Share this article

The Bitcoin (BTC) on-chain dynamics after its fourth halving indicate that BTC exchange outflows are reaching peaks not seen since January 2023 and that the market is showing a “robust absorption” of selling pressure. According to the latest edition of the “Bitfinex Alpha” report, those are “decidedly positive” on-chain metrics.

Since the SEC’s approval of spot Bitcoin exchange-traded funds (ETF) in the US on January 10, 2024, the BTC landscape has seen a marked transformation, the report highlights. The first quarter of the year has witnessed Bitcoin ETFs amassing approximately $60 billion in inflows, providing significant support to the market.

These ETFs have not only spurred some of the highest trading volumes on record but have also increased market liquidity by attracting new BTC demand.

The latest Bitcoin halving on April 20, 2024, has further tightened supply growth from mining rewards, which historically has led to substantial price increases. For example, the 2020 halving preceded a nearly seven-fold price escalation over the following year. Despite the immediate revenue drop for miners post-halving, the market typically recovers as prices rise and larger mining operations scale up.

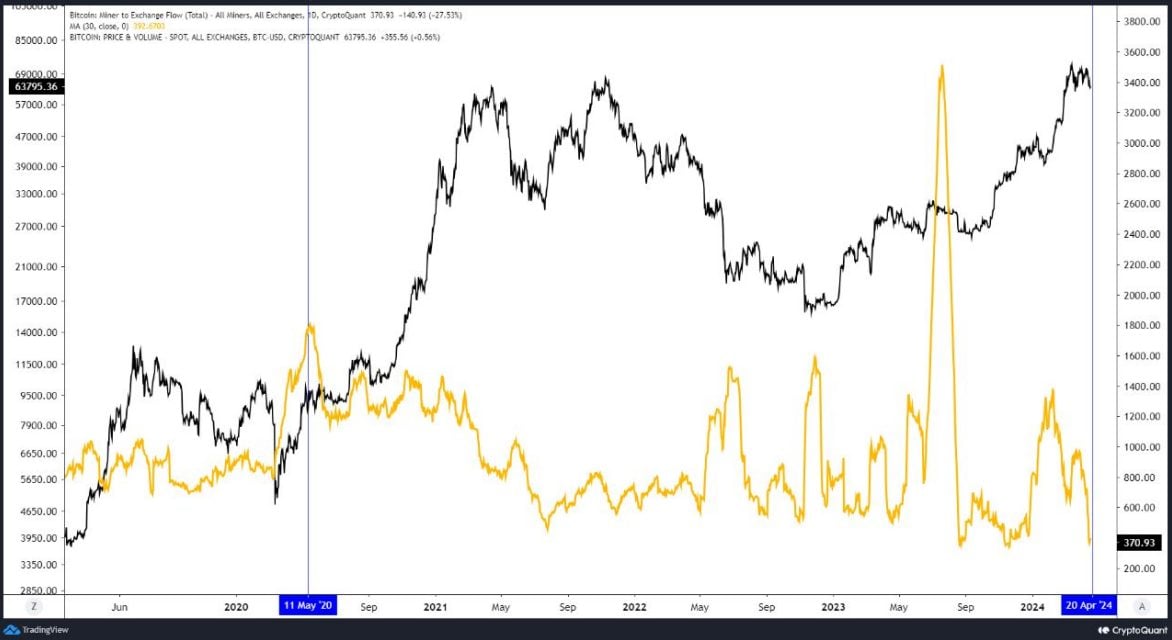

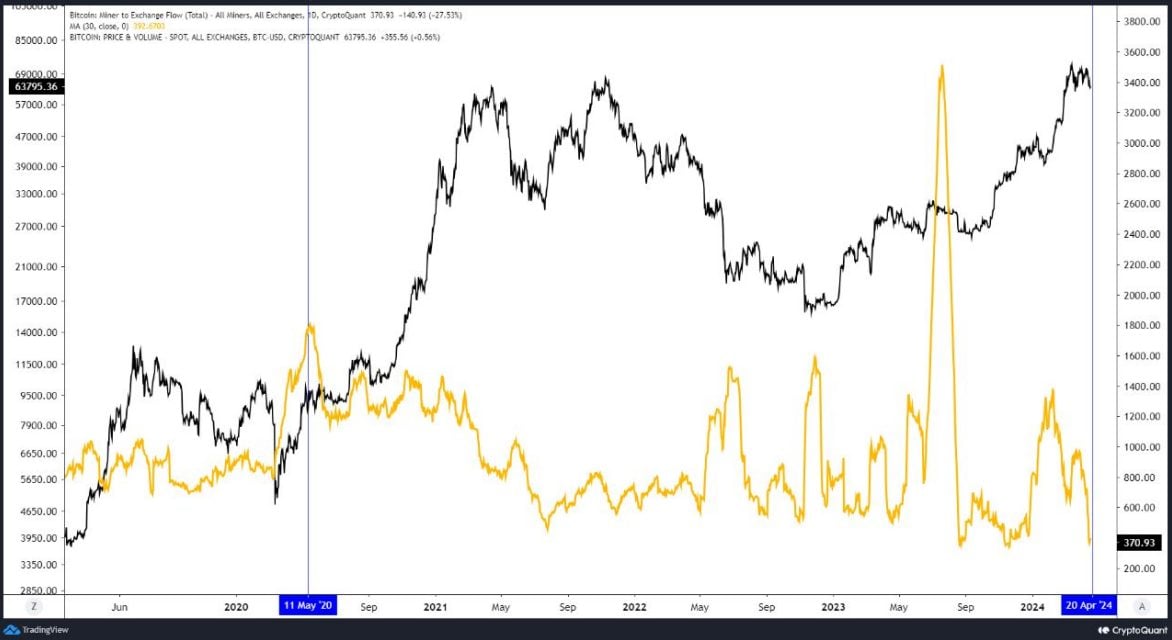

Recent data indicates a daily average of about 374 BTC sent to spot exchanges by miners over the last month, a decrease from the 1,300 BTC in February. This suggests miners sold their Bitcoin reserves ahead of the halving, distributing potential selling pressure over a longer period and avoiding a sharp market drop.

The evolving market dynamics for crypto assets, driven by institutional investor demand and the acceptance of Bitcoin ETFs, may mitigate the immediate impact of new Bitcoin issuance on market prices. ETFs are expected to significantly influence market volatility, with their ability to attract large-scale inflows and outflows.

Moreover, Bitcoin’s supply certainty, with a cap of 21 million to be reached by 2140, contrasts sharply with fiat currencies that are subject to inflationary government policies. Post-halving, the daily new supply of Bitcoin is estimated to add $40 million to $50 million in dollar-notional terms to the market, which is overshadowed by the average daily net inflows from spot Bitcoin ETFs of over $150 million.

Therefore, the SEC’s approval of spot Bitcoin ETFs has opened new avenues for demand, similar to the introduction of gold ETFs in 2004. Two months after the Bitcoin ETF launch, the daily net flow into ETFs remains positive, with demand outstripping the creation of new coins by over 150,000 BTC, a trend expected to persist in the coming months.

Share this article