Share this article

Stronghold Digital Mining, Inc. (NASDAQ: SDIG), a vertically integrated Bitcoin mining firm, has announced the initiation of a formal strategic review process to explore alternatives for “maximizing shareholder value,” including the potential sale of all or part of the company.

In its first-quarter 2024 earnings release, Stronghold reported revenues of $27.5 million, a 27% increase sequentially and a 59% increase year-over-year. The company also reported a GAAP Net Income of $5.8 million and a non-GAAP Adjusted EBITDA of $8.7 million for the quarter. GAAP refers to “generally accepted accounting principles,” a set of accounting rules, standards, and guidelines that publicly traded companies in the US adhere to.

The recently concluded earnings call from Stronghold mentioned that the firm has executed an agreement with Voltus, Inc. to assist in capturing demand response opportunities, which could further enhance economics when importing power from the grid.

Notably, Stronghold has retained Cohen and Company Capital Markets as its financial advisor and Vinson & Elkins LLP as its legal advisor to support the company’s management team and board during the strategic review process.

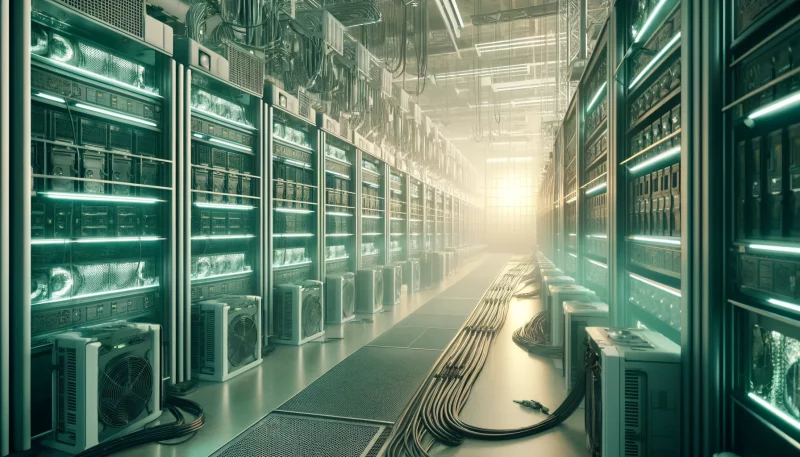

Stronghold, which operates two facilities that burn coal refuse to generate electricity for its mining operations, has a current market capitalization of nearly $40 million. The company’s shares, which were trading at around $11.25 in late 2023, have recently been trading at approximately $3.

Despite these financial results, Stronghold’s board and management team have decided to explore strategic alternatives, citing a “valuation dislocation” when comparing the company’s market value to those of public Bitcoin mining peers, merchant power companies, and data center and power generation assets.

“We believe that our 130 MW of existing Bitcoin mining capacity could potentially be expanded to over 400 MW for either Bitcoin mining or advanced computing, such as that which is used for artificial intelligence and machine learning,” said Greg Beard, chairman and CEO of Stronghold.

The decision to explore strategic alternatives comes in the wake of the recent Bitcoin halving event, which has raised concerns about the profitability of mining operations. However, Stronghold’s press release did not explicitly attribute the decision to halving-related pricing, despite Beard’s statements that the mining company needs to adapt to the effects of Bitcoin halving on output efficiency.

The company emphasized that there is no definitive timetable set for the completion of the review, and there can be no assurance that any proposal will be made or accepted, or that any transaction will be consummated.

Share this article