Local government financing vehicles (LGFVs) and consumer companies could trigger a new round of debt failures because of their bigger maturity walls and greater refinancing needs, the rating company said in a report on Tuesday. The most recent distress cases are just entering full restructuring and more will come this year, it added.

“Policies aimed at reining in excessive leverage have driven two default waves so far,” Charles Chang, S&P’s Greater China country lead for corporate ratings, said in the report. “More policies with similar aims, scale and effects may lead to the next wave of defaults.”

Companies in the industrial and commodities sectors led the first wave between 2015 and 2016, when the country experienced 80 defaults triggered by excess capacity and asset management, said Chang, who co-authored the report with China country specialist Chang Li. Beijing’s “three red lines” policy has led to the second wave from 2021, with real estate developers accounting for most of the 108 default cases since, he added.

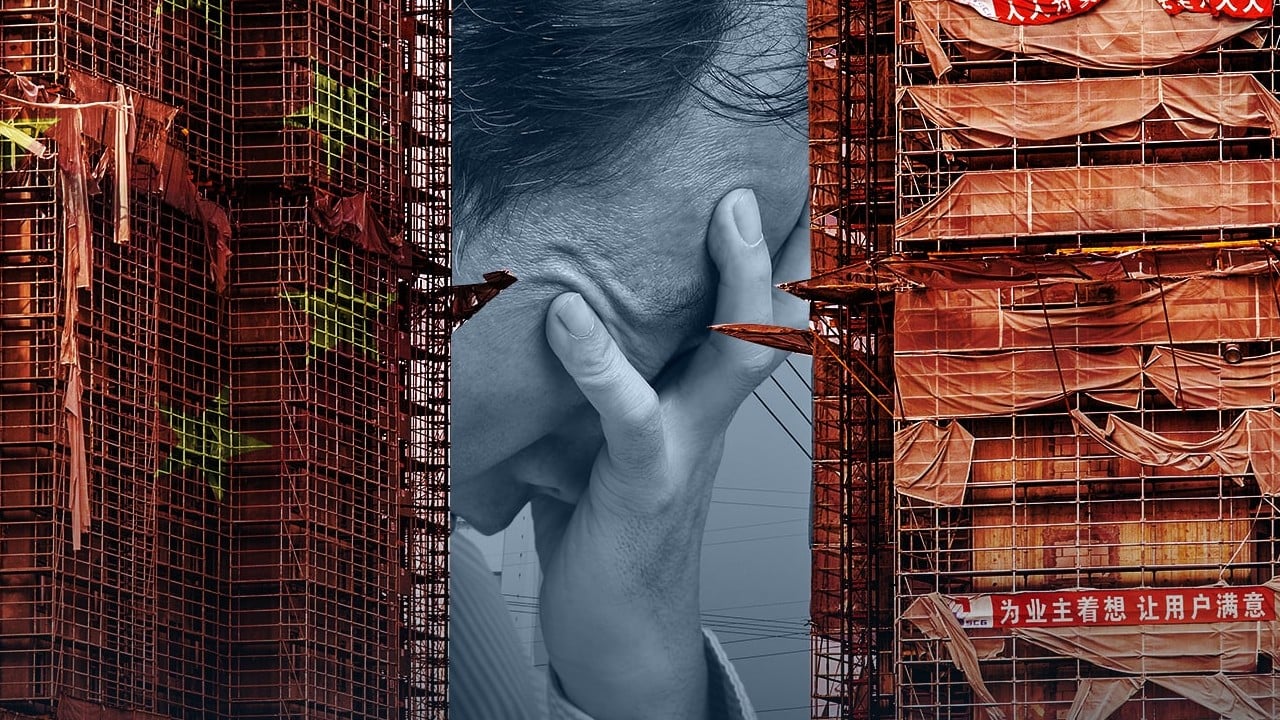

China Evergrande Group, which was ordered to liquidate in January amid an accounting scandal, first fell into distress in June 2021 after China squashed weak developers to contain systemic risks in the financial system. The cash crunch at Country Garden Holdings, once China’s largest home builder, showed the crisis has yet to run its course, S&P said in the report.

“Market access for privately owned firms has been negative for most months since 2021,” Chang said in the report. “For LGFVs, only higher rated firms were able to issue bonds but in lower volumes. Tightened regulation has restricted the market access of weaker LGFVs.”

Still, this year may mark a trough as the repayment amount drops, S&P said. Chinese entities have US$92 billion in offshore corporate bonds coming due, compared with US$111 billion that matured in 2023 and US$104 billion that will be payable in 2025, Chang said. As a result, China’s offshore default rate has fallen to 0.3 per cent in the first quarter, from 1.3 per cent in 2023 and 6.7 per cent in 2022.

Country Garden to raise funds for US$13 million bond coupon within grace period

Country Garden to raise funds for US$13 million bond coupon within grace period

China’s 5.3 per cent growth last quarter should not be viewed as a “significant slowdown”, said Kenny Ng, a strategist at Everbright Securities in Hong Kong. The country’s monetary policy is still quite accommodative and financing costs are still going down overall.

While there has been no default among onshore borrowers in the first three months of 2024, S&P said debt maturities are peaking this year at 8 trillion yuan (US$1.1 trillion). LGFVs face 3.5 trillion yuan of repayments, while the capital goods and power sectors each have 757 billion yuan and 738 billion yuan of obligations, respectively.

“Corporate debt is a rigid burden that is largely dependent on a company’s operations,” said Shen Meng, director at Beijing-based investment firm Chanson & Co. “The tightening of financing will further compress the flexibility of a company’s operations and shake the foundation of its financial stability.”