Chinese mutual funds increased their exposure to sectors that are closely linked to economic activity, ranging from consumer goods and services to financials and materials in the third quarter, analysts said, amid bets the world’s second-largest economy is set to rebound after authorities launched a swathe of growth-stabilising measures.

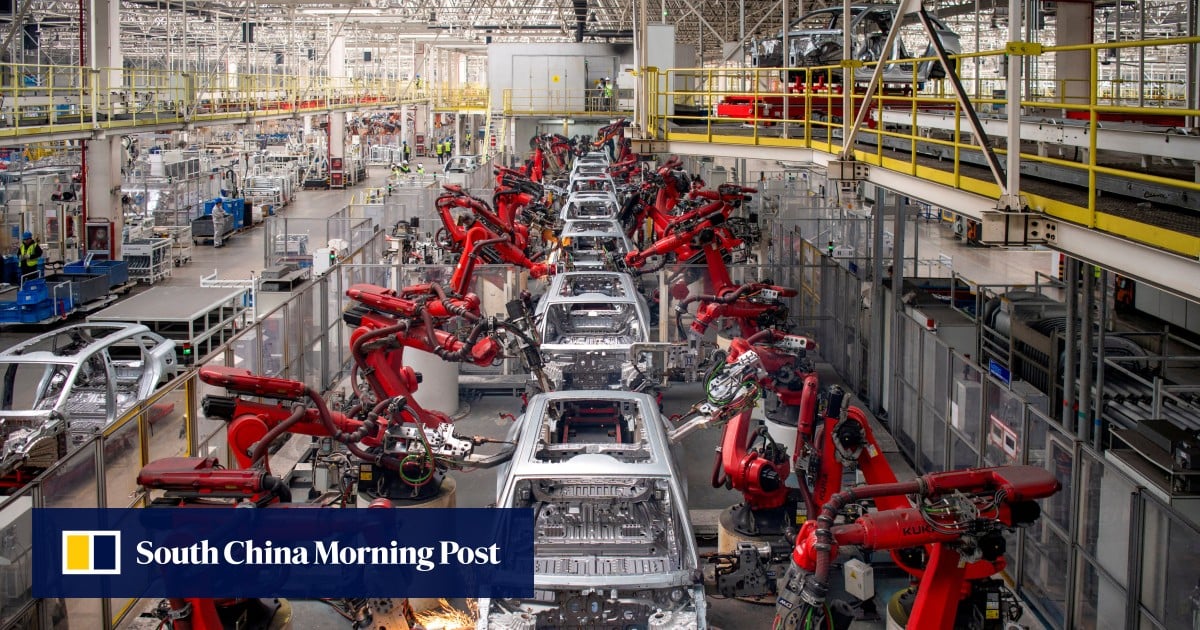

The funds also added positions in other so-called cyclical stocks that stand to benefit from a strengthening economy, buying shares of home appliances makers, carmakers and coal producers in the July-to-September period, according to Shenwan Hongyuan Group and China International Capital Corp (CICC). On the other hand, they unwound positions in technology stocks amid growing US-China tensions over semiconductors and other tech-related investments.

“Focus should be given more to those pro-cyclical industries about to bottom out and where investors have light positions against the backdrop of the economic recovery and policy tailwinds,” said Lin Limei, an analyst at Shenwan Hongyuan in Shanghai.

Goldman Sachs analysts said China’s growth drivers are changing with more opportunities in alpha themes rather than broad market beta, referring to the two key measurements used to evaluate the financial performance of a stock or an investment portfolio. Alpha is used to gauge the performance of a stock in relation to the market while beta measures relative volatility.

“China’s self-sufficiency drive can be distilled into mass consumption, hard technology/manufacturing upgrading, green/renewable energy, and SOE reform. Alpha opportunities appear greatest in such areas with clear and forceful policy support,” they said in a report.

Exits from China’s stock market add to worst capital flight since 2016: Goldman

Exits from China’s stock market add to worst capital flight since 2016: Goldman

The past quarter was rocky for stock market traders. The CSI 300 Index slid 4 per cent for a second quarterly loss, as a foreign investor-led sell-off dominated sentiment with the Federal Reserve’s hawkish tone on interest-rate increases triggering outflows. Overseas traders offloaded a record 90 billion yuan of Chinese onshore stocks through the exchange link with Hong Kong in August and remained net sellers in September. These outflows erased the net buying recorded in July with the result that they were net sellers of 80.1 billion yuan of stocks in the third quarter.

Mixed and stock-focused funds lost at least 6.3 per cent of their value on an average in the three months ended September, underperforming the benchmark gauge, according to Shenwan Hongyuan. In that period, redemptions rose to a two-year high of 102.4 billion units in the span, while issuances of new funds fell to 19.9 billion units, the lowest since the fourth quarter in 2018, said the brokerage.

Stock funds boosted their equity allocations by 0.3 percentage points from the previous quarter to 87.5 per cent, CICC said. They also increased the investments in Hong Kong stocks by 1.8 percentage points to 16.2 per cent, it said.

“The market has already priced in much of the pessimism after a significant correction,” the brokerage said in a report on Thursday. “Expectations are expected to improve after those headlines on the special government bond sales and Central Huijin’s purchases of index-based ETFs and their buying of the big four banks’ shares.”