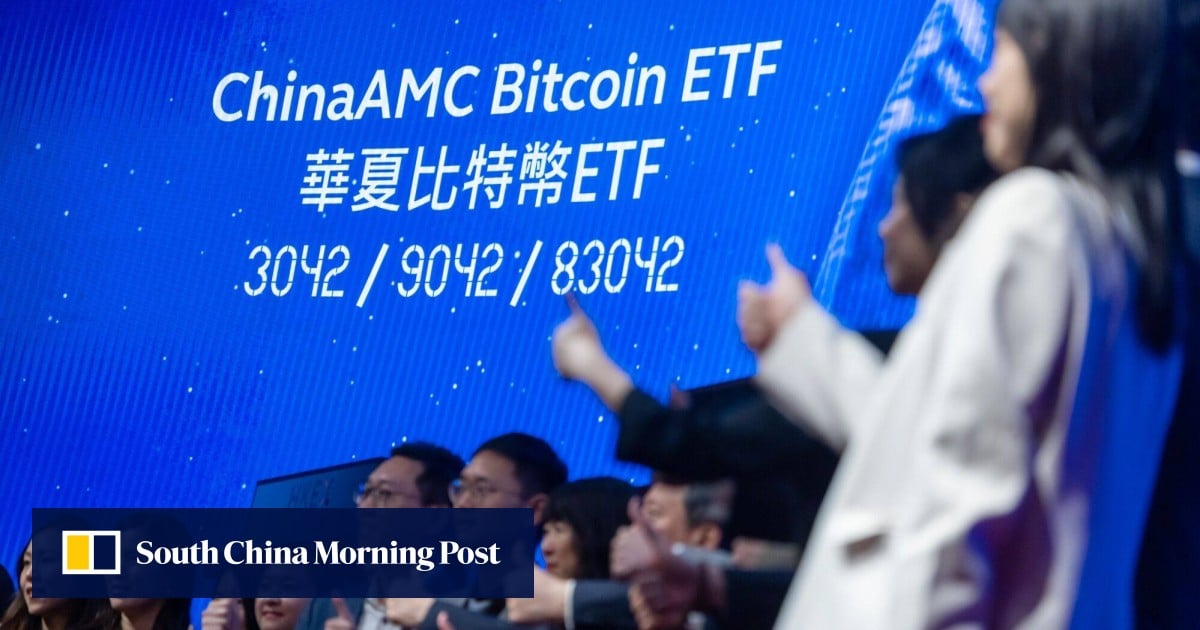

Hong Kong’s newly launched cryptocurrency exchange-traded funds (ETFs), hailed as a milestone in the city’s efforts to become a virtual asset hub, have so far failed to generate much interest amid a slumping bitcoin price, as turnover remained small in the first four days of trading.

The city’s three ETFs that invest directly into bitcoin saw HK$43 million (US$5.5 million) change hands on Friday, while the three spot ether ETFs recorded HK$5.5 million in trading volume on the same day.

The volume was significantly smaller than on the first day of trading on the Hong Kong exchange on Tuesday, when nearly HK$67 million was traded for the bitcoin ETFs.

Cryptocurrency ETFs are seen as a major way for the volatile virtual assets to attract mainstream investors, possibly helping to boost prices.

Hong Kong bitcoin, ether ETFs see tepid trading on debut

Hong Kong bitcoin, ether ETFs see tepid trading on debut

Bitcoin, which briefly dipped below US$60,000 last week, has lost nearly a tenth of is value in the past month and is down roughly 15 per cent from its all-time high of US$73,000 in March.

Some of the spot bitcoin ETFs in the US have also seen their biggest daily outflows this week since they launched in January. About US$564 million left the funds offered by the likes of Fidelity and BlackRock on Wednesday, according to Bloomberg.

While many found Hong Kong’s crypto ETF debut disappointing, some analysts saw reasons for optimism.

“Although the immediate price impact of the Hong Kong launches might be muted, this is a clear and important development in the global acceptance and adoption of the digital assets,” said William Cai, head of indices at Kaiko Indices.

Bloomberg Intelligence analyst James Seyffart noted in a YouTube interview that volumes are not directly comparable as Hong Kong’s ETF market is significantly smaller than that of the US.

“On an absolute basis, if you’re comparing this to the US launches, they’re not comparable,” Seyffart said. “On a relative basis, these were a very big success for the Hong Kong market.”