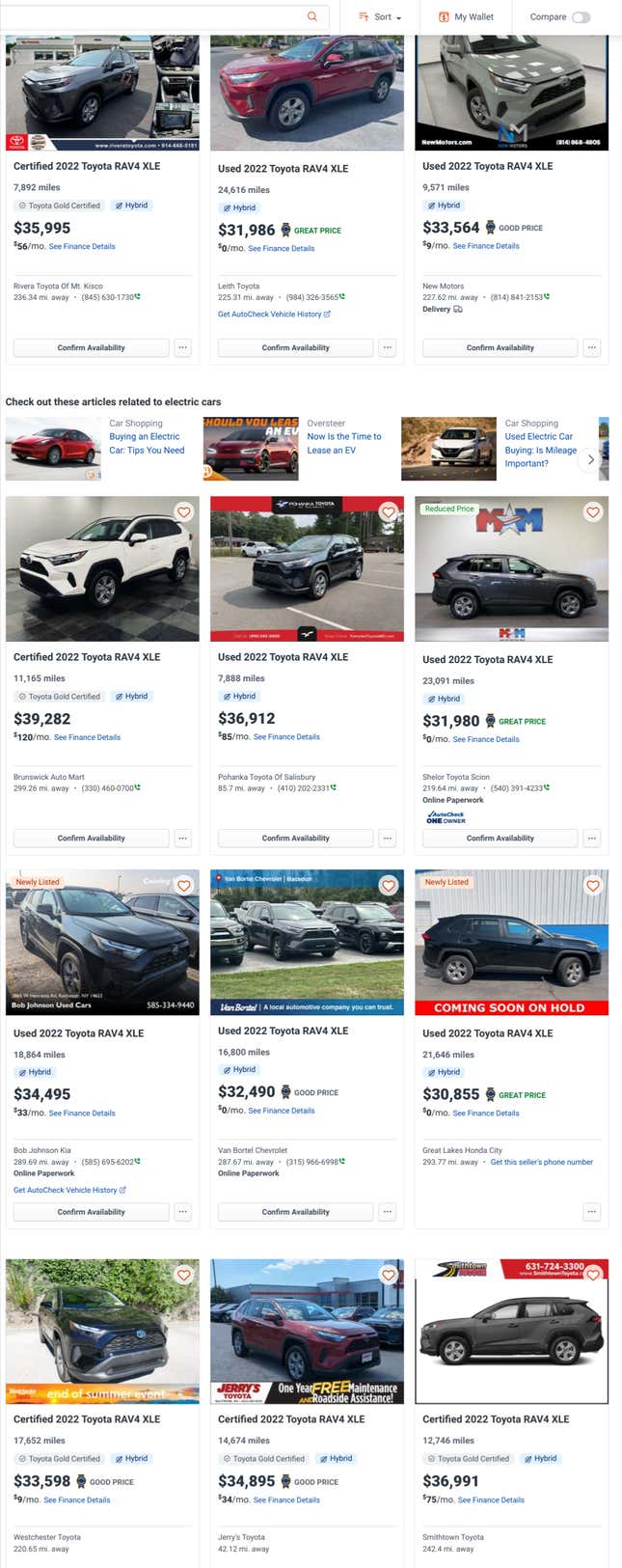

Let’s take a look at one of the most popular crossovers the RAV4 Hybrid. A market scan of the DC Metro looking at 2022 models with under 30,000 shows cars in the low to mid-$30,000 range.

A brand new 2024 XLE Hybrid with the weather package has an MSRP of $35,510 including the destination fee. Given that most of the two-year-old cars with reasonable miles cluster around $32,000 – $33,000, that savings delta doesn’t make a lot of sense compared to getting a new one with a full warranty.

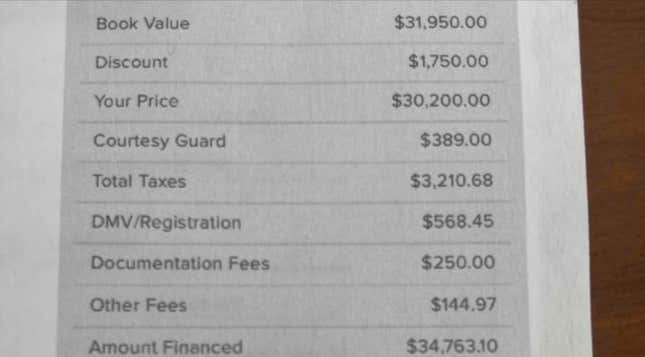

Sometimes the savings look wide enough to justify the pre-owned car, but once the interest rates are factored in, the value proposition changes. I was recently shopping for a used Subaru Ascent for some clients in the Seattle metro area. The customers wanted to be around $35,000 out the door and that meant something like this three-year-old model with about 30,000 miles.

A different local dealer was offering a brand new Ascent with an MSRP of $40,099 for $35,858, with a total price with tax of $40,556. That’s a price gap of around $4,700 between the new car and the used one, and most people would probably opt to keep that few grand in their pocket and go for the pre-owned.

However, Subaru currently offers 3.9 percent financing for 63 months or 4.9 percent for 72 months. Used car rates for buyers with good credit are hovering around 8.0 percent. On that pre-owned model with a total of $34,673 financed at 8.0 percent, they would have been looking at payments of $675 per month for a 63-month loan. On the new car with a total of $40,556 on a 63-month loan at 3.9 percent, payments would be $713 per month. That’s a $38 difference per month between a brand-new car and a three-year-old model.

Naturally, in segments such as luxury cars and electric vehicles, the depreciation gap is much wider, and pre-owned is likely the better move. However, when shopping for a specific model, especially one from a high-value brand, it’s worth exploring the market for both new and used deals.

Tom McParland is a contributing writer for Jalopnik and runs AutomatchConsulting.com. He takes the hassle out of buying or leasing a car. Got a car buying question? Send it to [email protected]