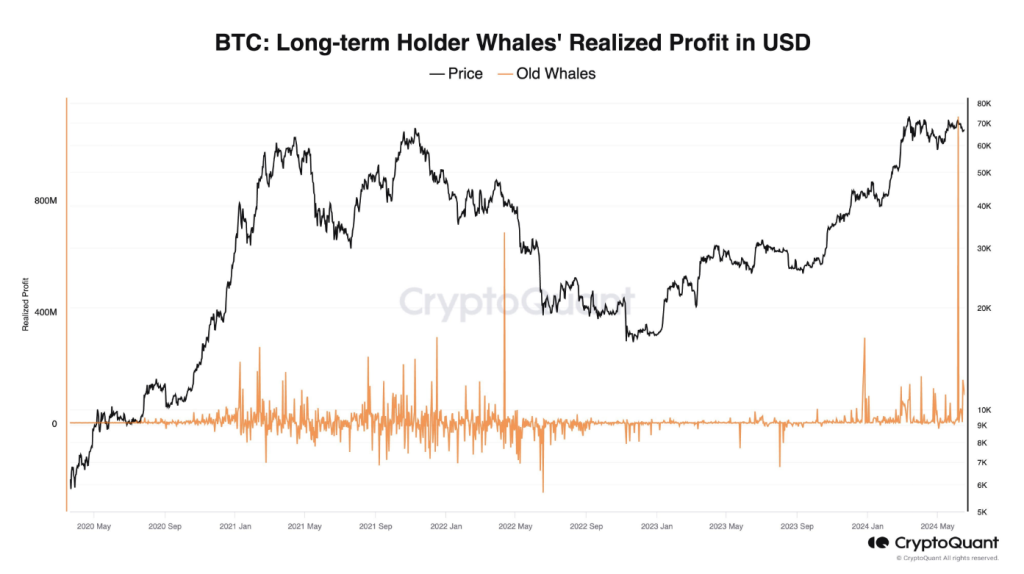

Bitcoin seems to be hitting an air pocket. Over the past two weeks, whales have been shedding their digital assets in large amounts. This exodus, totaling over $1.2 billion according to CryptoQuant, has been a cause for concern for many landlocked investor.

Related Reading

Where The Whales Go, The Market May Follow

The reasons for this sudden sell-off remain murky, but analysts point to a confluence of factors. One theory suggests a shift in priorities for miners, the brawny machines that secure the Bitcoin network and earn rewards in the form of new coins.

#Bitcoin long-term holder whales sold $1.2B in the past 2 weeks, likely through brokers.

ETF netflows are negative with $460M outflows in the same period.

If this ~$1.6B in sell-side liquidity isn’t bought OTC, brokers may deposit $BTC to exchanges, impacting the market. pic.twitter.com/oYeKsRqKeF

— Ki Young Ju (@ki_young_ju) June 18, 2024

With the booming artificial intelligence (AI) sector offering a potentially more lucrative goldmine, miners might be cashing out their crypto rewards to invest in the future of computing.

The allure of AI is undeniable, shared Lucy Hu, a senior analyst at crypto fund Metalpha. The sheer processing power needed for AI development aligns perfectly with the capabilities of mining rigs. It seems miners are strategically diversifying their revenue streams.

This potential exodus of miners from the Bitcoin ecosystem could have a domino effect. As miners sell their rewards, it increases the overall supply of BTC in circulation, potentially driving the price down.

This aligns with the observed decline in “UTXO age” – a metric used to track buying and selling patterns. A drop in UTXO age indicates increased selling activity, and that’s not a comforting sign for investors hoping to ride the Bitcoin wave.

Traditional Markets Beckon, Leaving Bitcoin On The Beach

Adding fuel to the fire is the broader market sentiment. The recent strength of the US dollar and a general flight towards “safer” assets like traditional stocks have put a damper on riskier investments like Bitcoin.

This risk aversion is further reflected in the net outflows of over $600 million from US-listed Bitcoin ETFs – the worst performance since late April.

Related Reading

Is This A Bitcoin Bust, Or A Temporary Hiccup?

The combined effect of these factors has been a steady decline in BTC’s price. From a lofty perch of $71,000 just a few weeks ago, Bitcoin has dipped to a little over $65,000. Some analysts warn of a potential freefall to as low as $60,000 if the tide of negative sentiment continues to flow.

Whales are unloading a ton of Bitcoin. Is this a fire sale, a big discount to buy Bitcoin, or a warning sign that things are about to get rough for Bitcoin? Investors are waiting to see if this is a good time to buy or if they should get out before the price drops even more.

Featured image from Getty Images, chart from TradingView