The price of Bitcoin has consolidated above $60,000 following the U.S. labor market report issued today.

The rise in Bitcoin (BTC) happened shortly after the publication of the U.S. jobs report, which shifted expectations of the Federal Reserve’s key rate cut from November to September.

Bitcoin gained more than 4% after the release of the statistics and continues to grow, moving towards $62,000, according to CoinMarketCap data.

CryptoQuant CEO Ki Young Ju said that Bitcoin whales accumulated 47,000 BTC in anticipation of the Fed’s report.

Macroeconomic data has caused expectations regarding the trajectory of the Fed key rate in 2024 to be revised — instead of one, the market is now taking into account two cuts of 0.25% each, with the first expected in September rather than November before the release of statistics.

Bloomberg analysts said the key report for investors will now be the report on consumer price dynamics on May 15.

“Overall the labor market still remains strong and they will need to see more evidence of a slowdown, or a surprise sharp drop in employment, to be worried about their employment mandate after such a strong string of job gains. Ultimately, the FOMC is going to stay on hold until they have clarity on inflation.”

Ali Jaffery, CIBC Capital Markets expert

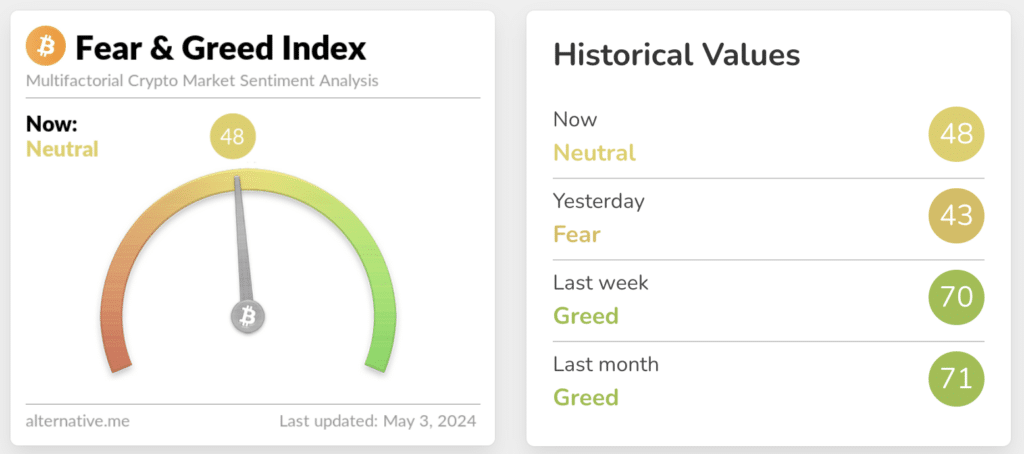

After the release of the U.S. labor market report, risk appetite increased in global markets. The S&P 500 stock index opened up 1.2%, and the cryptocurrency index of fear and greed rose by five points on the day, moving from the fear zone to the neutral zone.

Recently, BTC’s price fell below the $60,000 threshold. Against the backdrop of Bitcoin’s fall, Santiment analysts said that the released data in the United States caused a surge in discussions around the hashtag #buythedip and mentions of BTC.

According to analysts, this increase in sentiment indicates renewed polarization among traders. Some are in favor of a buying opportunity, while others remain cautious.